[ad_1]

GBP/USD – Prices, Charts, and Analysis

- Cable back above 1.1900 on US dollar weakness.

- UK jobs, inflation data, and politics will guide Sterling later this week.

- Little US data of note, Fed in a blackout period ahead of FOMC.

The US dollar has opened the week on the backfoot despite last week’s four-decade high U.S. inflation print. The US dollar basket (DXY) is around 0.50% lower today at 107.20 after having made a two-decade high of 109.03 last week. Friday’s University of Michigan’s survey showing inflation expectations easing to a one-year low set the tone for the US dollar to move lower and also changed the narrative back to a 75bp rate hike next week from a recently talked about 100bps. There is little in the way of US data this week to move the greenback, while Fed members will remain in the background as they observe the blackout period ahead of the July 27 FOMC meeting.

For all market-moving economic data and events, refer to the DailyFX calendar

In the UK the Conservative leadership contest enters a crucial week. The five remaining candidates will be whittled down to four this evening with Tom Tugendhat expected to poll the least votes. The remaining four candidates will then be cut down to two by the end of the week with bookmakers seeing a final run-off between Rishi Sunak and Penny Mordaunt as the most likely outcome. As always, anything can happen in politics.

Ahead this week, important UK jobs, wages, and inflation data will need to be closely watched. The UK labor market is and is expected to remain, robust, while inflation is expected to nudge ever higher. The headline annual figure, currently at 9.1%, is set to hit double-figures this year according to the Bank of England (BoE) and the UK central bank may well have to hike rates by 50bps to 1.75% at the next policy meeting on August 4. The BoE has hiked rates at the last five MPC meetings.

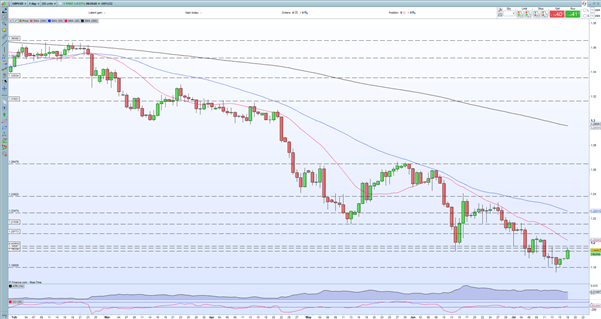

Cable is currently testing a clutch of prior support levels turned resistance on either side of 1.1950. While cable is two big figures above last Wednesday’s multi-year low at 1.1758, the pair remains weak and in a clearly defined downtrend. There remains a lot of work for cable to do before this trend turns positive.

GBP/USD Daily Price Chart – July 18, 2022

Retail trader data show 77.62% of traders are net-long with the ratio of traders long to short at 3.47 to 1. The number of traders net-long is 0.47% lower than yesterday and 5.48% higher from last week, while the number of traders net-short is 1.82% higher than yesterday and 14.80% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.