[ad_1]

Bernstein and Canaccord Genuity initiated coverage on Snowflake stock

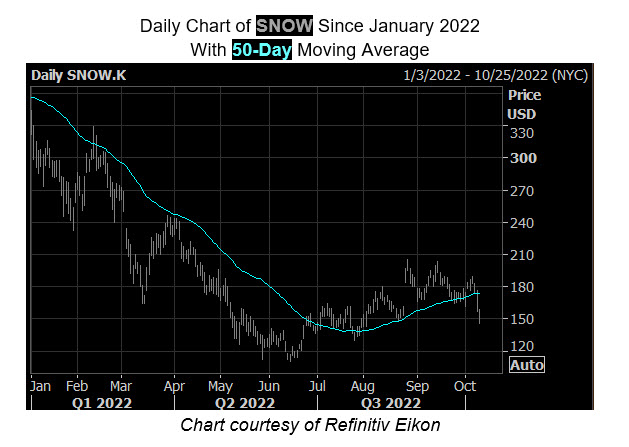

Snowflake Inc (NYSE:SNOW) stock is down 2.6% to trade at $155.04 this afternoon, with an uptick in put activity despite new bullish analyst coverage. Bernstein today initiated coverage with a “market perform” rating, while Canaccord Genuity yesterday doled out a “buy” rating and a $20 price-target hike to $220. The latter noted the cloud concern has shown “a remarkable ability to grow at scale,” after doubling total revenue in each of the past three fiscal years.

At last check, 25,000 calls have crossed the tape so far today, though the 24,000 puts exchanged represents twice the amount typically seen at this point. The two most popular contracts are the weekly 10/14 160- and 165-strike calls, while the December 175 is also seeing notable attention.

This penchant for bearish bets is nothing new, per SNOW’s 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands in the 74th percentile of readings from the past 12 months. Further, the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.12 stands higher than 82% of annual readings, indicating a put-bias amongst short-term options traders. Further,

Options could be an ideal way to speculate on the equity’s next move. This is according to the equity’s Schaeffer’s Volatility Scorecard (SVS) of 74 out of 100, which indicates the stock tends to realize bigger returns than options traders have priced in the past 12 months.

Snowflake stock has shed 16.5% in the last two days alone, breaching its 50-day moving average after an extended period of trading above the trendline. SNOW sits 54.2% lower year-to-date, while that aforementioned trendline has alternated between support and resistance all year.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.