[ad_1]

The SPY and the TXN are both sporting +50% five-year returns once again

Subscribers to Chart of the Week received this commentary on Sunday, September 16.

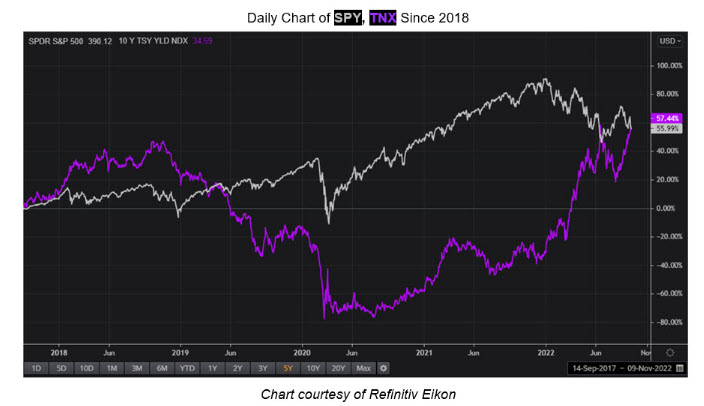

For all the hand wringing over the stock market in the last 12 months, it’s sometimes helpful to zoom out on the chart for some much-needed context. The SPDR S&P 500 ETF Trust (SPY) at last glance was up 57%. Digging through this data though, we found a coincidence that deserves a deeper dive. The Cboe 10-Year Treasury Yield (TNX) sits at nearly identical five-year return of the SPY’s, at 56%. If you’re getting déjà vu, it’s because we’ve been in this situation before.

In late July, we covered the occurrence in which the five-year return on the SPY and the TXN sat at an identical +50%. This happened on June 14 and 15, per the white and orange lines touching in the chart above. But three months later, on Sept. 14, the five-year return on the SPY and the TNX both synced up at +50% and are touching once more. Back in July, this signal marked a floor for the stock market, as the TNX and SPY quickly went in opposite directions, and investors enjoyed a brief summer respite from an otherwise dreary 2022.

A quick historical refresher on the importance of “big round numbers” is needed. The TNX bottomed to -75% in the summer of 2020 before bouncing to 50% (twice) this summer. The SPY has had numerous pullbacks to 0% during the pandemic, maxed out just shy of 100%, and is now clearing 50%.

If past is precedent, the connectivity of the TNX and SPY will face a tough test next week. The latest CME Group Data showed a xx% increase in the chances of a 100 basis-point interest rate hike from the Federal Reserve next week, up from xx before last week’s CPI data. TNX and SPY may very well go their separate ways next week, but the extent to which they diverge from the 50% level, given its historical context discussed above, will be noteworthy.

The future of TNX and SPY symmetry will face a tough test next week. The latest CME Group’s (CME) Fed Watch Data showed a 20% chance of a 100-basis point interest rate hike from the Federal Reserve next week. Before Tuesday’s CPI data last week, such chances were 8%. The TNX and SPY may very well go their separate ways next week, but the extent to which they diverge from the 50% level, given its historical context discussed above, will be noteworthy.

The June symmetry occurred during a Fed meeting where a 50-basis point hike was imminent, and the central bank’s decision didn’t shock the markets. But if the Fed were to really up the hawkish ante with a 100-basis point hike next week, the symbiotic nature between the SPY and TNX will be in pieces. If the expected 75-basis point occurs, maybe June’s convergence could signal an end to broad-market choppiness.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.