[ad_1]

The stock market rally continued in late trading Thursday with most indexes up modestly on significantly higher volume following this morning’s disappointing economic data.

X

The Nasdaq rose 0.9% while the Dow Jones Industrial Average and the S&P 500 rose 1%. Volume on the Nasdaq was up 24% while that on the NYSE was up 27% compared with the same time on Wednesday. The Russell 2000 was up 0.9% while the 10-year Treasury yield slid to 2.69%. Crude oil was down as well, at $96.60 a barrel.

GDP fell by 0.9% in the second quarter after a 1.6% decline in the first quarter. Economists generally consider a contraction for two quarters in a row as a recession. Initial jobless claims also rose by 5,000 from the previous week to 256,000.

Nonetheless, after yesterday’s stock market advance, it seems that the Fed will continue its rate hike, though perhaps not as aggressively as in June and July. The slightly dovish stance by the Fed Chairman Jerome Powell on Wednesday has left investors in hope of a soft landing.

Amazon, Apple On Earnings Watch

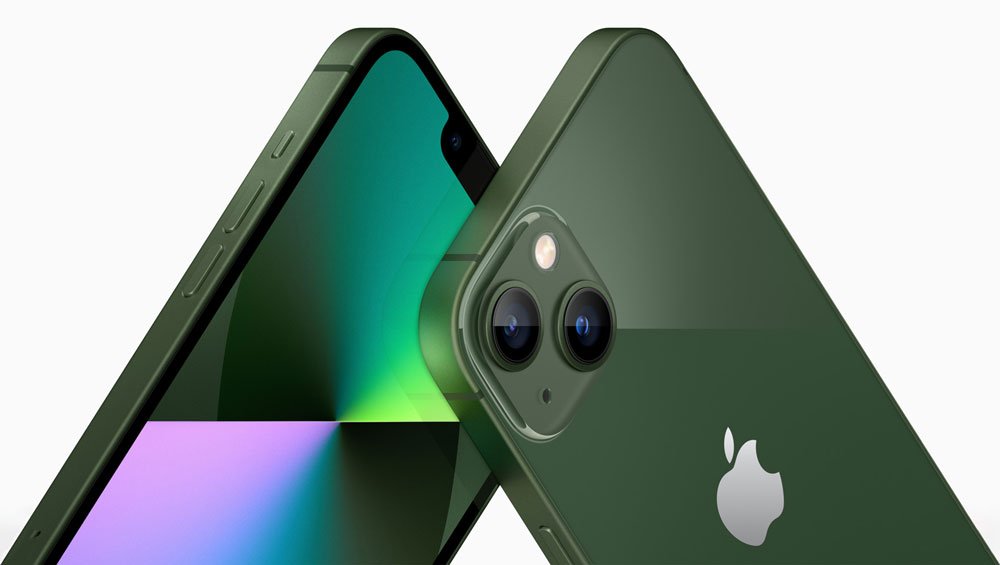

Apple (AAPL) and Amazon.com (AMZN) are on deck with earnings announcements after the close. Earnings estimates for Amazon stand at 52 cents a share on $119 billion in revenue. Apple is expected to earn $1.16 a share on revenue of $82.8 billion. Both stocks have broken above their 50-day moving averages.

Stock Market Today: Leaderboard Names Near Buy Point

Cheniere Energy (LNG) which has been trading within a consolidation phase, is trying to clear a 146.45 buy point. Watch for a further gain as the U.S.-Europe trade deal reduces Europe’s dependence on Russia for natural gas. The stock has a strong Relative Strength Rating of 97. Energy peer Chesapeake Energy (CHK) will also be an interesting stock to watch. The stock has climbed past its 50-day moving average as it forms a cup base.

United Health (UNH) is trading above a cup-with-handle and above its buy point of 534.15. The stock seems to have built support along its 200-day moving average. The company raised its full-year profit outlook to $20.45-$20.95 per share and adjusted net earnings to $21.40 to $21.90 after a strong Q2.

UNH is a member of Leaderboard since July 15.

Market Rally Extends Momentum As Apple Pops, Amazon Soars

Health Care Sector Remains Strong

In health care, Pfizer (PFE) broke records this morning after its largest quarterly sales on record. It beat estimates with revenue of $27.7 billion and earnings per share of $2.04. The stock sold off early but pared most losses and was back above the 200-day line after a brief dip.

Also, Merck (MRK) reported a strong $14.6 billion in sales with earnings of $1.55 per share. Elsewhere, in managed care, Humana (HUM) and Centene (CNC) reported 26% and 47% earnings increases, respectively. Centene is in extended above its buy point of 87.44. Humana is trading in the buy zone above its buy point of 469.44.

Molina Healthcare (MOH) also delivered robust results with earnings of $4.55 per share. The stock has outperformed the broader market so far this year and is climbing above a double-bottom base, close to a buy point of 316.

Stock Market Movers Today

Among the movers in today’s market rally, Dycom Industrials (DY) has spiked past its buying point of 102.27. Quanta Services (PWR) is also trading steeply up above its buy point of 138.56 but it remains in buy range. Coupled with a relative strength line that is at an all time high, this stock is one to watch. Atmos Energy (ATO) is surging above a double bottom with a buy point of 117.75.

YOU MIGHT ALSO LIKE:

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

What Is CAN SLIM? If You Want To Find Winning Stocks, Better Know It

IBD Live: Learn And Analyze Growth Stocks With The Pros

MarketSmith’s Tools Can Help The Individual Investor

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

[ad_2]

Image and article originally from www.investors.com. Read the original article here.