[ad_1]

Australian Dollar, AUD/USD, Employment Report, RBA, Technical Outlook – TALKING POINTS

- AUD/USD falls after Australia’s July jobs report disappoints expectations

- Modest RBA rate hike bets and an already weak AUD cushion price reaction

- Technical outlook mixed but prices are holding above key support levels

The Australian Dollar fell against the US Dollar after a downbeat jobs report that saw 40.9k jobs lost for July. The unemployment rate fell to 3.4% from June’s 3.5%. However, that was likely due to a drop in the participation rate, which declined to 66.4% from 66.8% in June. Despite taking a hit on the jobs data, AUD/USD’s reaction is rather subdued, with prices holding nearly 1% above the August low.

AUD/USD 1-Minute Chart

Chart created with TradingView

The Reserve Bank of Australia (RBA) has lagged behind its major peers in tightening policy, and rate hike expectations were already modest ahead of the jobs report. The September meeting shows an implied move of 38 basis points in the target cash rate. Consumer inflation expectations have eased along with consumer confidence. The relatively subdued view on future rate hikes, along with the recent fall in the Aussie Dollar, helps to explain the modest reaction to the jobs report. However, that leaves an upside risk to prices should the RBA deliver another 50-bps hike.

An ailing Chinese economy, a major Australian trade partner, has also weighed on the Australian Dollar lately. China’s central bank cut its medium-term lending facility rate earlier this week, but that failed to assuage wary investors. The PBOC is seen cutting its 1- and 5-year loan prime rates next week, which may bolster economic sentiment across the Asia-Pacific region.

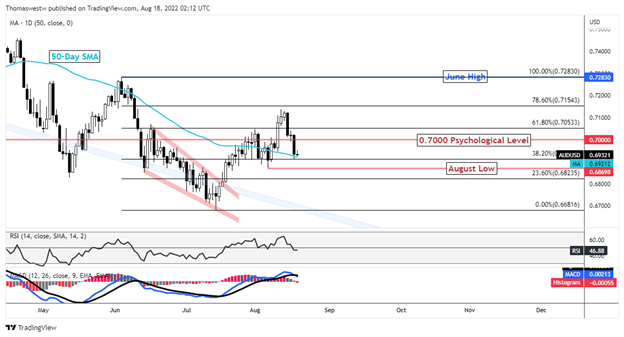

AUD/USD Technical Outlook

AUD/USD is holding above its 50-day Simple Moving Average (SMA) after prices sliced below the psychological 0.700 level earlier this week. The Relative Strength Index crossed below its midpoint, and the MACD made a bearish cross below its signal line. That suggests a bearish outlook, but the 38.2% Fibonacci retracement offers another level of support to underpin prices before threatening the August low.

AUD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.