[ad_1]

Welcome back to our Dividend Investing blog! Today’s article will be a little twist – as I wanted to dive into Bank of America’s (BAC) results and discuss how they performed AND what type of stage they may be setting.

Bank of America (BAC) reported earnings on October 17th. The big bank, one of the too big too fail banks, had amazing numbers, but it’s something they recorded that could be setting the stage for a record earnings year of 2023! Let’s dive in and go over the release!

Bank of AMerica (BAC) Top Line Revenue

First, Bank of America’s results could show an indication that companies are managing the extreme volatility quite well. When interest rates rise, that means they make more money on loans.

In fact, BAC had an 8% increase in revenue to $24.5 billion for the quarter. The major point of this increase, is that net interest income increased 24% to $13.8 billion.

Non-interest income, which is where another bulk of income comes for banks, was also up. Non-interest income comes from overdraft fees, NSF fees, interchange income (aka making money on every swipe of a credit and/or debit card), wealth management revenue, the list goes on!

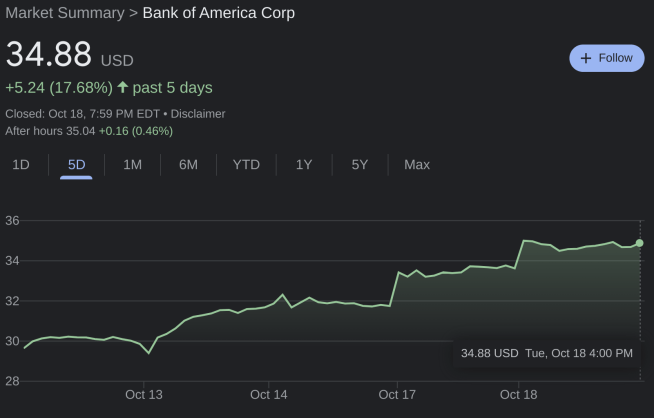

I digress. Bank of America increased their revenue from the last quarter. I would expect and anticipate all of the other banks to be performing very similar. Therefore, this could provide indication that the stock market may have a “green” finish to October. If this is how the earnings results will come in, should be interesting to see what occurs. At the time of this writing, Bank of America is up 10%, for their stock price:

Bank of America (BAC) Bottom Line Net Income

Bank of America earned $7.1 billion in net income for the 3rd quarter or earnings per share of $0.81. Net income was higher than the previous quarter or quarter 2. Compared, though, to the 3rd quarter last year, Bank of America’s net income is lower by $600 million. What happened this quarter?

Provision for credit losses went way up. This is the key piece here. Provision went up by $1.5B, but they only recorded $898 million in provision. Provision for loan losses, is setting aside funds for losses you expect to incur on your loan portfolio. Now you see, in Q3 of 2021, Bank of America REVERSED provision by over $600 million last year. This was the built up reserve during the pandemic, only for big banks, such as Bank of America, to say they did not need that much at that time.

Therefore, could this be a repeat of 2020? Bank of America hasn’t recorded this much provision for over a year. Given that they are starting to record hundreds of millions in provision expense, there could be a large reversal in 2023 and/or 2024. They are using the current economy to record the provision, given delinquencies and charge offs are higher, recession looms and – of course – inflation is still at all time highs. Therefore, Bank of America is “expecting” higher charge offs and possible devaluation to collateral values, such as cars, homes, etc..

What does that mean for dividend investors? Yes, let’s run them through the Dividend Diplomat Stock Screener!

Bank of America (BAC) Dividend Stock Metrics

I cannot wait to put Bank of America stock through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

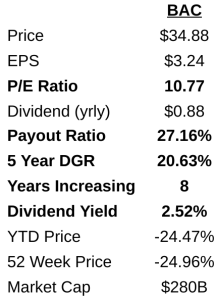

1.) P/E Ratio: A great valuation here, at 10-11x forward earnings. I used the last quarter’s earnings per share and annualized the figure for the remainder of the year. The S&P 500 is currently at 19x earnings, but the banking industry is typically in the 8-14 range. Therefore, there is some value here.

2.) Dividend Payout Ratio: We all know our perfect payout ratio is between 40% and 60%. Bank of America is keeping it very safe, with just a 27% dividend payout ratio. Leaving safety to the dividend and room for big increases in the future.

3.) Dividend Growth Rate: 8 years of consecutive increases, their last one was only one cent, from $0.21 to $0.22, or 5%. Therefore, though the 5 year growth rate is 20%, they may not be juicing up the dividend by that much going forward.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for BAC is at 2.52%. Not the highest yielding dividend stock, given the current market.

is Bank of America Stock a Stock to buy now?

Now that we’ve gone through the metrics, is BAC a stock to buy for the dividend stock portfolio?

Bank of America, though is doing really well, just carries too low of a dividend yield for me, given other competitors out there. Bank of America did give us insight to what the big banks may be doing – taking severe losses now, to set up for strong earnings in future years, with their provision. It’s hard to buy Bank of America stock when JPMorgan (JPM) stock has a yield over 3.3%.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Bank of America’s stock? Do you own other big bank stocks? Are you buying any bank stocks right now? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

[ad_2]

Image and article originally from www.dividenddiplomats.com. Read the original article here.