[ad_1]

The Zacks Computer and Technology Sector has struggled to find its footing in 2022 amid a hawkish pivot from the Fed, down more than 30% and widely lagging behind the S&P 500.

A company residing in the sector with a unique business, Airbnb ABNB, is on deck to unveil quarterly earnings on November 1st, after the market close.

Airbnb is a leading platform for unique stays. The company provides a marketplace for connecting hosts and guests online or through mobile devices to book spaces and experiences.

Currently, the company sports a favorable Zacks Rank #2 (Buy) paired with an overall VGM Score of a B.

How does everything shape up for the company heading into its print? Let’s take a closer look.

Share Performance & Valuation

ABNB shares have sailed through rough waters in 2022, down more than 30% and lagging behind the S&P 500.

Image Source: Zacks Investment Research

However, the price action of ABNB shares over the last three months has been visibly strong, with shares tacking on 3% in value and outperforming the general market by a fair margin.

Image Source: Zacks Investment Research

The strong near-term price action of ABNB shares tells us that sellers have lost their grip, with buyers finally stepping up to the plate.

The company’s 8.7X forward price-to-sales ratio is undoubtedly on the higher end, representing a 175% premium relative to its Zacks Computer and Technology sector.

Still, the value is a fraction of its 16.4X median since its IPO in December 2020.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bullish in their earnings outlook, with two positive earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.45 suggests Y/Y earnings growth of a solid 19%.

Image Source: Zacks Investment Research

ABNB’s top-line is also in solid standing; the Zacks Consensus Sales Estimate of $2.9 billion indicates an improvement of more than 25% from year-ago quarterly sales of $2.2 billion.

Quarterly Performance & Market Reactions

Airbnb has posted mighty strong bottom-line results, chaining together five consecutive EPS beats, all by double-digit percentages. Just in its latest print, the company surprised on the bottom-line by more than 35%.

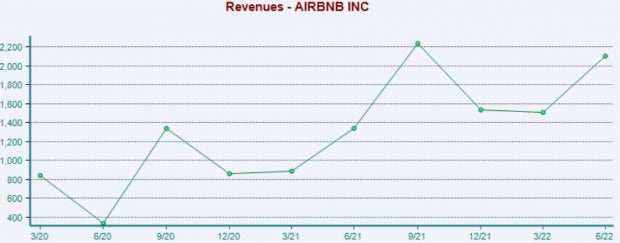

Revenue results have also been solid; ABNB has exceeded the Zacks Consensus Sales Estimate in six of its last seven quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, it’s worth noting that the market cheered on its latest earnings release, with shares tacking on roughly 3.4% in value following the print.

Putting Everything Together

ABNB shares are in the red YTD but have been notably strong over the last several months, indicating that the selling has slowed down dramatically.

The company’s forward price-to-sales ratio resides on the higher end, but that’s the price investors pay for strong growth. In addition, it’s worth highlighting that valuation multiples are nowhere near their historic levels.

Analysts have been bullish in their earnings outlook, with estimates indicating Y/Y upticks in both revenue and earnings.

The company has consistently exceeded earnings estimates by significant percentages, and the market cheered on its latest earnings release.

Heading into the print, Airbnb ABNB carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of 5.5%.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Airbnb, Inc. (ABNB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.