[ad_1]

Archean Chemical Industries IPO Review: Archean Chemical Industries Limited is coming up with its Initial Public Offering. The IPO will open for subscription on November 9th, 2022, and close on November 11th, 2022.

It is looking to raise Rs 1,462.31 Crores, out of which Rs 805 crores will be a fresh issue and the remaining Rs 657.31 Crores will be an offer for sale. In this article, we will look at the Archean Chemical Industries IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Archean Chemical Industries IPO Review – About The Company

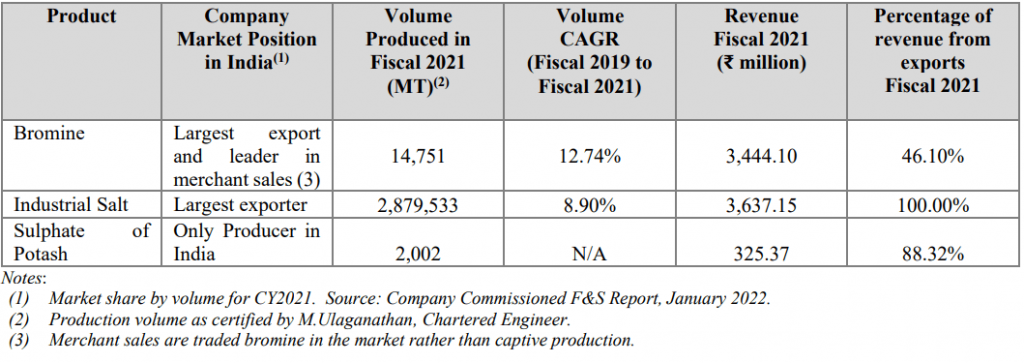

Archean Chemical Industries is a leading specialty marine chemical manufacturer in India that is focused on producing and exporting bromine, industrial salt, and sulfate of potash to customers around the world.

The company has marketed its products to 13 global customers in 13 countries along with 29 domestic customers.

The products of the company are used in industries that include pharmaceuticals, agrochemicals, water treatment, flame retardant, additives, oil & gas, and energy storage batteries.

The product portfolio of the company

(Source: DRHP of the company)

The competitors of the company

(Source: DRHP of the company)

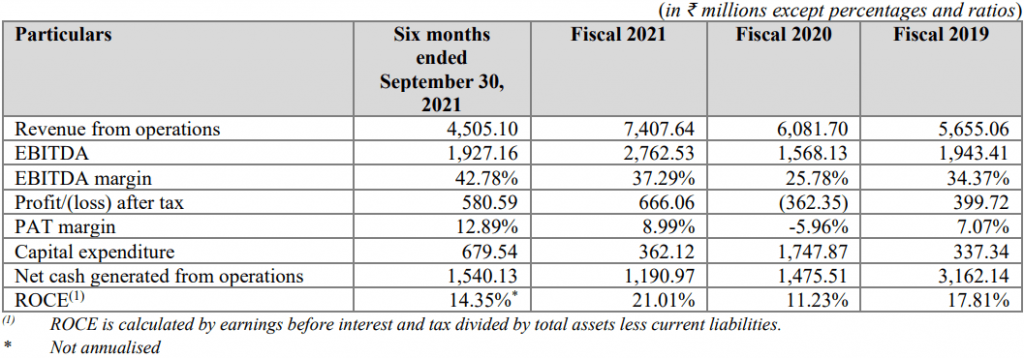

Archean Chemical Industries IPO Review – Financial Highlights

(Source: DRHP of the company)

Archean Chemical Industries IPO Review – Industry Overview

Between 2015-2020, the Indian specialty chemicals segment grew faster than the Indian commodity chemicals segment (10.4% vs. 8.7%). In the next five years, the Indian specialty chemicals segment is expected to grow at a CAGR of 11.2%.

To boost the industry further, the government has allowed 100% Foreign Direct Investment (FDI). According to the Company Commissioned F&S Report, total FDI inflow in the chemicals (other than fertilizers) sector in India reached US$17.77 billion between April 2000 and June 2020.

