[ad_1]

Ibrahim Akcengiz

Introduction

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) aims to hold high quality U.S. companies with strong 10-year track records of maintaining or increasing their dividend. The ETF charges an expense ratio of just 0.06%, making it a truly low-cost way for investors to get access to a bundle of high-quality dividend-paying stocks. SCHD aims to track the Dow Jones U.S. Dividend 100 Index and has done so very well.

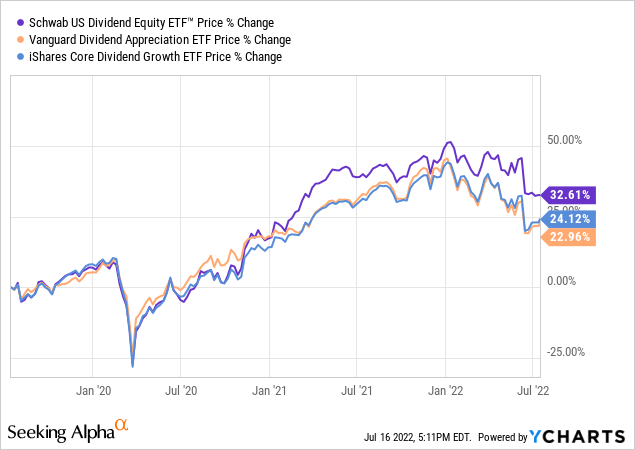

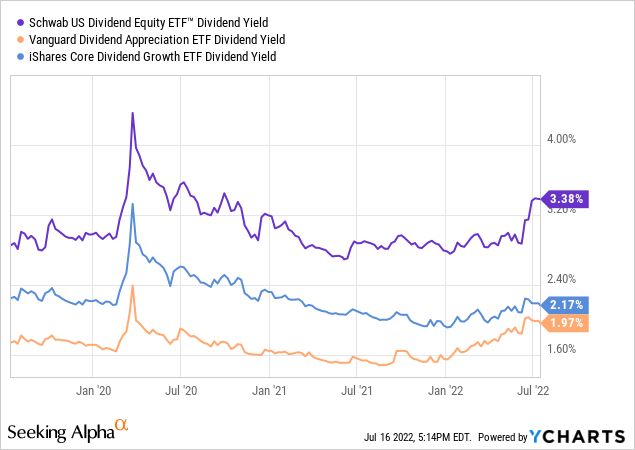

SCHD has consistently outperformed similar peer ETFs such as the Vanguard Dividend Appreciation ETF (VIG) and the iShares Core Dividend Growth ETF (DGRO) on most time frames while also paying a higher yield, meaning that performance adjusted for dividends would be even better.

SCHD rebalances quarterly and reviews its composition annually. The ETF is easily liquid enough for most, if not all, retail investors and even options traders.

Ultimately SCHD remains one of my preferred ETFs for many investors looking for high-quality businesses that can grow their intrinsic value over time while also paying out some earnings as dividends. Here are four reasons I think SCHD should remain in one’s portfolio.

1. Recession Resistant Holdings

SCHD has been through many rebalances and composition changes. Recently, the fund has been buying companies that tend to be resistant to recessionary pressures.

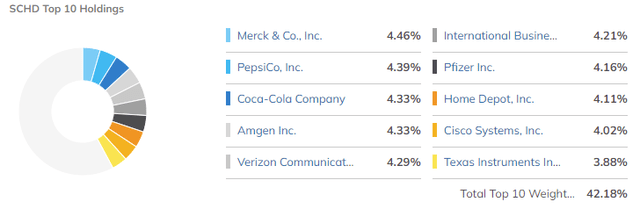

Companies like Merck & Co (MRK), PepsiCo (PEP), and Coca-Cola (KO) all tend to hold up well in recessions. Merck, which manufactures pharmaceutical products for both humans and animals, is unlikely to see sales or earnings impacted greatly during a recession, as people will continue to prioritize the purchase of these potentially life-saving products. Coca-Cola and Pepsi tend to also be recession resistant as humans are creatures of habit and cut out their favorite beverages and snacks only when truly necessary. Amgen (AMGN) is yet another healthcare/pharmaceutical company, as is Pfizer (PFE). Verizon (VZ) also should hold up well in tough economic times as people continue to use their telecom services. Home Depot (HD) is arguably more exposed to a recession with people cutting out or holding off on expensive home improvement projects.

