[ad_1]

(Bloomberg) — Some of Wall Street’s biggest banks boosted their forecasts for European Central Bank interest rates, saying faster-than-expected inflation will convince officials to react with even more aggression.

Most Read from Bloomberg

Economists at Goldman Sachs Group Inc., Bank of America and JPMorgan Chase & Co. now predict a 75 basis-point increase at next week’s meeting, which hawkish Governing Council members had floated as an option in recent days. Investors are also fully pricing such a move by October.

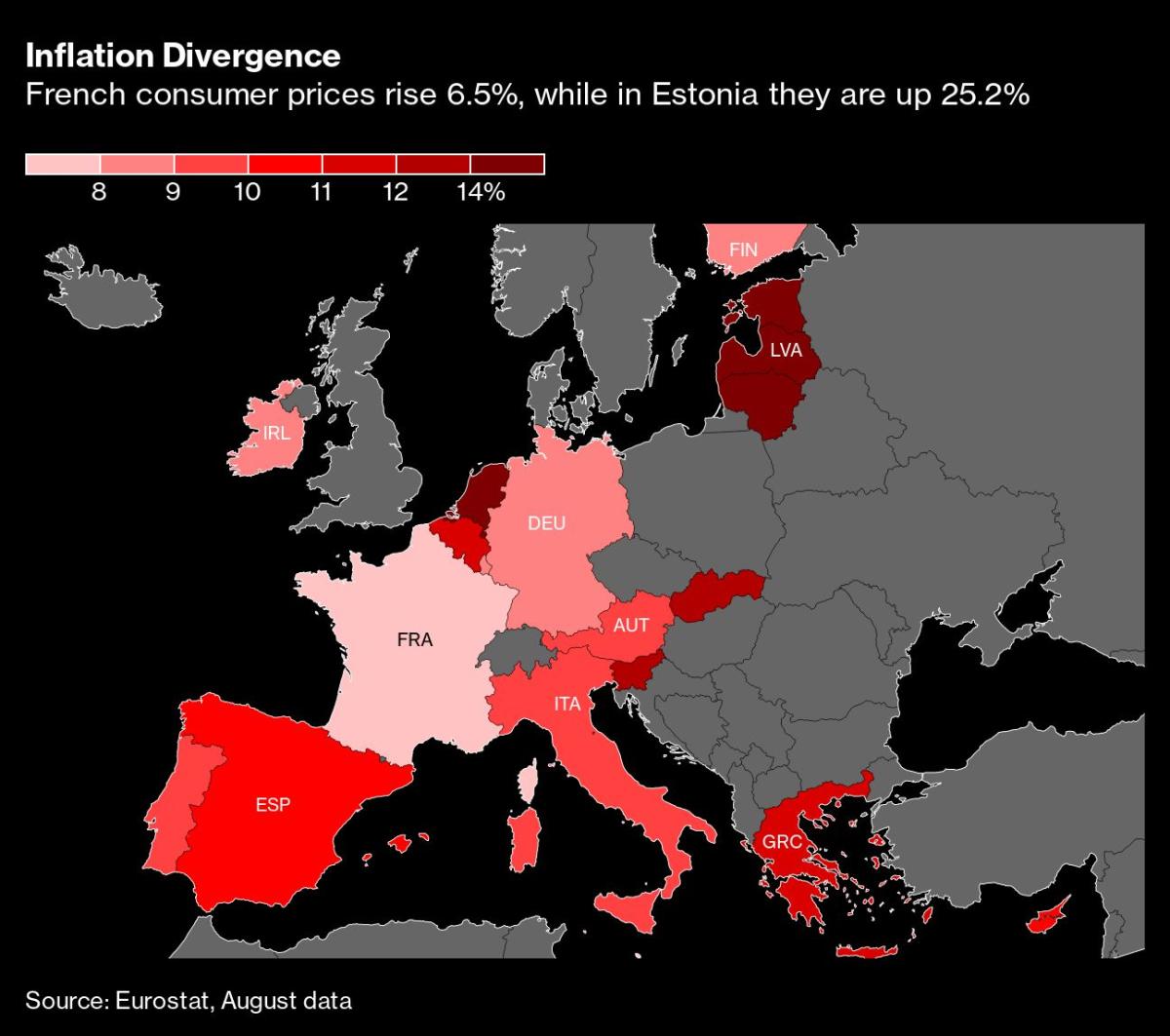

The shift follows euro-area data on Wednesday that showed inflation at an all-time high of 9.1% in August, more than economists predicted and even further above the ECB’s 2% target. A measure of underlying price growth stripping out volatile items like food and energy also reached a fresh record of 4.3%.

“The number of policy makers at the ECB preferring a more forceful response has grown,” JPMorgan economist Greg Fuzesi said in a note to clients. Wednesday’s inflation data “will have encouraged them further. While the relative size of the different camps in the Governing Council is hard to gauge after the summer break, we now suspect that a 75bp hike will be forthcoming next week.”

Minutes after the inflation data, Bundesbank President Joachim Nagel called for a “strong rise in interest rates in September” and added that “further interest rate steps are to be expected” afterwards. Also on Wednesday, his Austrian colleague Robert Holzmann said that there’s “no reason to show any kind of leniency.”

Goldman economist Sven Jari Stehn highlighted activity data that had “held up somewhat better than expected,” saying the euro area may only experience a “mild downturn.” He sees inflation accelerating further as temporary support measures in Germany come to an end and high energy costs continue to feed into retail prices.

Such forecasts come laced with uncertainty however. Bank of America said its new prediction was “a very close call.”

“The debate is highly complex, but the mix of recent communication paired with the August upward surprise in headline, and especially core inflation, means a bigger move than in July has now become marginally more likely,” its economists wrote in their report.

In recent days, a growing group of policy makers had begun calling for a 75 basis-point step to be debated next week. That’s an increment that’s been deployed twice already by the Federal Reserve. Dovish ECB officials caution against following suit as Europe braces for a recession.

The quickest price gains since the euro was introduced more than two decades ago leave policy makers in Frankfurt seeking a delicate balance: Rates must be raised sufficiently to steer inflation back toward their 2% target, but not so much that it chokes off whatever economic momentum remains amid fears of a Russian energy cutoff this winter.

The latest datamay receive extra scrutiny after officials including Executive Board member Isabel Schnabel said the ECB should focus more on inflation outcomes than projections as the war in Ukraine complicates forecasting.

What Bloomberg Economics Says

“Several prominent members of the Governing Council are pushing for a large rate hike in September, inflation is again beating forecasts and the global monetary policy backdrop has swung more hawkish. While not a done deal, our view is that a front-loaded 75 basis-point hike is the mostly likely outcome.”

–Click here for full comment

While Russia’s invasion is certainly behind the spike in energy prices, Dutch central bank chief Klaas Knot said Tuesday that strong consumer demand after lockdowns ended had also pushed prices higher. Rising wages and a weak euro represent upside risks, he warned, urging a “swift” normalization of monetary policy.

Other officials have called for more restraint. Chief Economist Philip Lane this week urged a “steady pace” of hikes to minimize the risk of disruptions, while Executive Board member Fabio Panetta said a weaker economy would help temper inflation.

France’s Francois Villeroy de Galhau, one of the Governing Council’s more moderate members, said Wednesday that rate increases should be “orderly and predictable.”

Economists increasingly predict a euro-area recession in the coming quarters as the rising cost of living saps demand, undermining the pandemic rebound. The ECB will shed some light on the outlook with a new set of forecasts at its Sept. 7-8 meeting.

(Updates with French central bank chief in penultimate paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Image and article originally from ca.finance.yahoo.com. Read the original article here.