[ad_1]

Tyson Foods TSN fiscal Q4 report was much looked to for insights into the larger food industry and how wholesalers will be able to perform amid rising inflation and economic downturn. As more consumers stick to the essentials, food consumption is expected to hold up better than other areas of consumer spending.

Let’s see what’s going on with Tyson Foods after earnings.

Q3 Results

Historically investors have sought out food companies like Tyson Foods during challenging economic times and market uncertainty for defensive protection. Unfortunately for TSN stock, this has not been the case. Investors were hoping a strong fiscal Q4 report could give a boost to TSN’s performance this year.

Tyson stock has actually lost momentum this week, down roughly -3% since reporting. The nearby chart shows that industry competitor Hormel Foods HRL has climbed over the last year and acted more defensive, while TSN shares have lagged the S&P 500.

Image Source: Zacks Investment Research

In its fiscal Q4 results, TSN missed earnings expectations by -4% with EPS of $1.63. This represented a -29% YoY drop from Q4 2021 and a -16% decline from the previous quarter. The company was able to beat top line expectations with sales of $13.73 billion. This was up 7% from a year ago and 2% from the previous quarter.

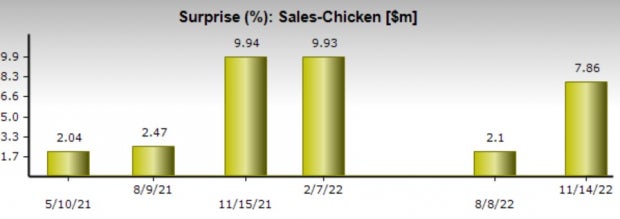

The company delivered record sales and earnings for the full year, which CEO Donnie King attributed to a diverse portfolio and continued strength in consumer demand for protein. Another highlight of the quarter was Tyson Foods’ improvement in its chicken segment with chicken supply previously one of the biggest issues facing the company.

Image Source: Zacks Investment Research

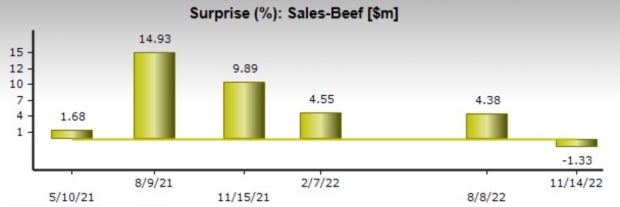

Chicken segment sales jumped 19% YoY, with chicken prices up 18%. This boosted the chicken segment’s operating income to $340 million compared to a loss of -$136 million in Q4 2021. However, total operating income was down -60% at $766 million compared to $1.90 billion in the prior-year quarter.

The decline is mostly attributed to a hard to follow record year in beef sales. However, earnings estimate revisions for TSN have continued to trend down following the report. The company gave guidance for FY23 sales between $55-$57 billion, with the Zacks Estimate at 54.04 billion.

Image Source: Zacks Investment Research

The United States Department of Agriculture’s (USDA) outlook for FY23 also indicated domestic protein production (beef, port, chick, and turkey) should decrease by 1% compared to fiscal 2022 levels. It is important to note this could affect supply and raise costs for the broader industry with competitor Hormel Foods seeing declining earnings estimates as well.

Outlook

Year over year, TSN earnings are now expected to drop -24% in its current fiscal 2023 at $6.63 per share. FY24 earnings are projected to decline another -3% to $6.45 a share.

Sales are now expected to be up 1% in fiscal 2023 and rise another 2% in FY24 to $55.37 billion. Sales estimates have gone up following the report indicating that operating costs are expected to affect the company’s bottom line as earnings revisions have declined.

Performance & Valuation

TSN is now down -25% YTD. This has underperformed the S&P 500’s -18% and its peer group’s -20% decline. Over the last decade, TSN is still up an impressive +299% when including its dividend to beat the benchmark and its peer group’s +139%.

Image Source: Zacks Investment Research

Trading around $65 a share, TSN trades at 9.5X earnings after its recent drop. This is slightly above the industry average P/E of 8.8X. TSN trades below its decade-high of 17.2X and the median of 12.2X. The stock trades attractively relative to its past but FY23 earnings estimates continue to decline.

Image Source: Zacks Investment Research

Bottom Line

TSN lands a Zacks Rank #4 (Sell) as earnings estimate revisions continue to fall following the company’s fiscal Q4 report. Tyson Foods stock trades reasonably relative to its past, but a strong fiscal Q4 report and even stronger guidance could have been crucial for the stock. With the company unable to provide either, investors may want to be cautious even with the stock near 52-week lows.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Hormel Foods Corporation (HRL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.