[ad_1]

As we progress through the holiday season, investors are hoping stocks start gathering momentum leading up to Christmas and New Year’s Day. The hopes of a Santa Clause rally will be more anticipated this year as broader markets still hover near bear market territory.

Here are two stocks that could be poised to climb higher by year-end and are worthy of consideration entering 2023.

Bowman Consulting Group BWMN

One stock investors should be watching going into FY23 is Bowman Consulting Group (BWMN). The company went public in 2021 and provides planning, engineering, construction management, commissioning, environmental consulting, geomatics, survey, and land procurement among other technical services to customers operating in a diverse set of regulated end markets.

Earnings estimate revisions are rising for BWMN and the stock also has an overall “A” VGM grade. Year over year, BWMN earnings are expected to climb a stellar 1,566% to $0.50 per share from $0.03 a share in 2021. FY23 earnings are anticipated to jump another 54% to $0.77 per share.

As the company moves further into profitability, top line growth is also expanding. Sales are projected to be up 70% this year and rise another 21% in FY23 to $308.68 million.

Year to date, BWMN is only down -9% to outperform the S&P 500’s -17%. This has largely outperformed the Business Services Market’s -42% YTD performance. BWMN is up +37% since its 2021 IPO to beat the benchmark and crush its Zacks Subindustry’s -23% performance during this period.

Image Source: Zacks Investment Research

Trading around $19 per share BWMN has a forward P/E of 38.5X. This is above the industry average of 17.3X but the rising earnings estimates support the industry premium paid for BWMN stock at the moment. Plus, BWMN trades well below its historic high of 233.3X and beneath the median of 42.5X. And the Average Zacks Price Target suggests 55% upside from current levels.

DecisionPoint Systems DPSI

Another name investors might want to consider going into the new year is DecisionPoint Systems. The enterprise mobility and radio frequency technology company is seeing earnings estimates rise. DPSI also has an overall “A” VGM grade in addition to its Computer-Software industry being in the top 36% of all Zacks industries.

DecisionsPoint sells and installs mobile devices, software, and related bar-coding equipment. Earnings are expected to leap 500% this year to $0.36 per share. FY23 earnings are forecasted to rise another 20%.

Top line growth is expected as well, with sales set to jump 37% this year and another 6% in FY23 to $96.17 million.

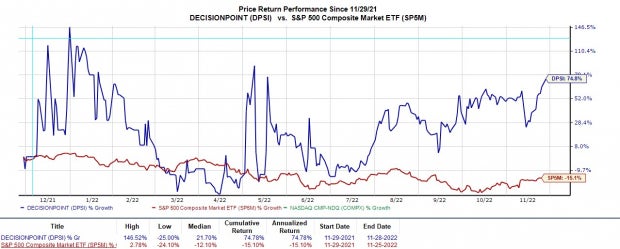

Year to date, DPSI is down -29%, on par with the Nasdaq’s decline. However, over the last year, DPSI is still up a stellar +75% to blast the benchmark and the Nasdaq.

Image Source: Zacks Investment Research

DPSI currently trades around $8 per share and roughly 38% from its highs. This year’s volatility in DPSI stock could turn out to be a long-term buying opportunity.

At current levels, DPSI has a forward P/E of 21X. This is below the industry average of 25.3X. Even better, DPSI trades at a discount to its decade-high of 122X and nicely below the median of 26.4X. The Average Zacks Price Target also suggests 32% upside.

Bottom Line

The combination of solid value, growth, and momentum supports investors’ considering these stocks going into fiscal 2023. Rising earnings estimate revisions also make BWMN and DPSI good stocks to consider as growth is expected to slow for most companies next year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

DecisionPoint Systems Inc. (DPSI) : Free Stock Analysis Report

Bowman Consulting Group Ltd. (BWMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.