[ad_1]

Last year, I asked you who would have thought 2021 would have been such a great year? We paid the price of karma, and here we are, 12 months later, sitting in the middle of a bear market. This is no ordinary bear market, though; it’s a bear that is hurting many “investment hedges”:

- Bonds suffered as interest rates have increased steadily and it’s not over yet

- Bitcoin suffered as it proved to be nothing, but a tulip

- Gold suffered even though it’s supposed to be an inflation hedge

Only one thing worked in 2022… Oil & Gas!

Do I Regret not Investing in Oil? Not at all

I’ve been quite vocal since 2013 that I don’t like oil & gas stocks. It has nothing to do with where I live (Quebec), and environmental values, and I’m not saying oil stocks are bad investments. When it comes to investing, I would rather focus on the numbers. Numbers tell me energy stocks make bad dividend growers. How many Energy stocks show at least 10 years of dividend growth?

- Enbridge (ENB.TO)

- TC Energy (TRP.TO)

- Canadian Natural Resources (CNQ.TO)

- Imperial Oil (IMO.TO)

- Enterprise Products Partners LP (EPD)

- Magellan Midstream Partners LP (MMP)

- Special mention to Chevron (CVX) and Exxon Mobil (XOM) who didn’t increase their dividends in 2020 but kept the “annual total dividend paid” increase streak alive.

Did I miss anyone? That’s 6 companies (8 if you want to include CVX and XOM) out of 116 companies in our DSR stock screener. To be fair, there are a few duplicates since some stocks are trading on both markets. Therefore, we can say that 6-8% of all energy stocks qualify as long-term dividend growers.

While I clearly missed this opportunity, I also avoided losing a boatload of money in between 2013 and 2020. But most importantly, I stayed loyal to my investment strategy: dividend growth investing. Investing with conviction means that you will miss opportunities. It will also mean that you will make mistakes. However, that conviction will make sure you don’t panic sell, that you make rational decisions, and that you follow a clear plan.

A full podcast series on How to Invest 2023 is available to you now! Get your plan for the year ready, and catch it up!

Here are some great stock ideas for 2023:

