[ad_1]

SARB Rate Hike, USD/ZAR Analysis

- SARB hikes 75 basis points – feeling pressure from global peers and local inflation

- Key USDZAR technical levels assessed ahead of Fed rate decision

- FOMC and US GDP present potential opportunity for USD/ZAR bearish reversal

SARB Hikes 75 Bps as Global Peers Increase Rate Hike Increments

The South African Reserve Bank (SARB) voted to hike local lending rates by 0.75%. The 75 basis point increase was deemed necessary in order to keep up with the accelerated rate hike increments in the developed world as well as to calm the current trajectory of inflation which has breached the 3%-6% target range.

Vote Split:

- 1 vote for 50 bps

- 3 votes for 75 bps

- 1 vote for 100 bps

Earlier this month the Bank of Canada shocked markets by raising rates by a full 1% or 100 bps which had a ripple effect on market expectations for a potential 1% hike by the Fed next Wednesday. Such impulsive expectations have settled since then, now anticipating a 75 bps hike.

Regarding price stability (inflation), SA CPI has breached the 6% ceiling for two months in a row now and has resulted in the SARB revising its inflation forecast to 6.5% for 2022, up from 5.9% and 5.7% for 2023, up from 5%.

On the growth front, better than expected GDP data for Q1 welcomed a positive revision in 2022 GDP to 2%, up from 1.7% but Q2 GDP is forecast to show a 1.1% contraction as a result of regular load shedding and the impact of the Kwazulu-Natal (KZN) floods.

Customize and filter live economic data via our DaliyFX economic calendar

USD/ZAR Technical Levels Ahead of FOMC and Q2 GDP (US)

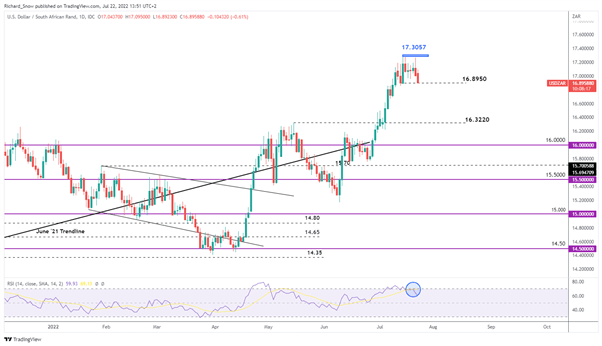

The Rand has been under immense pressure since breaching that 16.3220 level. The reason for that is we have witnessed a continued surge in the dollar and at the same time major headwinds emerged for the ZAR (load shedding, floods and more recently lower metals prices).

USD/ZAR tests the prior swing low at 16.8950 as the first test of renewed bearish momentum. The extended upper wicks around the high of 17.3057 suggested that higher prices would be hard to come by while the return from overbought territory via the RSI helps add conviction to a developing bearish reversal.

Support lies at 16.8950 followed by the psychological 16.50 round number and finally, the distant 16.3220. There is only one figure for resistance based on recent levels and that is 17.3057.

USD/ZAR Daily Chart

Source: TradingView, prepared by Richard Snow

Main USD/ZAR Risk Events Next Week

Next week Wednesday the FOMC will meet to decide on the most appropriate rate hike for the US economy with the potential for a negative surprise a day later with the first Q2 GDP print coming due. Thus far, economists anticipate a dismal 0.9% increase in GDP growth which contrasts the Atlanta Fed’s GDP Now estimate, forecasting a second successive contraction which would throw the US into a technical recession. Should GDP print inline with the Fed’s estimates, USD/ZAR stands to drop further.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.