[ad_1]

(Photo by Win McNamee/Getty Images)

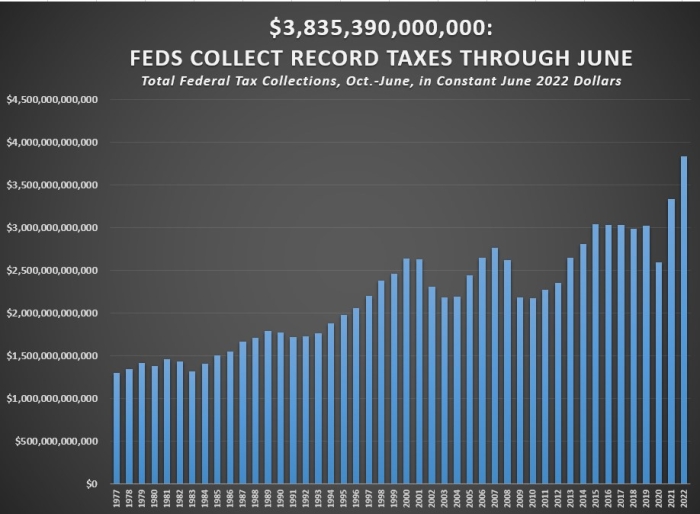

(CNSNews.com) – The federal government hauled in a record $3,835,390,000,000 in total taxes in the first nine months of fiscal 2022 (October through June), according to the Monthly Treasury Statement.

That was up $502,438,730,000—or 15.07 percent—from the then-record $3,332,951,270,000 (in constant June 2022 dollars) that the federal government collected in taxes in the first nine months of fiscal 2021.

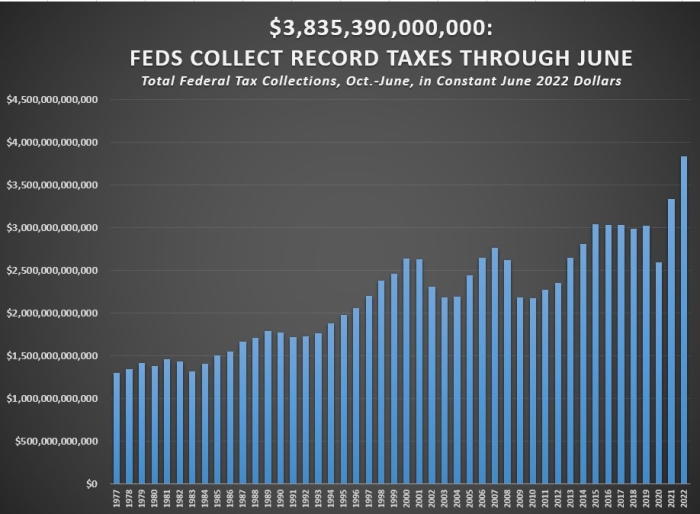

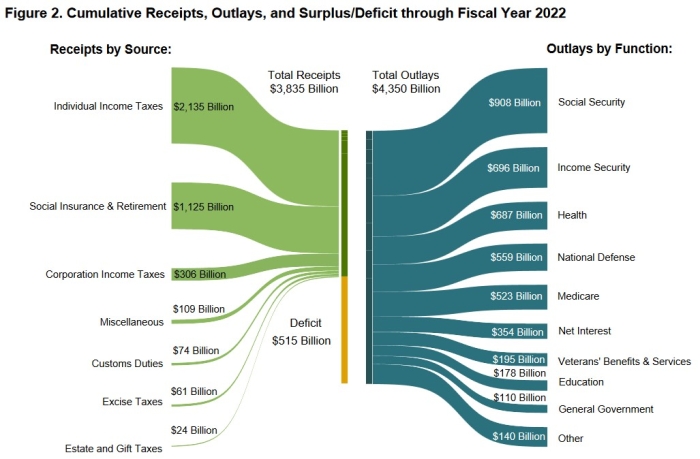

The record $3,835,390,000,000 in total taxes that the federal government collected in the first nine months of this fiscal year included $2,135,472,000,000 in individual income taxes; $1,125,464,000,000 in social insurance and retirement receipts; $61,035,000,000 in excise taxes; $24,032,000,000 in estate and gift taxes; $74,181,000,000 in customs duties; and $109,154,000,000 in what the Treasury calls “miscellaneous receipts.”

At the same time that it was collecting this record $3,835,390,000,000 in total taxes, the federal government spent $4,350,457,000,000. Thus, the federal government ran a deficit of $515,067,000,000 in the first nine months of the fiscal year.

The Department of Health and Human Services spent the most money of any federal agency during the first nine months of the fiscal year, expending $1,191,470,000,000. The Social Security Administration spent the second most: $952,222,000,000. The Department of the Treasury spent the third most: $944,194,000,000. (This included $520,955,000,000 in interest on Treasury Debt Securities and $423,239,000,000 on other expenses.)

The Department of Defense—Military Programs spent the fourth most: $531,079,000,000.

The business and economic reporting of CNSNews.com is funded in part with a gift made in memory of Dr. Keith C. Wold.

[ad_2]

Image and article originally from www.cnsnews.com. Read the original article here.