According to the Company Commissioned F&S Report, with abundant resources, India’s bromine capacity has developed rapidly, from 20,000 MT in the year 2008 to 60,000 MT in the year 2020.

In the year 2020, India ranked 6th globally in the export of industrial salt. As per the same report, the global industrial salt industry will grow at a CAGR of 2.8% from 157 million MT in 2020 to 185 million MT in 2025.

The overall Sulphate of Potash (SOP) market in India was approximately 55,757 MT in Fiscal 2020. According to the Company Commissioned F&S Report, the growth in SOP in India is expected to follow the global trend of approximately 6% until the year 2025.

Strengths of the Company

- The company was the largest exporter of bromine and industrial salt in India in Fiscal 2021.

- The company has a competitive advantage as the industry in which it operates has high entry barriers.

- The company has made huge capital expenditures to build integrated manufacturing sites that have proven to be cost-effective for the company.

- The company has an Experienced management team, promoters, financial investors, and stakeholders.

- The company has a history of strong and consistent financial performance.

Weaknesses of the Company

- Bromine and certain raw materials used by the company are hazardous in nature. Thus, it has an inherent operational risk.

- The company is subject to extensive safety, health, environmental, and labor laws.

- Since the company has an extensive presence in the international markets it is subject to exchange rate fluctuations.

- The company is dependent on third-party transportation and logistics service providers. Any disruptions can affect the business.

- The company does not own any patents and its logo is not registered as a trademark. Therefore, protecting intellectual property is crucial to the success of their business.

Archean Chemical Industries IPO Review – GMP

The shares of Archean Chemical Industries traded at a premium of 14.74% in the grey market on November 7th, 2022. The shares tarded at Rs 467. This gives it a premium of Rs 60 per share over the cap price of Rs 407.

Archean Chemical Industries – Key IPO Information

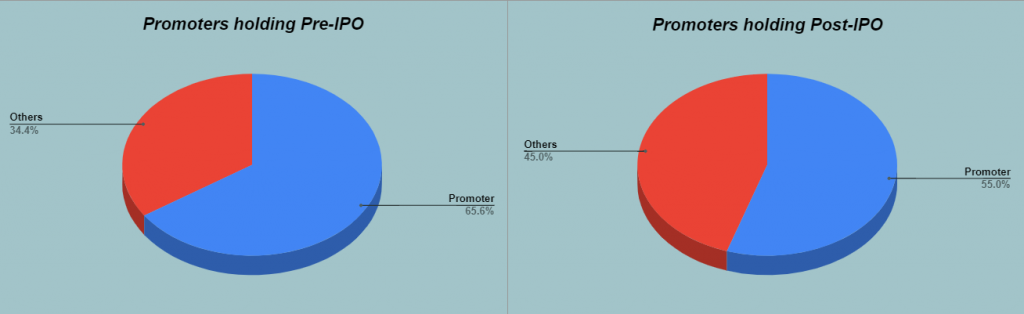

Promoters: Chemikas Speciality LLP, Ravi Pendurthi, and Ranjit Pendurthi.

Book Running Lead Managers: JM Financial Limited, ICICI Securities Limited, and IIFL Securities Limited.

Registrar To The Offer: Link Intime India Private Limited

| Particulars | Details |

|---|---|

| IPO Size | ₹1,462.31 Crore |

| Fresh Issue | ₹805 Crore |

| Offer for Sale (OFS) | ₹657.31 Crore |

| Opening date | November 9, 2022 |

| Closing date | November 11, 2022 |

| Face Value | ₹2 per share |

| Price Band | ₹386 to ₹407 per share |

| Lot Size | 36 Shares |

| Minimum Lot Size | 1 (36 Shares) |

| Maximum Lot Size | 13 (468 shares) |

| Listing Date | November 21, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for:

- Redemption or earlier redemption, in part or full, of NCDs issued by the company; and

- General corporate purposes

In Closing

In this article, we looked at the details of Archean Chemical Industries IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favorite stocks

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.