[ad_1]

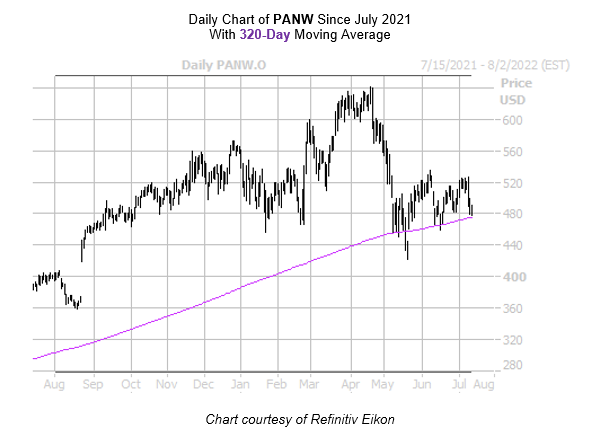

PANW just pulled back to its historically bullish 320-day trendline

Palo Alto Networks Inc (NASDAQ:PANW) stands 13.2% lower year-to-date. The shares have shed 7% already this week amid the broad market selloff. The silver lining: this week’s dip has put PANW near a trendline that, if past is precedent, could help the tech stock dig out of its recent hole.

PANW stock just came within one standard deviation of its 320-day moving average. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, similar moves occurred twice in the last three years, with Palo Alto Networks stock seeing a positive one-month return both instances, and averaging a 21.3% gain. A similar move from its current perch at $485.19 would put the equity just above $589 per share.

Short interest has begun to unwind, down 8.8% in the last two reporting periods. However, the 37.79 million shares sold short still accounts for 7.1% of the stock’s available float. At PANW’s average pace of trading, it would take more than four days to buy back these bearish bets, an ample amount of buying power that could unwind and fuel upside.

A shift in sentiment in the options pits could provide even more tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), PANW’s 10-day put/call volume ratio of 1.10 sits higher than 75% of readings from the past year, which indicates a preference for bearish bets in the last two weeks.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.