[ad_1]

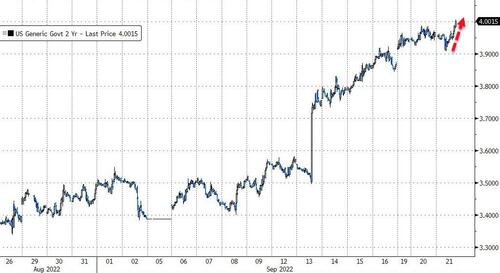

For the first time since October 2007, the yield on 2Y US Treasury bonds has topped 4.00%…

…having soared over 60bps since Fed Chair Powell gave his hyper-hawkish speech at Jackson Hole…

Meanwhile, the terminal rate for Fed rate-hikes has risen to 4.52% this morning, expected in March 2023…

Do we really think The Fed can get there without folding to political pressure or flip-flopping to abate risk-asset carnage?

As we noted earlier, how do we think Elizabeth Warren is going to react to this?

When the Fed hikes to 3.25% from 2.50%, it will be paying banks $460MM in daily interest on IOER/Reverse Repo.

When the Fed hikes to 4.25% by year end, it will be paying $600 million in daily interest to BANKS.

Think that won’t be a political issue? Think again

— zerohedge (@zerohedge) September 20, 2022

Finally, which would you rather own – 2Y notes backed by the US govt paying 4% or the S&P 500 paying 1.7%?

TINA is dead… and remember all of this is priced into the rates market already…

What is priced in right now:

+75bps tomorrow;

+75bps in Nov,

+50bps in Dec.

-> 4.49% in March pic.twitter.com/G28WSGnz3A— zerohedge (@zerohedge) September 20, 2022

Maybe not so much the stock market.

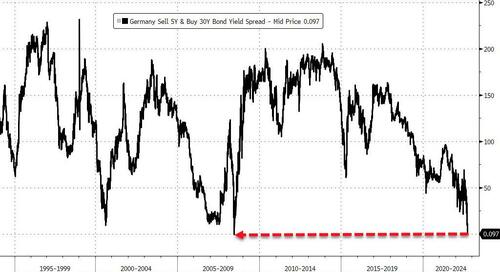

Meanwhile, the German yield curve is the most inverted… ever…

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.