[ad_1]

Australian Dollar Talking Points

AUD/USD is under pressure as Federal Reserve Chairman Jerome Powell offers a hawkish forward guidance while speaking at the Kansas City Fed Economic Symposium, and the US Non-Farm Payrolls (NFP) report may drag on the exchange rate as the update is anticipated to show a further improvement in the labor market.

AUD/USD Rate Vulnerable to Upbeat US Non-Farm Payrolls (NFP) Report

AUD/USD struggles to retain the advance from the start of the week as the commodity bloc currencies weaken against the Greenback, and the exchange rate may continue to give back the rebound from the yearly low (0.6681) as the Federal Open Market Committee (FOMC) prepares US households and businesses for a restrictive policy.

The update to NFP report may encourage the FOMC to retain its current approach in combating inflation as the economy is anticipated to add 300K jobs in August, and evidence of a strong labor market may generate a bullish reaction in the US Dollar as it fuels speculation for another 75bp Fed rate hike.

In turn, AUD/USD may track the negative slope in the 200-Day SMA (0.7127) after failing to push above the moving average earlier this month, and it remains to be seen if the FOMC will alter the forward guidance at the next interest rate decision on September 21 as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP).

Until then, data prints coming out of the US may largely influence AUD/USD even as the Reserve Bank of Australia (RBA) argues that the board “is not on a pre-set path,” but a further decline in the exchange rate may fuel the tilt in retail sentiment like the behavior seen earlier this year.

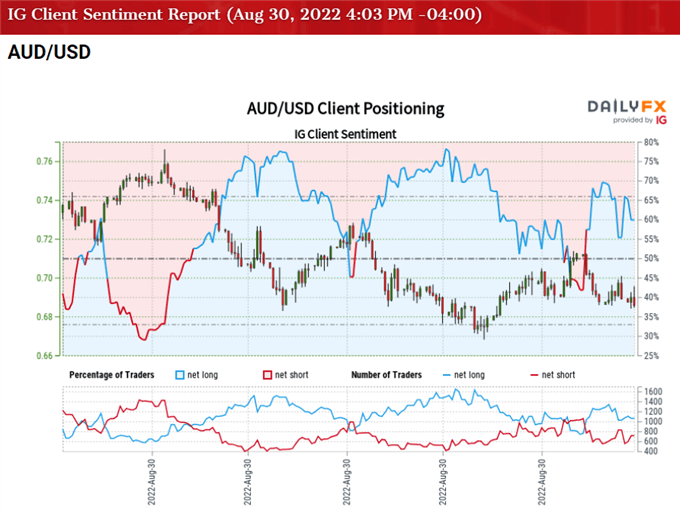

The IG Client Sentiment report shows 63.42% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.73 to 1.

The number of traders net-long is 2.93% higher than yesterday and 5.62% lower from last week, while the number of traders net-short is 5.81% lower than yesterday and 6.62% lower from last week. The decline in net-long interest has done little to alleviate the crowding behavior as 63.17% of traders were net-long AUD/USD last week, while the decline in net-short position comes as the exchange rate bounces back from a fresh monthly low (0.6841).

With that said, the US NFP report may lead to bearish reaction in AUD/USD as the update is anticipated to show a further improvement in the labor market, and the exchange rate may struggle to retain the rebound from the yearly low (0.6681) as it appears to be tracking the negative slope in the 200-Day SMA (0.7127).

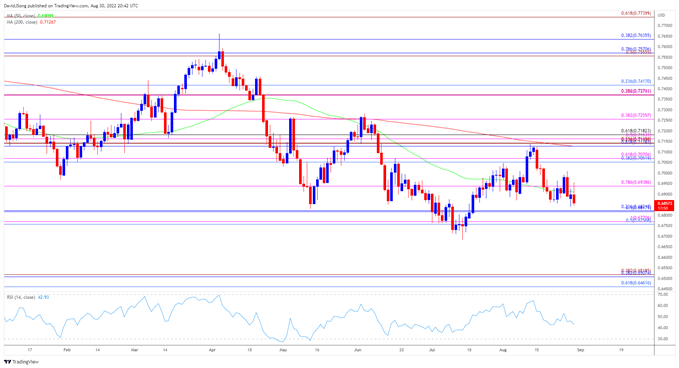

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD seems to be mirroring the price action from June after failing to test the 200-Day SMA (0.7127) earlier this month, with the exchange rate trading to a fresh monthly low (0.6841) as it appears to be tracking the negative slope in the moving average.

- Need a break/close below 0.6820 (23.6% retracement) to bring the 0.6760 (50% retracement) to 0.6770 (100% expansion) region on the radar, with a break of the yearly low (0.6681) opening up the Fibonacci overlap around 0.6460 (61.8% retracement) to 0.6520 (38.2% expansion).

- However, failure to break/close below 0.6820 (23.6% retracement) may push NZD/USD back towards the 0.6940 (78.6% expansion) region, with a move above last week’s high (0.7009) bringing the 0.7050 (38.2% retracement) to 0.7070 (61.8% expansion) area back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.