[ad_1]

ISM SERVICES KEY POINTS:

- August ISM services PMI inches up to 56.9 from 56.7 in July, beating expectations calling for a decline to 55.1

- Better-than-forecast data suggests the economy remains resilient

- The recovery in the services sector is bolstered by a rebound in production, new orders and the employment component of the survey

Most Read: S&P 500, Nasdaq 100 Forecast for Week Ahead – Path Higher Difficult but Possible

A gauge of U.S. business services activity unexpectedly rebounded last month, albeit at a modest pace, defying the doom-and-gloom narrative from certain corners of Wall Street, and easing fears that the country is headed for a painful recession, undermined in part by rising interest rates aimed at curbing runaway inflation.

According to the Institute for Supply Management (ISM), August non-manufacturing PMI rose to 56.9 from 56.7 in July, expanding for the 27th consecutive month and topping expectations calling for a decline to 55.1, a sign that the economy remains extraordinarily resilient. For context, any figure above 50 indicates growth, while readings below that level denote a contraction in output.

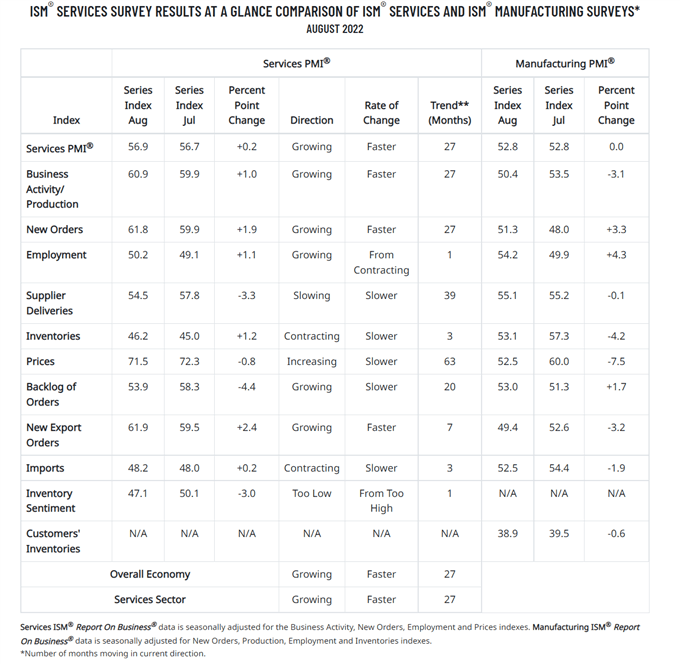

RESULTS AT A GLANCE

Source: DailyFX Economic Calendar

Looking under the hood, the services sector, where most Americans work and the most important for GDP calculations, was bolstered by a small recovery in the production, new orders and employment components of the survey, indicating that the demand environment is positive despite tightening financial conditions. All this suggests that the Fed may still be able to achieve the elusive soft-landing.

Elsewhere, the prices paid index continued to moderate compared to previous months’ readings, coming in at 71.5 versus 72.3 at the start of the current quarter. Easing cost burdens for U.S. businesses may translate into lower CPI figures later in the year, but more significant improvements are likely required to blunt the impact of sky-high inflation across industries in a more meaningful way.

ISM SERVICES DATA

Source: Institute for Supply Management

The ISM service sector survey follows the group’s report last week on manufacturing PMI, which showed resilient economic expansion and a sharp moderation in the growth of prices paid, two encouraging developments for policymakers, who are trying to reduce inflation while preventing a hard-landing with deleterious effects for most Americans.

Taken together, recent data may help allay concerns about a major downturn. However, with the economy holding up well and inflation well above the central bank’s 2% target, the Fed is likely to press ahead with its plans to raise interest rates steadily in the coming months, delaying a monetary policy pivot for the foreseeable future. While constructive for the U.S. dollar, this scenario is likely to spark volatility from time to time, preventing stocks from staging a sustainable and durable recovery.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.