[ad_1]

Klaus Vedfelt

Thesis

BlackRock Multi-Sector Income Trust (NYSE:BIT) is a closed-end fund from the BlackRock suite. We wrote a couple of articles about the fund and its composition and in today’s piece we are going to explore the fund’s performance from the lens of its zero-duration set-up. BIT is a rare CEF where management chose to take a view on interest rates and positioned the fund with a flat duration profile. This is achieved via swaps and futures and we discuss in the “Metrics” section below the specific mechanics.

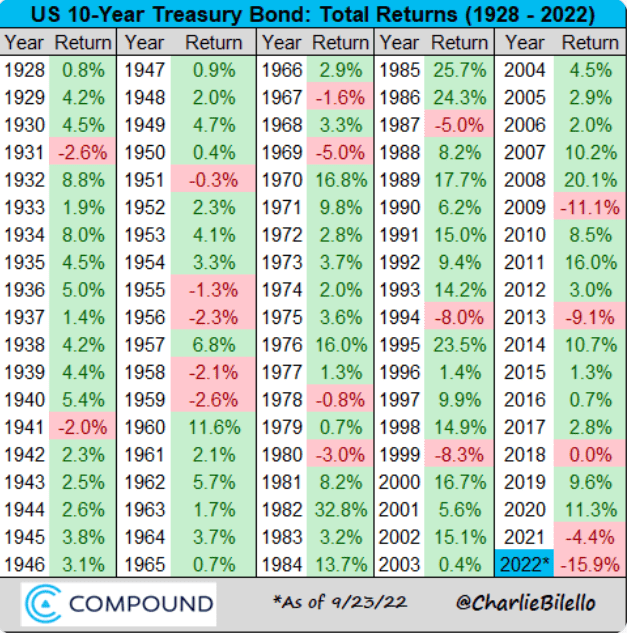

Rates have been on a tear this year with the 5-year treasury rate moving from 0.8% in September 2021 to almost 4% now. That is an unprecedented move that has made 2022 the worst year on record for the 10-year treasury returns as an example:

10-Year Bond Total Returns (Compound Advisors)

Sudden and vertical increases in rates are the worst possible environments for bond funds. Protracted rate increases (over several years) are preferable since they can be dampened by the fund’s dividend yield.

The article highlights how BIT has been able to spectacularly outperform its peers in the high yield and multi-sector bond fund space with a year-to-date total return of only -12%. To that end BIT has managed to outperform even 10-year Treasuries, which in many investor’s minds (erroneously), are risk free. Duration is an extremely important component when analyzing a bond CEF and in our prior article we highlighted this unique feature for BIT and predicted its outperformance.

Metrics

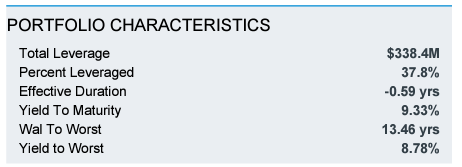

We can see from the fund’s factsheet its duration metrics:

Portfolio Characteristics (Fund Fact Sheet)

A very interesting aspect and a cornerstone of this active management strategy is the propensity of the fund to trade the interest rate curve via duration positioning. The fund exhibits a negative effective duration number. This means that the fund will gain as interest rates go up. As a reminder, this is achieved via swaps and futures. An asset manager can do fixed for floating interest rate swaps to hedge out the duration component of a portfolio. How do you do that? Fairly straight forward.

Let us assume a theoretical portfolio has $100 mm notional of bonds that generate call it 6k of DV01s in the 5-year bucket. The manager can then go and do a fixed for floating interest rate swap that matches the 6k DV01s and turn the portfolio duration negative. There is of course a cost to that (what you pay on the swap) but you can avoid portfolio loses when interest rates rise via this methodology.

A portfolio of bonds always has a positive duration (i.e. bond prices go down as interest rates rise) but BIT has chosen to aggressively reduce, and in fact, position the portfolio for negative duration.

As a reminder duration refers to the percentage change in price with a change in yield. As yields go up, bond prices go down, unless there is interest hedging put in place to reduce portfolio duration.

