[ad_1]

Australian Dollar, AUD/USD, CPI, Inflation, RBA – Talking Points

- The Australian Dollar slipped after CPI came in lower than anticipated

- A 6.1% headline CPI gives the RBA some breathing space for gradual rate rises

- AUD and bond yields went south, but the ASX is steady in the aftermath of the data

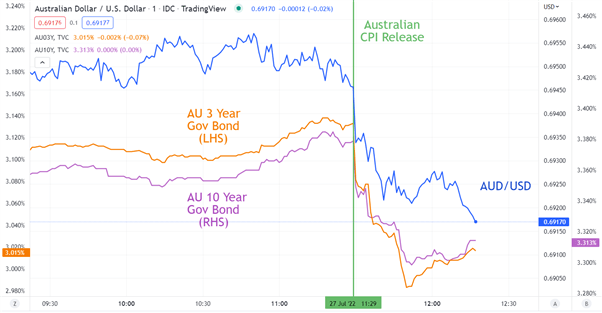

The Australian Dollar and domestic bond yields slid lower after CPI came in below expectations to ease pressure for rate hikes from the RBA.

Going into the CPI number the Aussie had been oscillating around 0.6950 despite the US Dollar strengthening against other major ahead of the Federal Reserve meeting later today. The market is anticipating a 75- basis point hike from them.

For AUD/USD, the RBA is squarely in focus for their meeting next Tuesday 2nd August. The market is pricing in a 50- basis point hike, although the probability was lowered slightly after CPI.

The 3- and 10-year Australian Commonwealth Government bond (ACGB) yields moved lower. At the time of going to print, the 3-year is down 14 bp at 2.99%, while the 10- year is 8 bp lower at 3.30%. The ASX 200 recovered earlier losses to be trading around 6800.

Today’s CPI number has given the RBA time to implement measured rate rises rather than a jumbo lift, such as the 100 bp seen by the Bank of Canada earlier this month.

The scope for the RBA to continuing to hike is supported by a very tight labour market and healthy trade figures. The June unemployment rate came in at 3.5% against 3.8% forecast and 3.9% previously. The latest trade surplus of AUD 15.96 billion for the month of May was a big beat on AUD 10.85 billion anticipated.

While the fight on inflation is clearly understood, the global growth outlook remains somewhat opaque. Global central banks raising rates, the Ukraine war and a sluggish outlook for the Chinese economy are all weighing on sentiment.

These risks were highlighted overnight with the International Monetary Fund (IMF) warning of slowing global growth.

Retails sales, PPI numbers and building approvals data will be released ahead of the RBA’s monetary policy meeting next Tuesday.

AUD/USD, 3-YEAR AU BOND AND 10-YEAR AU BOND

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.