[ad_1]

(Bloomberg) — Argentina’s central bank held its benchmark interest rate at 52%, even as inflation accelerated to its fastest pace in 30 years, and set a reference range for monetary policy.

Most Read from Bloomberg

The decision by the bank’s board came on Thursday after yields at the latest Treasury note auction rose by as much as 400 basis points to 63.5% earlier this week, according to a person with direct knowledge of the matter. Policy makers want to encourage banks to purchase Treasury notes rather than the benchmark Leliq notes that the central bank sells, the person said, asking not to be named because the discussion isn’t public.

In a separate statement, the central bank said it was setting a reference range for monetary policy, having rates for one-day repos as the floor, Treasury notes as the ceiling, and keeping the 28-day Leliq as the benchmark. Currently, the rate for one-day repos is 40.5% while Treasury notes stand at 63.5%.

The range will serve as a “guide” for the central bank to determine the benchmark rate and to show it remains above inflation, as requested by the International Monetary Fund, a bank spokesman said.

The measures are also intended to provide liquidity to the debt market in pesos and gradually advance in the use of Treasury instruments as monetary policy instruments, according to the statement.

What Bloomberg Economics Says

“The range is wide to the point of being meaningless as a guidance. Our preliminary understanding is that the new design hints that the rate may approach the yield demanded by markets to fund the government – which would be a positive step to secure positive real rates. However, that could have been done by simply raising the policy rate. The fact that they opted to do so instead by creating a range — and one with such a low floor – adds unnecessary and inconvenient noise to what is already a turbulent market.”

— Adriana Dupita, Argentina economist

Surprise Decision

The decision to maintain the key rate at 52%, reported by Bloomberg News earlier on Thursday, took financial markets by surprise because the bank was broadly expected to raise them, as it has done in recent months every time official data showed inflation accelerating.

Argentina’s consumer prices rose 64% in June from a year ago, and are expected to increase at an even faster rate in coming months after the sudden resignation of Economy Minister Martin Guzman led many businesses to jack up prices overnight last week.

Read More: Argentines Brace for 90% Inflation After Economy Minister’s Exit

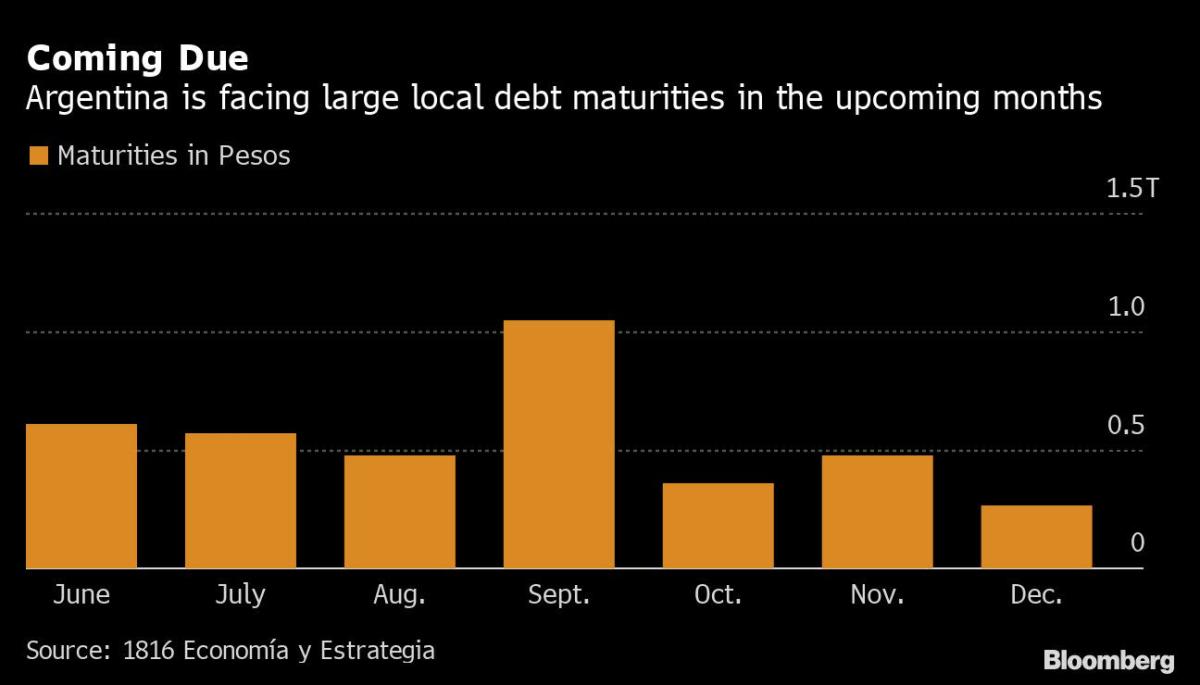

Argentina has had trouble finding enough participation to roll over maturing local debt in recent auctions as many investors fear the nation’s local debt burden is unsustainable. Earlier this week, the central bank offered a put option on its local bonds to encourage banks to purchase Treasury assets. The country has a large local maturity of around 500 billion pesos ($3.9 billion) at the end of July.

Guzman’s replacement, Economy Minister Silvina Batakis, pledged this week to maintain interest rates, measured by the effective annual rate, above inflation. So-called real positive rates are a pillar of Argentina’s $44 billion agreement with the International Monetary Fund.

(Updates with central bank confirmation and statement on new range for monetary policy rates starting in third paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Image and article originally from finance.yahoo.com. Read the original article here.