[ad_1]

BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Grim global outlook weighs on brent.

- U.S. economic data in focus later today.

- Brent crude trading at key area of confluence.

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil has marginally recovered in early trading after yesterday’s API Crude Stock Change data surprised to the downside reflecting a reduction in U.S. inventories by 448Mbbls (EST: 117Mbbls). Looking back at the CoT report below, we can see a slight uptick in open interest on brent crude oil after reaching lows last seen in 2015 – predominantly due to market hesitancy in terms of oil forecasts. This has much to do with the current geopolitical situation stemming from Russia/Ukraine which has now been exacerbated by slowing global growth concerns while other factors like the Iranian nuclear deal adds more complexity to the forward outlook.

BRENT CRUDE FUTURES COMMITMENT OF TRADERS OPEN INTEREST

Source: Refinitiv

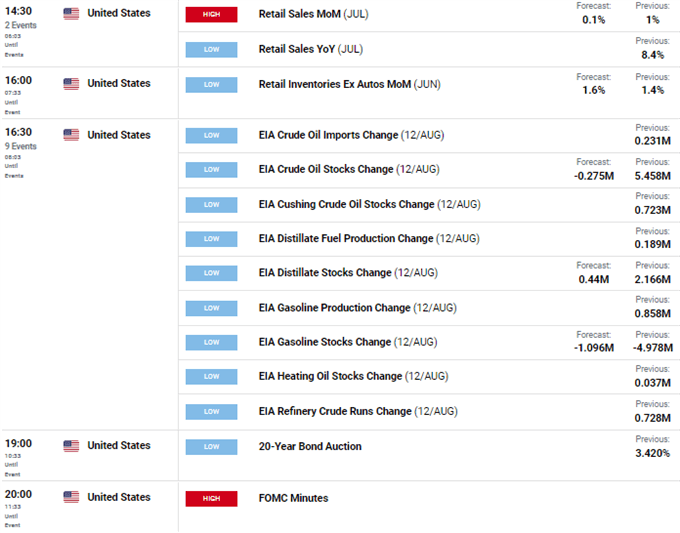

Later today, we look forward to EIA data as well as key U.S. economic data (see economic calendar below) including retail sales, but the main focus for today will come from the FOMC minutes release. Markets are looking for forward guidance as to whether or not the Federal Reserve will look to ease monetary policy in 2023 or look to quell the ‘pivot’ talk and maintain interest rate hikes. Money markets are currently favoring the easing narrative and should the FOMC push back, the dollar good find some bids and weigh negatively on brent crude prices.

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

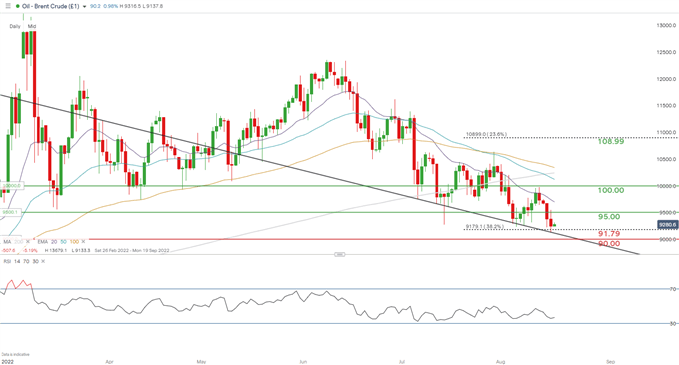

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Pushing off 6-month lows, price action on the daily brent crude chart above has the 91.79 (38.2% Fibonacci) holding as short-term support. A key level that could spark a move lower should bears manage to pierce below.

Key resistance levels:

- 100.00

- 20-day EMA (purple)

- 95.00

Key support levels:

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are NET LONG on Crude Oil, with 74% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we settle on a short-term downside bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.