[ad_1]

While many investors expect a recession in 2023, we believe we are already there. Unlike most recessions caused by over-capacity and high unemployment, the labor market continues to be relatively tight. We believe that productivity improvement and investments in automation, robotics, and AI, will be the only way to tackle wage inflation sustainably.

CONTENTS

- Has Artificial Intelligence (AI) gone out of style?

- Are we already in a recession?

Has AI gone out of style?

Given how poorly technology stocks have been trading this year, there is a fair bit of skepticism around AI. But, about a week ago, OpenAI announced the public availability of ChatGPT, an artificial intelligence (AI) chatbot, which put the spotlight on AI and its potential. Seeing the power first hand has left many investors wondering what the impact will be and what is next to come.

OpenAI is a company backed by Microsoft which made an initial investment in 2019 to obtain exclusive license of the GPT-3 language model, the basis of ChatGPT. As a background, the GPT-3 Natural Language Processing (NLP) model was trained in 2021 using a super computer that reportedly contained 385K CPU cores and 10K GPUs.

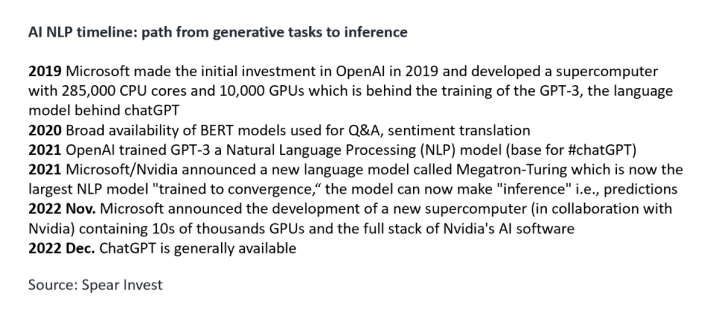

There have been many developments over the past year+ in this field including new language models and hardware enhancements. Most notable:

- Megatron-Turing – the largest NLP model “trained to convergence,” meaning that the model can now make “inference” i.e. predictions

- Recently announced, Microsoft’s new supercomputer (in collaboration with Nvidia) containing 10s of thousands GPUs and the full stack of Nvidia’s AI software

- Step up in hardware capabilities. Nvidia’s new GPU architecture (Hopper H100) available in 2023 runs 30x faster than its predecessor when deploying models, and requires 6 to 9x less infrastructure to train models

It is important to note the scale of the chart below to appreciate the pace of development.

We expect that, in the medium term, AI will be a meaningful contributor to productivity improvement, especially at a time where we have a structural labor shortage. In the long run, we expect that the breakthrough is going to come from AI models evolving from “generative” tasks (e.g. chatGPT) to “inference” i.e. predictive tasks. This will significantly broaden the use cases from “chat/language” to other fields e.g., developing chemical compounds for therapeutics, material properties for next-gen manufacturing and material science, etc.

Per Nvidia, there are now 10,000 inception start-ups working with the company to use AI and broaden the use cases. The challenge from investment perspective will be to identify the business models that will be able to generate returns, as most will be using the same/similar infrastructure which lowers the barriers to entry.

MACRO BACKDROP

Are we already in a recession?

While most investors expect that a recession will come in 2023, we believe that we are already in a recession. We will go into more details about each subsector in our next week’s 2023 Outlook, but in short there are several sub-sectors that we consider to be “canaries in the coal mine”. Those are:

- Consumer discretionary

- Trucking

- Commodities

- Semiconductors

All four experienced major slowdown in May/June and the main driver was excess inventory. Over the summer demand stabilized at a lower level, but the latest Fed rate increase (10Y>3.5%) resulted in a significant step down post Labor Day.

Our channel checks and conversations with management teams indicate that the impact of higher rates and recession fears has now broadened from select industries to most end markets, resulting in a spending freeze.

The key question that we are trying to solve is if sentiment is actually worse that end-demand. It is common in recessions that sentiment will precede demand, but we are now seeing inventories (in several commodities) depleted below normal levels (recessions are generally characterized with oversupply).

Below is an example of copper inventories at the LME:

We believe that industrial activity, while weakening with interest rates and lack of capital availability, still has significant support from re-shoring. As an example, earlier this week, TSMC announced a second plant in Arizona, tripling its investment in the US to $40bn. To put this in context, the entire US annual equipment manufacturing capex is slightly over $200bn. Consequently, we expect that this recession will likely be focused on the consumer, while industrials are likely to hold up better.

Stay tuned for our 2023 outlook next week.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.