[ad_1]

“Past performance is not indicative of future results.”

We’ve all heard the commonly used disclaimer in the financial industry. But one of the best ways to formulate an outlook for the stock market is to examine what happened in previous years with similar economic conditions. We are privileged to have many decades of market statistics and performance that can guide us in the future. Using this underlying theme, let’s examine a past case that boasts several striking similarities to 2022 and see what we can learn.

The stock market has been an effective leading indicator of the economy – at both peaks and troughs. Back in 1966, the Vietnam war was escalating, inflation was rampant, interest rates were surging, and concerns over a global recession pounded stocks. A midterm year similar to this year, stocks suffered a bear market in 1966, with the S&P 500 falling about -22% from peak to trough. We can see below that the blue-chip index fell steadily throughout the year before ultimately bottoming out in October.

Image Source: StockCharts

In the fourth quarter of ’66, stocks were able to quietly stage a 6% comeback during the fourth quarter. And oddly enough, despite the December declines this year, the S&P has stealthily increased just under 6% in Q4. The outlook remained gloomy heading into 1967 just as it is now. Fears of an impending recession and lower asset prices put a damper on investor sentiment.

What happened in the following year? With almost no one expecting it, 1967 delivered a new bull market, with stocks rising over 20%. Because economic fears were overblown, even slightly better-than-expected outcomes triggered powerful upside momentum. There is a real possibility that 2023 could play out in a similar fashion. Remember – when the crowd thinks they know an unknowable future, they are usually wrong and the opposite occurs.

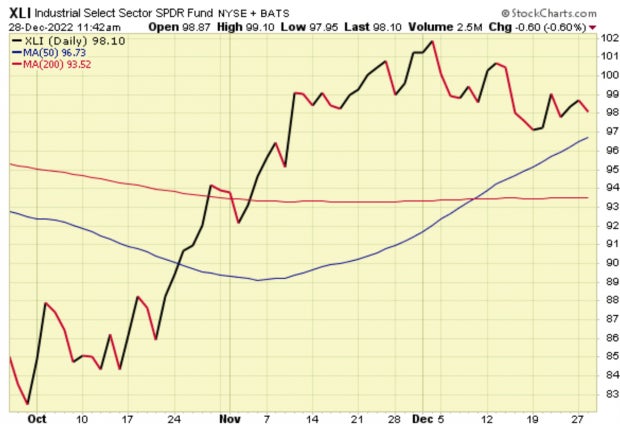

Knowing this, what sectors should we be targeting? While energy has led the way this year (and last), it may take a back seat in 2023. Industrials have shown real strength off the October lows. The Industrial Select Sector SPDR ETF XLI is a great way to gain exposure to this sector. XLI seeks to provide representation to companies in industries such as aerospace and defense, machinery, road and rail, construction and engineering, and transportation infrastructure. The Industrial Select Sector SPDR ETF offers an effective depiction of the industrial sector of the S&P 500.

XLI, a Zacks Rank #2 (Buy) ETF, has advanced nearly 20% off the late September low. Bucking the trend, XLI is trading above both its 50-day and 200-day moving averages, depicted below by the blue and red lines, respectively. Many individual stocks within the XLI ETF are now trading back near 52-week highs – another sign of strength.

Image Source: StockCharts

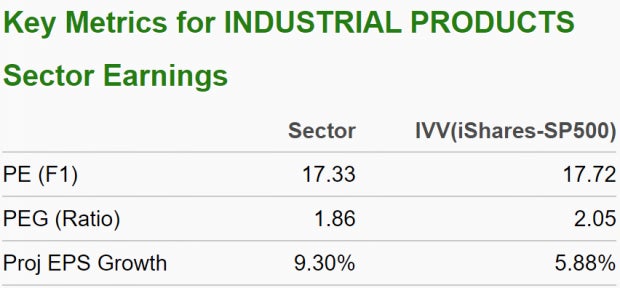

In addition, the Zacks Industrial Products sector is showing some favorable characteristics as we can see below:

Image Source: Zacks Investment Research

There are plenty of reasons to believe that industrials have more upside. But keep in mind, if 2023 surprises to the upside as 1967 did, new sectors that had previously been lagging may come back to the forefront such as technology and consumer discretionary. With just two more trading days left in 2022, I know most investors are ready to put this year behind them. But stock gains and renewed optimism may be just around the corner.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Industrial Select Sector SPDR ETF (XLI): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.