[ad_1]

Central Bank Watch Overview:

- Inflation pressures are worsening in the Eurozone and the UK as the energy crisis mounts ahead of the winter months.

- Both the Bank of England and the European Central Bank are expected to raise rates further in recent months, but recession concerns are mounting.

- Retail trader positioning suggests both EUR/USD rates and GBP/USD rates have a mixed bias in the near-term.

Hikes Coming in September

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. The rapidly unfolding global energy supply crisis, which has sent European energy costs skyrocketing in recent weeks, is provoking market participants into believing that more aggressive rate hikes will transpire over the coming months. Growth concerns are taking a backseat for now, which may ultimately setup both the British Pound and the Euro for disappointment if the BOE and ECB fail to meet rate hike expectations.

For more information on central banks, please visit the DailyFX Central Bank Release Calendar.

BOE Hike Odds Edge Higher, Again

UK stagflation risks continue to rise as growth slows and inflation pressures ratchet higher. For the time being, however, traders believe that the Bank of England is focused on the latter of these two issues, given the unfolding energy crisis that threatens to push UK inflation rates even higher into double digit territory over the next few months. Markets are now their most aggressive they’ve been all year in terms of BOE hike odds.

Bank of England Interest Rate Expectations (August 25, 2022) (Table 1)

UK overnight index swaps (OIS) are discounting a 122% chance of a 50-bps rate hike in September (a 100% chance of a 25-bps hike, a 100% chance of a 50-bps rate hike and a 22% chance of a 75-bps rate hike). If 75-bps don’t materialize in September, then they’re being penned in for November (72% chance), with markets leading towards an additional 50-bps rate hike in December. The BOE’s expected terminal rate for 2022 now sits at 3.365%, up from 3.002% last week and from 2.888% in mid-July. The BOE’s main rate is expected to peak at 4.267% by June 2023, which means an additional 275-bps of hikes are priced-in from where things stand today.

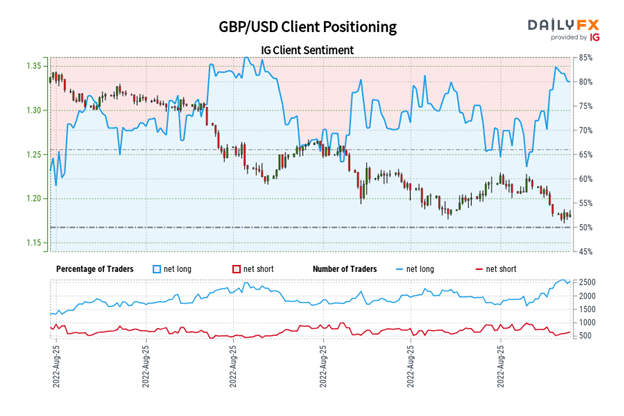

IG Client Sentiment Index: GBP/USD Rate Forecast (August 25, 2022) (Chart 1)

GBP/USD: Retail trader data shows 77.97% of traders are net-long with the ratio of traders long to short at 3.54 to 1. The number of traders net-long is 3.71% lower than yesterday and 16.67% higher from last week, while the number of traders net-short is 4.61% higher than yesterday and 13.09% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

ECB Hikes, Then Pauses?

European Central Bank policymakers have been quiet on the lecture circuit in recent weeks, but that will change soon as summer comes to a close. The July ECB meeting minutes revealed that there was a split over the 50-bps rate hike even as Eurozone inflation pressures have intensified. While rates markets are discounting a more aggressive path moving forward, it seems possible that the ECB will ultimately disappoint over the coming months as concerns swing back towards lackluster growth.

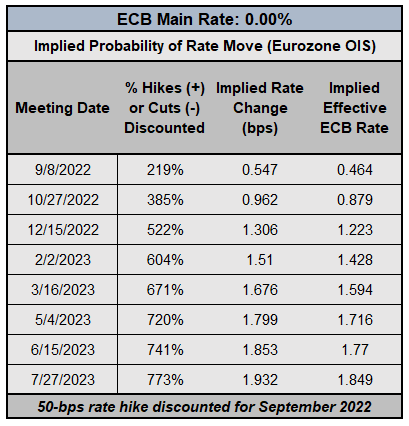

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (August 25, 2022) (TABLE 2)

Eurozone OIS are now pricing in a 119% chance of 50-bps rate hike in September (100% chance of a 25-bps rate hike, a 100% chance of a 50-bps rate hike, and a 19% chance of a 75-bps rate hike). This is a slight increase in rate hike odds at the margin, but not meaningfully changed from recent months when there were 100-bps of tightening anticipated through September, which is still the discounted expectation. €STR, which replaced EONIA, is now priced for 135-bps more hikes through the end of 2022, up from 105-bps last week. Rates markets may be getting ahead of themselves, however, as the ECB is expected to bring its main rate to 1.849% by July 2023.

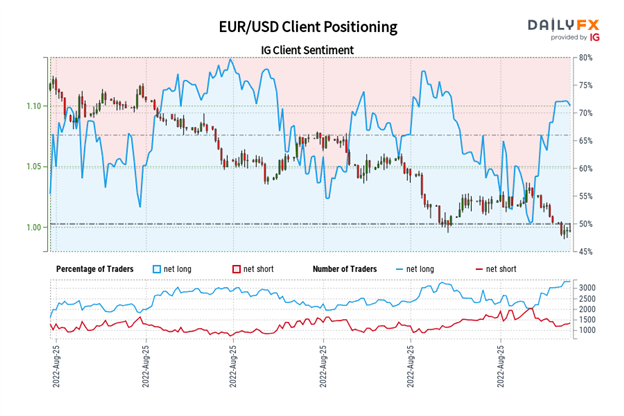

IG Client Sentiment Index: EUR/USD Rate Forecast (August 25, 2022) (Chart 2)

EUR/USD: Retail trader data shows 70.13% of traders are net-long with the ratio of traders long to short at 2.35 to 1. The number of traders net-long is 7.12% lower than yesterday and 17.68% higher from last week, while the number of traders net-short is 7.93% higher than yesterday and 7.87% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.