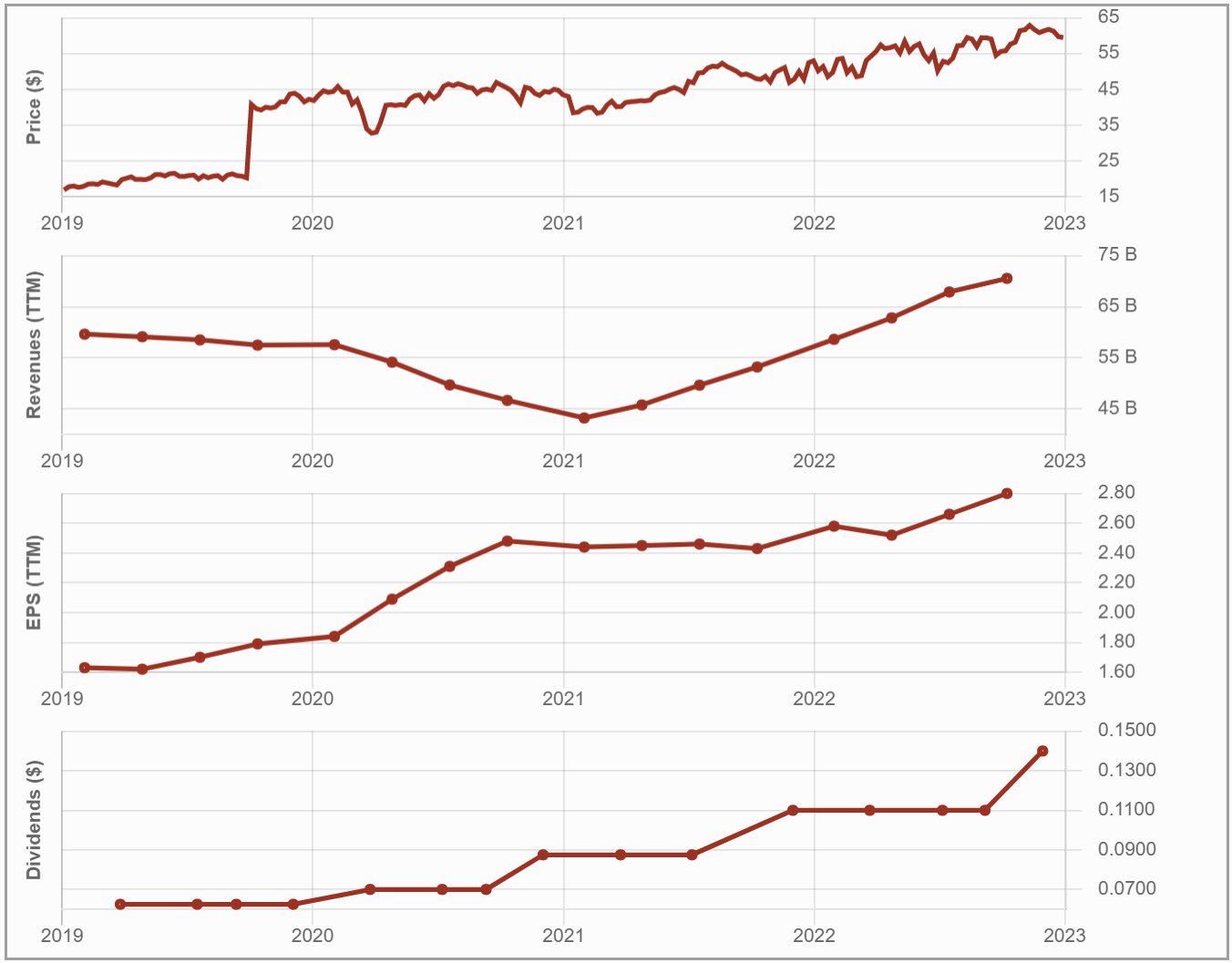

Alimentation Couche-Tard (ATD.TO)

- Market cap: 61B

- Yield: 0.90%

- Revenue growth (5yr, annualized): 9.55%

- EPS growth rate ((5yr, annualized): 19.95%

- Dividend growth rate (5yr, annualized): 18.75%

I can’t stress my admiration for the world’s second-largest convenience store chain enough. Many will ask how Couche-Tard will make money once we all drive electric vehicles. First, know that we are very far from this scenario. It will take at least 10 years to reach a level where there are more EV’s on the road than ICE (Internal combustion engine) vehicles. Second, they are already thriving in Norway where 14% of the vehicle fleet is electric. They succeed in this market by having chargers in strategic locations and even by installing their own chargers at consumers’ homes. Third, 65% of Couche-Tard transactions don’t include gas sales. Therefore, 2/3 of Couche-Tard’s business is 100% sheltered from the energy transition. Fourth, the bulk of their profit comes from convenience store sales. ATD focuses on improving their customers’ experiences by adding products such as fresh food fast (their version of healthy fast food!), automating cashiers, and building a loyalty program.

On top of organic growth vectors, Couche-Tard also enjoys a robust balance sheet. It means they can pull the trigger on any acquisitions coming their way. The management team remains disciplined and won’t waste a penny on a bad deal for growth.

