[ad_1]

The security has limited growth potential

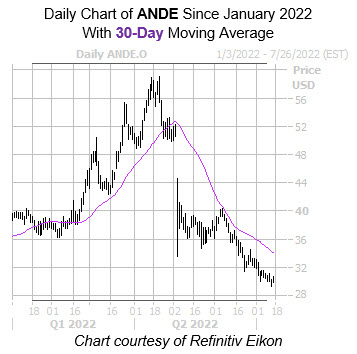

The shares of agribusiness Andersons Inc (NASDAQ:ANDE) are up 2.9% to trade at $30.57 at last check, with the equity likely enjoys some broader market tailwinds. The security has largely cooled off from its April 21, roughly eight-year high of $59, however, slipping below the 30-day moving average later that month. Plus, ANDE is fresh off an annual low of $29.35, and carries a 21% deficit so far this year.

The brokerage bunch is firmly bullish towards Andersons stock, with all three analysts in coverage carrying a “strong buy” rating. Plus, the security’s 12-month consensus target price of $51.25 is a notable 67.7% premium to current levels, leaving ANDE exposed to potential price-target cuts and/or downgrades.

Andersons stock trades at a cheap forward price-earnings ratio of 10.05, and a price-sales ratio of 0.07. ANDE also offers a decent dividend yield of 2.42%, with a forward dividend of 72 cents, pointing to a higher reward potential for long-term and dividend investors.

The business comes with a high level of risk, though. Andersons reportedly owes $1.16 billion in debt, which is more than double the its market cap of $1.04 billion. ANDE also holds just $36.35 million in cash on its balance sheet, which will likely hurt its long-term growth and profits.

What’s more, Andersons is already expected to report a decline in earnings for 2022, with estimates suggesting a 7.6% decrease. Still, the company is expected see a 13.5% increase in revenues for 2022. Additionally, its mixed growth expectations could last into 2023, with estimates indicating no revenue growth, but 11.6% earnings growth.

It’s worth worth noting the company recently completed the sale of its railcar repair business to Cathcart Rail. According to a press release, the sale helps advance its vision of being the most nimble and innovative agricultural supply chain company in North America, and reflects an active effort to improve the business’ balance sheet. Nonetheless, Andersons stock remains a high-risk investment, with limited growth potential.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.