[ad_1]

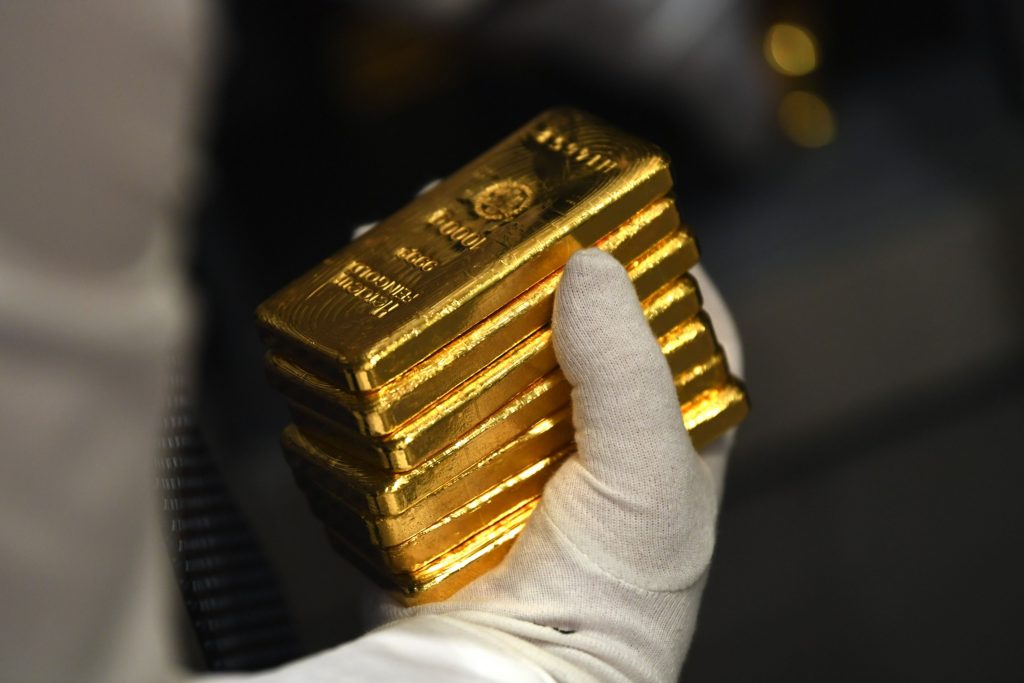

Gold dipped after rallying in the wake of a searing inflation report from the US, as investors again turned to the greenback as a haven asset.

Bullion on Wednesday bucked a downward trend that’s seen it slide for four consecutive weeks after data showed US inflation roared last month to a fresh four-decade high, up 9.1% from a year earlier.

The precious metal finished up 0.6% in the previous session as investors bet that the Fed is more likely than not to raise interest rates by 100 basis points when it meets July 26-27, a move that would boost the chances of the world’s largest economy entering a recession.

By Thursday, investors had digested the inflation news and again turned away from gold to the greenback as a hedge, according to David Lennox, a resources analyst at Fat Prophets.

“We’d really need to see a much lower US dollar for gold to get a sustained positive kick going forward,” said Lennox. “Investors are turning more to the greenback than bullion as a haven asset.”

This year, gold prices have been volatile as Russia’s invasion of Ukraine spurred a rally in the haven to well above $2 000 an ounce in March, only for the momentum to fade as the growth and inflation outlook shifted. In recent weeks, investors have cut holdings in bullion-backed exchange-traded funds.

Spot gold was down 0.4% to $1 728.09 at 9:10 a.m. in Singapore. The Bloomberg Dollar Spot Index gained 0.3%, reversing Thursday’s decline. Silver, platinum and palladium all fell.

© 2022 Bloomberg

[ad_2]

Image and article originally from www.moneyweb.co.za. Read the original article here.