[ad_1]

There’s a large variety of investors out there. Some prefer to target growth, and some prefer to target value.

However, some choose to target dividend-paying stocks in order to receive steady payouts from their investments.

And in a historically-volatile 2022, it goes without saying that investors have cherished dividends.

After all, it’s easy to understand why – dividends provide a passive income stream, limit the impact of drawdowns, and provide the ability to achieve maximum returns through dividend reinvestment.

Three companies with annual dividend yields currently above 5% – Delek Logistics Partners DKL, Lazard LAZ, and Alexander’s ALX – could all be of consideration for investors with an appetite for income.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Delek Logistics Partners

Delek Logistics Partners is a master limited partnership (MLP) formed to own, operate, acquire, and construct crude oil and refined products logistics and marketing assets.

Analysts have taken a bullish stance on DKL’s earnings outlook, helping land it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

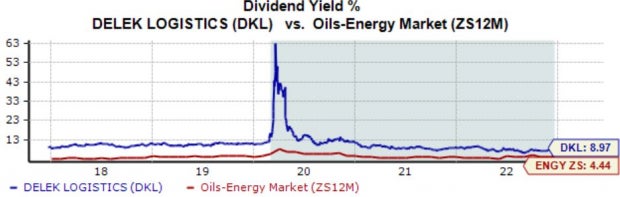

DKL’s annual dividend currently yields a sizable 9%, well above its Zacks Oils and Energy sector average.

Impressively, the company has upped its dividend payout 20 times over the last five years, translating to a 6.9% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

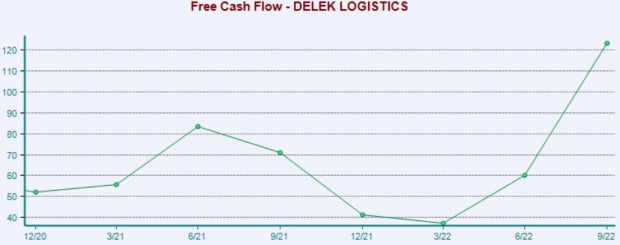

Additionally, DKL’s free cash flow strength is hard to ignore; in its latest release, the company generated $123 million in free cash flow, reflecting a 73% Y/Y uptick and an even larger 105% sequential increase.

Image Source: Zacks Investment Research

Lazard

Lazard is a significant global financial advisory and asset management firm offering solutions for complex financial and strategic challenges to various clients worldwide. The company sports a favorable Zacks Rank #2 (Buy).

LAZ’s annual dividend yield presently sits at 5.6%, more than double its Zacks Finance sector average. Further, the company’s payout ratio sits at a sustainable 40%.

Image Source: Zacks Investment Research

Lazard has repeatedly provided better-than-expected quarterly results; the company has exceeded top and bottom line estimates in four consecutive quarters.

Just in its latest release, LAZ surpassed the Zacks Consensus EPS Estimate by nearly 30% and reported sales 13.4% above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Alexander’s Inc.

Alexander’s is a real estate investment trust engaged in leasing, managing, developing, and redeveloping properties.

Like the stocks above, analysts have pushed their earnings outlook higher across all timeframes over the last several months, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Currently, ALX’s annual dividend yields a steep 8%, crushing its Zacks Finance sector average.

Image Source: Zacks Investment Research

Bottom Line

Volatility has rocked the market back and forth in 2022, leaving many investors wondering what’s on the horizon. A hawkish Fed and lingering COVID-19 uncertainties have been just a few issues weighing heavily on sentiment.

Unsurprisingly, many investors have turned to dividend-paying stocks to shield themselves.

For those focused on income, all three stocks above – Delek Logistics Partners DKL, Lazard LAZ, and Alexander’s ALX – could be considered.

All three presently carry an annual dividend yield above 5% and have witnessed favorable earnings estimate revisions.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Lazard Ltd (LAZ) : Free Stock Analysis Report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

Alexander’s, Inc. (ALX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.