Performance

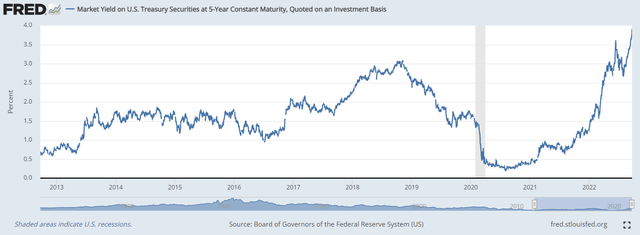

2022 has seen a substantial increase in risk free rates:

5-Year Treasuries (The Fed)

As we can see from the above table 5-year treasuries are at decade long highs in yields. What is more shocking is that the move up was vertical in 2022. In September 2021 5-year treasuries were yielding 0.8%. They are now at almost 4%!

Given that BIT strips out duration we should expect the CEF to outperform other peers in the group:

YTD Total Return (Seeking Alpha)

And indeed its performance chart shows BIT as the best performing vehicle in the cohort, being down only roughly -12% in 2022, when other peers in the high yield space have exceeded the -20% threshold.

This year has seen not only risk-free rates increase but also credit spreads widen and MBS prices collapse. BIT’s losses stem from the credit risk aspects of the portfolio rather than the duration component.

Holdings

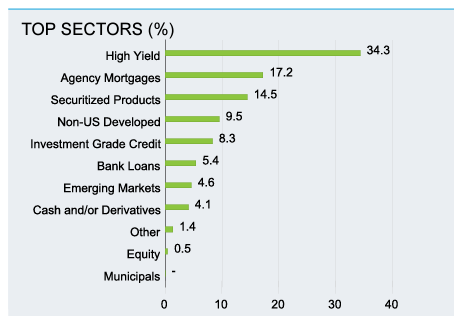

The fund is now overweight high yield bonds and MBS securities:

Top Sectors (Fund Fact Sheet)

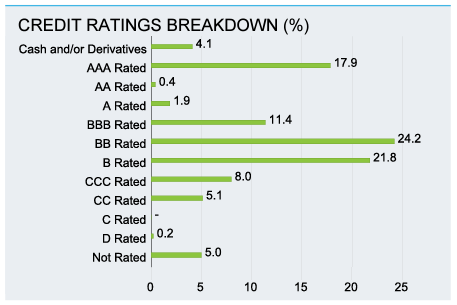

From a credit rating perspective the fund has a bar-bell approach:

Ratings (Fund Fact Sheet)

The vehicle is overweight AAA credits via the MBS bucket and “BB” and “B” bonds via the high yield holdings. The CEF has seen credit spreads widen and hence posted a negative performance on its credit risky holdings.

Premium / Discount to NAV

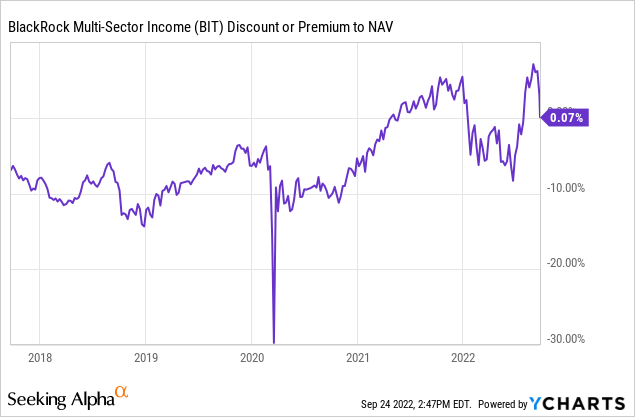

Prior to 2021 the fund had been trading at discounts to NAV:

When rate increases were first discussed in 2021, the market correctly started pricing in the low duration feature, bringing the fund to a flat to NAV position.

Conclusion

BIT is a multi-sector bond CEF from BlackRock. It is currently overweight high yield bonds and Agency MBSs. The fund has been able to outperform its peers year to date on the back of an active duration management. The CEF was set-up to enter the year with a flat duration profile (achieved via swaps and futures) and has been able to side-step a significant portion of the ongoing bond onslaught. The vehicle did lose value due to credit spread widening but its performance outshines its peer group and speaks volumes regarding an active duration management in a rising rates environment.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.