Overall, the current composition of SCHD’s top 10 holdings, which make up 42% of the entire fund, seems very well positioned in a recessionary environment. Most of these companies’ products will continue to be purchased even when times are tough.

2. Inflation-resistant portfolio

In addition to being recession-resistant, many of SCHD’s top holdings have pricing power and are therefore inflation resistant as well. This was evident in Pepsi’s recent earnings report where they beat on the top and bottom line thanks to cost controls and the ability to raise prices by 12% (though the strong U.S. dollar could be a headwind for Pepsi going forward on international business). Obviously, Coca-Cola will have a similar ability to raise prices as these companies are effectively a duopoly in many beverage categories.

SCHD’s healthcare holdings likely have an even greater ability to raise prices as people will simply pay whatever it costs for many healthcare products.

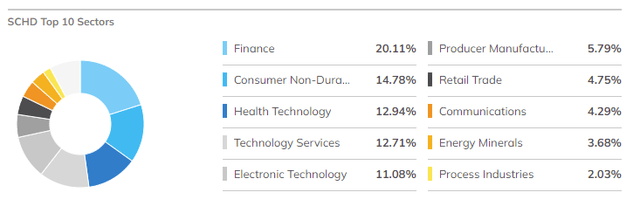

Finally, although we don’t really see any in the top 10 holdings, SCHD’s largest sector is financials. As many financial companies often have some sort of % transaction fee in their business model, they should do relatively well during an inflationary environment.

3. Pullback is an opportunity for longer-term investors

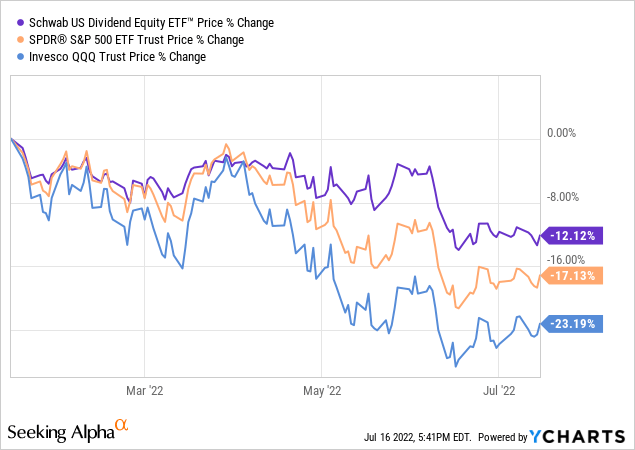

SCHD has pulled back over the last few months and now sits at a double-digit percentage lower than its all-time highs. However, compared to The S&P500, represented below by the SPDR S&P 500 Trust ETF (SPY) and the Nasdaq, Invesco QQQ Trust (QQQ) below, SCHD has held up better.

Given that inflation and a potential recession remain key risks to broad markets, I believe that a pullback in an ETF with a portfolio that is resistant to these risks such as SCHD remains a strong choice for investors. Thus, investors should consider this current pullback in SCHD as an opportunity to buy some great high-quality companies with a bit of yield income to boot.

Risks

Although a recession and inflation continue to be risks, perhaps the more significant risk here for SCHD specifically is interest rates. With U.S. 10-year treasury yields nearing 3%, SCHD’s 3.4% yield is perhaps not enticing enough for some given there remains equity risk that bonds do not have. Then again, bonds have inflation risk, something that SCHD is likely more resistant to. Thus, investors probably want to consider an approach that is balanced correctly for them.

Conclusion

At the end of the day, SCHD invests in high-quality businesses that are likely to increase their intrinsic value over time. The equity portfolio’s current composition is positioned well to take on most macro risks today. These companies continue to pay some of their earnings out as dividends and when combined with the recent pullback in SCHD, give the ETF a distribution yield that hasn’t been seen in nearly 2 years. SCHD remains one of my top ETFs for retail investors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.