[ad_1]

Utility stocks offer generous dividends and typically have lower volatility making them favorable income investments. While there is a seasonal trend in utility usage, businesses and individuals will always have the need for gas and power.

This makes the Utility-Electric Power Industry which is in the top 29% of over 250 Zacks Industries worthy of investors’ attention. Let’s take a look at two utility stocks to consider.

Consolidated Edison (ED)

ConEd ED is a diversified utility holding company that has been around since 1823. The company’s subsidiaries run businesses through Consolidated Edison Company of New York (CECONY), Orange and Rockland Utilities (O&R), Con Edison Clean Energy Businesses Inc., and Con Edison Transmission Inc.

The essential utility consumption by consumers is seen through ED’s CECONY business, a regulated utility that provides electricity to around 3.5 million customers and natural gas to 1.1 million customers.

ED currently sports a Zacks Rank #2 (Buy) with annual EPS revisions starting to rise for this year and FY23. ConEd’s earnings are expected to pop 3% to $4.52 a share in 2022, based on Zacks Estimates. Fiscal 2023 calls for another 7% earnings growth. Top line growth is expected as well, with sales set to jump 7% this year and another 2% in FY23 to $14.98 billion.

Year to date ED is up +5% to outperform the S&P 500’s -23% and its peer group’s -4%. ED‘s total return including its dividend is a solid +22% over the last two years, outperforming the benchmark and its peer group’s -3% despite the impacts of Covid and the current high inflationary environment

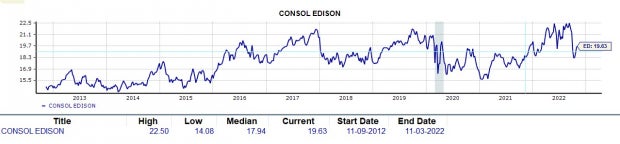

Image Source: Zacks Investment Research

ConEd currently trades around $90 a share, roughly 12% below its 52-week highs. ED has a forward P/E of 19.6X. This is slightly above the industry average of 17.1X, but ED stock has outperformed its peers. Plus, it’s trading below its decade-long highs of 22.5X and near the median of 17.9X. Even better, ED offers investors a solid 3.56% dividend yield at $3.16 per share and recently beat earnings expectations this week by 11% at $1.63 per share.

Image Source: Zacks Investment Research

Exelon (EXC)

Exelon EXC is a utility holding company engaged in the generation, delivery, and marketing of energy businesses. EXC stock has been hit harder than most utility stocks after separating its power generation and competitive energy business, Constellation Energy Corp CEG.

While EXC has seen higher volatility than other Utility stocks due to the split, it may be reaching oversold territory. Exelon will focus solely on transmission and distribution operations but still serves over 10 million customers through its regulated utilities.

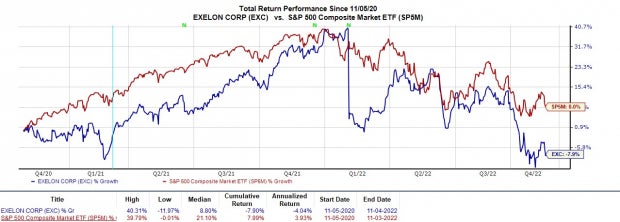

EXC is down -36% YTD with a large leg of the decline coming after completing the Constellation Energy separation in February. Despite the tough YTD performance, we can see from the nearby chart that EXC’s total return over the last two years is still near the benchmark and slightly above its peer group’s -10%.

Image Source: Zacks Investment Research

According to Zacks Estimates, EXC earnings are expected to decline -19% this year at $2.27 a share. However, Fiscal 2023 earnings are expected to stabilize and rise 6% to $2.41 per share. Exelon’s sales are projected to decline -47% this year but rise 3% in FY23 to $19.65 billion. As Exelon makes the shift to focus on its transmission and distribution operations its top and bottom lines are taking a hit but may be presenting an opportunity for long-term investors.

Exelon stock is 26% off its highs, trading around $37 per share. EXC has a forward P/E of 16.2X. This is below the industry average of 17.1X. Better still, EXC is trading at discount to its decade-highs of 22.1X and slighly above the median of 13.9X.

Image Source: Zacks Investment Research

EXC currently lands a Zack Rank #3 (Hold). Patient investors may be rewarded as the company starts adapting to its transition and EXC trades attractive relative to its past. EXC offers a generous 3.65% dividend yield at $1.35 per share and the Average Zacks Price Target suggests 22% upside from current levels.

Bottom Line

As uncertainty remains in the market and the economy investors may want to consider less volatile stocks with businesses that can survive or thrive amid a challenging operating environment. Utility stocks generally tend to provide stability and utility costs are essential even during an economic downturn.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC): Free Stock Analysis Report

Consolidated Edison Inc (ED): Free Stock Analysis Report

Constellation Energy Corporation (CEG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.