[ad_1]

Apple AAPL, a behemoth in the market, is on deck to unveil quarterly earnings on October 27th, after the market close.

Revenue from the company’s flagship product, the iPhone, will be a closely watched metric and a focal point of the entire release.

Let’s take a deeper dive into what to expect.

iPhone Revenue

In its latest print, the company’s iPhone revenue grew 2.8% Y/Y to $40.7 billion on the back of solid demand for the iPhone 13, accounting for roughly 49% of AAPL’s total sales in the quarter.

Further, the reported figure easily beat the Zacks Consensus Estimate of $38.9 billion by 4.4%, representing the fifth positive surprise out of the last six, undoubtedly a major highlight.

Image Source: Zacks Investment Research

For the upcoming print, the Zacks Consensus Estimate for iPhone revenue sits at $42.8 billion, indicating an improvement of 10% from year-ago iPhone revenue of $38.9 billion.

Still, it’s worth noting that the company has decided to pull back production of its newest iPhone 14 models owing to demand that has failed to show.

Share Performance & Valuation

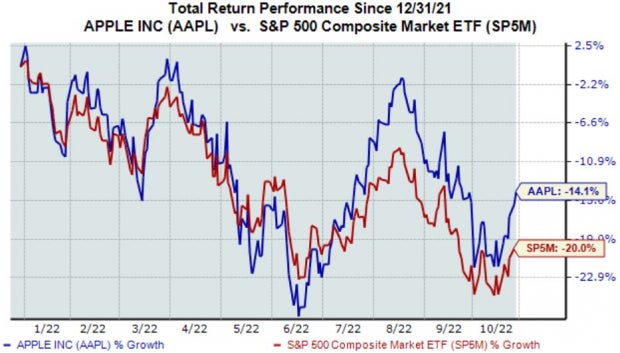

Year-to-date, Apple shares have held up relatively well, down 14% vs. the general market’s decline of roughly 20%.

Image Source: Zacks Investment Research

The relative strength shows that market participants have respected Apple shares much higher than most, undoubtedly a positive in a historically-volatile 2022.

AAPL’s valuation multiples have pulled back by a fair margin; the company’s 22.9X forward earnings multiple is just a tick below its five-year median and nowhere near 2021 highs of 35.6X.

The company carries a Value Style Score of a C.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have primarily been bullish regarding their earnings outlook, with three positive earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.26 suggests Y/Y earnings growth of a modest 1.6%.

Image Source: Zacks Investment Research

Apple’s top-line looks to improve as well; the Zacks Consensus Sales Estimate of $88.5 billion suggests revenue growth of 6% from year-ago quarterly sales of $83.4 billion.

Bottom Line

Revenue from the company’s flagship product, the iPhone, will be a closely monitored metric in the earnings call.

As it stands, the Zacks Consensus Estimate suggests solid Y/Y revenue growth for the legendary product, and Apple has positively surprised on this metric consistently as of late.

Of course, the lower-than-expected demand for the iPhone 14 product family causing AAPL to pull back production is something that can’t be ignored.

The tech titan has an impressive earnings track record, exceeding revenue and earnings estimates in nine of its last ten quarters. Just in its latest print, Apple AAPL registered a 5.3% EPS beat and a 1.2% revenue beat.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.