[ad_1]

monkeybusinessimages/iStock via Getty Images

Thesis

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) is an equity buy write fund from the Eaton Vance suite. As per the fund’s literature:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.

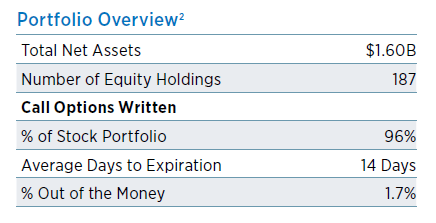

Currently 96% of the fund’s portfolio has written calls against it, options which have a 14-day average expiration period:

Portfolio Overview (Fund Fact Sheet)

2022 has been a year of increased volatility and equity underperformance. The VIX has seen 3-handle levels, with an overall increased volatility environment:

VIX Price (Seeking Alpha)

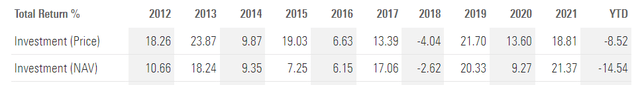

As the Fed continues to hike rates and data comes in we are going to see continued elevated levels for the VIX given investors’ divergent views on a soft or hard economic landing and stock market implications. While in 2021 an investor could have just bought a stock index and woken up at the end of the year with a 20%+ return, this year is different. Investors have come to realize that volatility is here to stay this year and that the stock market outlook is fairly cloudy. In turn, they have correctly assessed that a good way to take advantage of the high vol levels is to sell call options. ETV does that for an investor in a systematic way, and has been a CEF with a superb historical track record:

Historic Returns (Morningstar)

We can see that outside of 2018 this CEF has always provided positive market price total returns in the past decade. This is an exemplary return profile when compared to any other asset class. Please do note that the market price total return differs from the fund NAV total return. This is due to the CEF’s premium, which brings us to the “meat and potatoes” of the article.

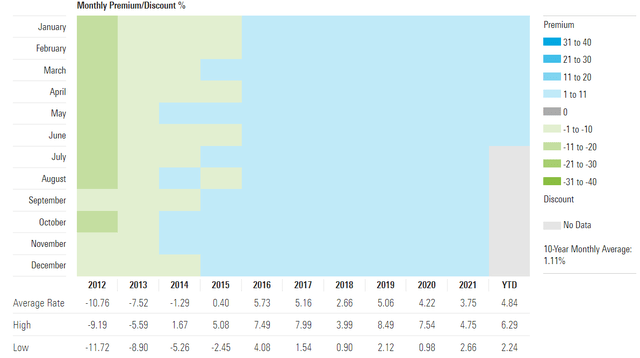

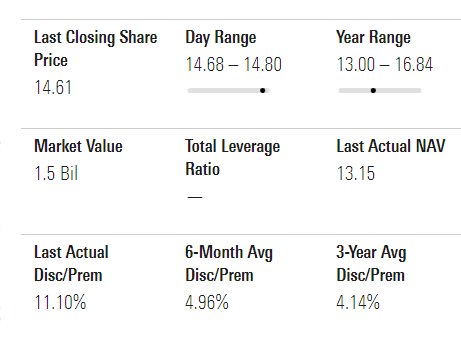

ETV is currently trading at a historic premium to NAV:

Premium / Discount to NAV (Morningstar)

We can see from the above table that in the past decade the high in the fund premium was achieved in 2019 when we saw a 8.49% premium to net asset value. Today that premium is more than 11%:

Premium (Morningstar)

This means that if the fund was liquidated tomorrow there would be an 11% shortfall between the cash the fund would realize by liquidating and what investors would get. A premium to NAV only works on other people’s belief that the fund NAV or premium to NAV will go higher. We have seen the same story in 2021 when all high yielding CEFs were trading at exorbitant premiums to NAV because of the drive for yield. What happened? How did the story end? In tears for many fund investors. Not only did the respective vehicles experience substantial NAV declines, but the premiums to NAV disappeared as well.

We like ETV, we hold ETV in our portfolio but we are taking an active approach and lightening up on some of the exposure here. The fund will do great long term, but we cannot ignore a historic high premium to NAV. We can observe that the average premium for the fund in the past 3-years has been close to 4%. That is a 7% gap that needs to be filled on the downside. We feel we are in a bear market rally and the next leg down in the market will see the compression in the ETV premium to more normalized levels. As we have seen in 2021/2022 exorbitant premiums to NAV are not sustainable and only thrive on investors’ herd mentality. Everybody is now trying to sell calls to protect the downside. Do not do that via a fund that already has an 11% premium to NAV. We believe in an active approach to portfolio management and therefore are lightening up on some of our ETV exposure at this historic premium to NAV. Let us not mince our words – we hold ETV, it is a core holding, and we will continue to do so, however we cannot ignore the red flag that a historic premium to NAV is exposing.

Holdings

The fund holds an equities portfolio that closely resembles the S&P 500:

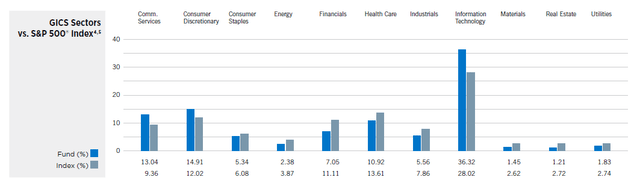

Sector Allocation (Fund Fact Sheet)

We can see that the CEF is overweight Information Technology and Consumer Discretionary when benchmarked against the index. The fund is underweight Financials and Health Care.

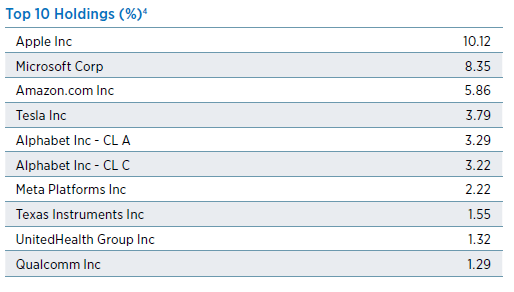

The top holdings in the fund are well-known large capitalization stocks:

Top 10 Holdings (Fund Fact Sheet)

Following fairly similar weightings as the index, the fund has in its top 10 holdings well-known large-cap stocks.

Conclusion

ETV is a premier buy-write fund from the Eaton Vance family. The CEF has extraordinary long-term results which make it a core holding for us. However, the particularities of the CEF structure allow for premiums to net asset values. The premium to NAV for ETV has reached a decade-long high on the back of investors’ desire to monetize a high VIX level. Just like in 2021 with high yield CEFs, premiums to NAV always revert to historic norms. We feel this is the case for ETV as well and we are trimming some of our exposure to monetize this historic high premium to NAV.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.