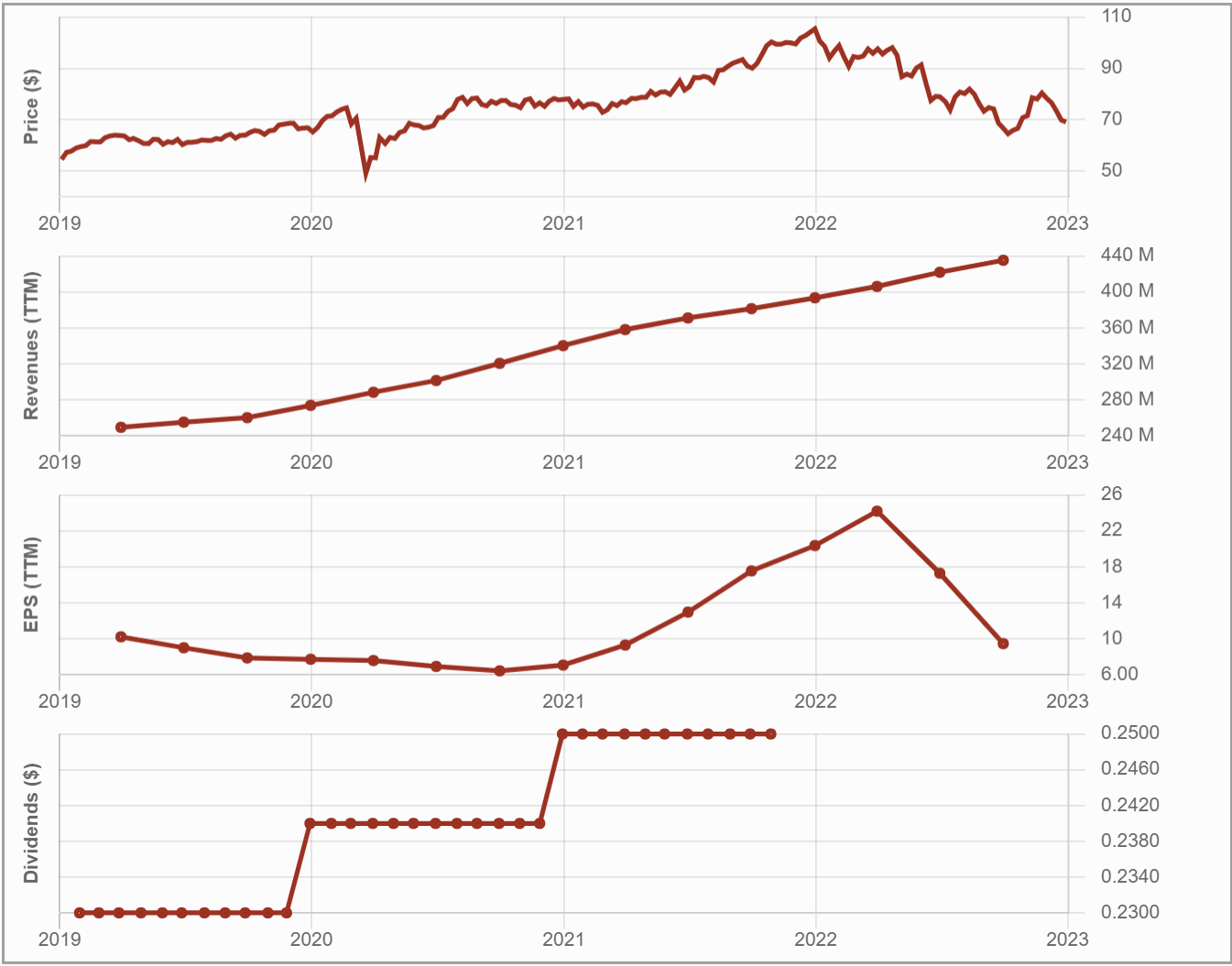

Granite REIT (GRT.UN.TO)

- Market cap: 3B

- Yield: 4.65%

- Revenue growth (5yr, annualized): 12.00%

- EPS growth rate ((5yr, annualized): 28.15%

- Dividend growth rate (5yr, annualized): 4.40%

Granite saw its unit price deplete throughout 2022 (-28%) while reporting impressive results. Granite REIT reported another good quarter with revenue up double-digits (+14%) and FFO per unit up 4.3%. GRT’s growth was mostly driven by new acquisitions and contractual rent adjustments. The REIT announced another dividend increase of 3% and reported an AFFO payout ratio of 80% for the quarter. While many investors are worried about the future of industrial properties now that interest rates are increasing, Granite keeps reporting stellar occupation rates (99%) and a solid pipeline. The demand remains strong in this sector.

Another proof that this industry is now offering a good opportunity was the acquisition of Summit Industrial REIT (SMU.UN.TO) by GIC (a Singapore sovereign wealth fund) and Dream Industrial (DIR.UN.TO) for $5.9B. That represented a premium of 31% on SMU’s price. This news led to a boost in valuation for all other Canadian industrial REITs.

Interestingly, Granite has a similar market capitalization (4.85B for Granite, $4.3B for Summit). Maybe it will be a target for an acquisition in 2023?

Find out about 6 companies that will crush 2023

I compile a list of stocks expected to do better than the market for Dividend Stocks Rock members each year. This year, I’ve reviewed the 11 sectors for them and included top picks for each. I’ve decided to share three of them with you: Financials, Information Technology, and Utilities.

You can download 6 of my top 23 for 2023 right here:

[ad_2]

Image and article originally from www.thedividendguyblog.com. Read the original article here.