[ad_1]

Australian Dollar Talking Points

AUD/USD trades to a fresh monthly high (0.6983) to largely track the advance across the commodity bloc currencies, but the exchange rate may mirror the price action from last month as it struggles to hold above the 50-Day SMA (0.6969).

AUD/USD to Mirror June Price Action on Failure to Hold Above 50-Day SMA

AUD/USD is likely to face increased volatility over the coming days as Australia’s Consumer Price Index (CPI) is expected to widen for three consecutive quarters, with the headline reading projecting to increase to 6.2% from 5.1% per annum in the first quarter.

Evidence of rising inflation may generate a bullish reaction in the Australian Dollar as it puts pressure on the Reserve Bank of Australia (RBA) to further normalize monetary policy over the coming months, but the market reaction may end up being short lived as the Federal Reserve is anticipated to deliver another 75bp rate hike.

The Federal Open Market Committee (FOMC) rate decision may ultimately sway the near-term outlook for AUD/USD as the central bank shows a greater willingness to carry out a restrictive policy, and the exchange rate may struggle to retain the advance from the yearly low (0.6681) should the central bank unveil plans to implement higher interest rates throughout the remainder of the year.

As a result, AUD/USD may mirror the price action from last month as it struggles to hold above the 50-Day SMA (0.6969), but a shift in the Fed’s forward guidance may fuel a larger recovery in the exchange rate if Chairman Jerome Powell and Co. deliver a dovish rate hike.

In turn, AUD/USD may continue to retrace the decline from the June high (0.7283) if the central bank plans to take a break from its hiking cycle, and a further advance in the exchange rate may lead to a flip in retail sentiment like the behavior seen earlier this year.

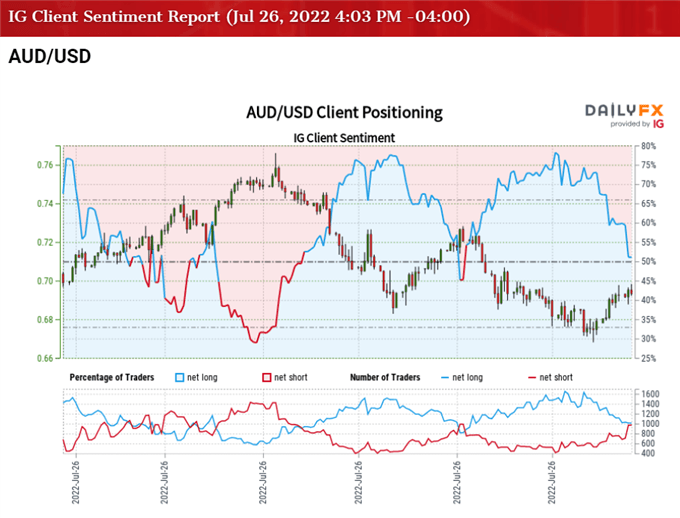

The IG Client Sentiment report shows 55.76% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.26 to 1.

The number of traders net-long is 6.72% higher than yesterday and 6.74% lower from last week, while the number of traders net-short is 11.19% lower than yesterday and 5.15% higher from last week.

The number of traders net-long is 3.89% lower than yesterday and 23.45% lower from last week, while the number of traders net-short is 30.23% higher than yesterday and 45.55% higher from last week. The drop in net-long position comes as AUD/USD trades to a fresh monthly high (0.6983), while the rise in net-short interest has alleviated the crowding behavior as 59.11% of traders were net-long the pair last week.

With that said, the Fed rate decision may undermine the recent recovery in AUD/USD if the central bank stays on track to implement a restrictive policy, and the exchange rate may mirror the price action from last month as it struggles to hold above the 50-Day SMA (0.6970).

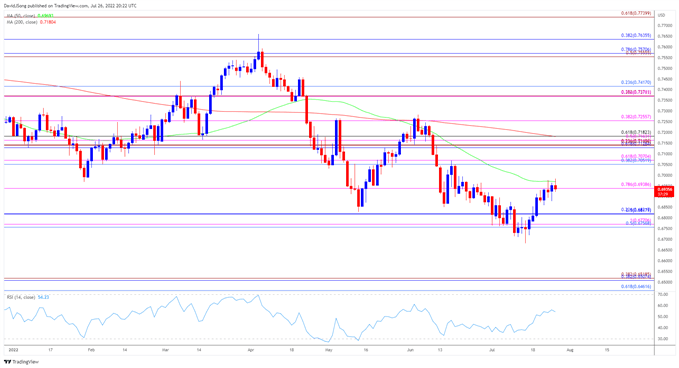

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD tests the 50-Day SMA (0.6970) after clearing the opening range for July, with the break/close above the 0.6940 (78.6% expansion) area raising the scope for a move towards the 0.7050 (38.2% retracement) to 0.7070 (61.8% expansion).

- Next area of interest comes in around 0.7130 (61.8% retracement) to 0.7180 (61.8% retracement), but AUD/USD may mirror the price action from last month as it struggles to hold above the moving average.

- Lack of momentum to hold above 0.6940 (78.6% expansion) may push AUD/USD back towards the 0.6820 (23.6% retracement) region, with a break/close below the 0.6760 (50% retracement) to 0.6770 (100% expansion) area bringing the yearly low (0.6681) on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.