[ad_1]

In a busy week of big tech earnings, investors turned their attention to Meta Platforms META and its dreadful Q3 earnings report. META missed earnings expectations by -13% at $1.64 per share. This was after Altimeter Capital called for the company to focus on its core business Facebook.

CEO Mark Zuckerberg’s somewhat brazen comments that the company would continue its metaverse push helped spark the selloff. This came despite many thinking the Metaverse spending could take away from core revenue and unnecessarily increase costs amid an already tough operating environment.

Image Source: Zacks Investment Research

Despite the earnings miss, sales beat expectations by 1% at $27.40 billion to show operating costs are indeed having an ill effect on the company’s bottom line. META has now tumbled 72% from its highs after the post-earnings decline this week and its lowest levels since 2016.

Facebook Vs. Metaverse

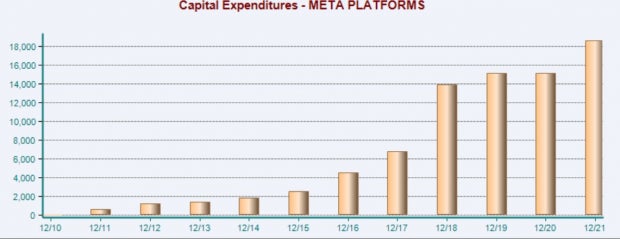

Facebook accounts for the majority of Meta Platforms revenue through advertising. Earnings are starting to decline with the company focusing on building the Metaverse, which is not profitable at this point. As we can see from the nearby chart, Meta’s capital expenditures, a big part of which is spent on the Metaverse, are skyrocketing to the disappointment of many shareholders.

Image Source: Zacks Investment Research

Before Q3 earnings, one of META’s larger shareholders Altimeter Capital stated Meta Platforms can get its “Mojo Back” by cuttings its headcount expense by at least 20%, and reducing its annual capital expenditures by at least $5 billion to $25 billion. Additionally, Altimeter Capital thinks Meta Platforms should invest no more than $5 billion annually in the Metaverse and shift its focus back to its core businesses. The announcement caused META shares to spike 7% before Q3 earnings but may have worsened the selloff after the company reiterated its intention to expand the Metaverse.

Despite the disappointment, META was not alone with fellow big tech giants Alphabet (GOOGL) and Amazon AMZN also sinking after earnings this week.

Performance & Valuation

Year to date META is now down -70% to underperform the S&P 500’s -21% and the Nasdaq’s -29%. Although the operating environment has been difficult for most tech stocks, shareholders have been calling out META for severely underperforming the Nasdaq. Investors are hoping META can get back to its stellar performance over the last decade. Over the last 10 years, META has still crushed the benchmark and the Nasdaq.

Image Source: Zacks Investment Research

Long-term investors may see even more value in the stock with META trading just under $100 a share at its lowest level since 2016. At current levels, META has a P/E of 10.2X. This is much lower than the industry average of 43.4X. META trades at a significant discount to its decade-high of 325.5X and the median of 31.5X. Also, after traditionally trading at a premium well above the broader market, META now trades at what appears to be a discount to the benchmark’s 17.4X.

Image Source: Zacks Investment Research

Outlook

Year over year, META earnings are now expected to decline -32% but rise 10% in FY23 at $10.24 per share. Sales are expected to be down -2% this year but rise 4% in FY23 to $121.07 billion. The company’s outlook for Q4 revenue called for a range of $30-32 billion, with the Zacks Consensus estimate being $31.64 billion and earnings of $2.30 per share.

Bottom Line

META currently lands a Zacks Rank #3 (Hold) and its Internet-Software Industry is in the top 34% of over 250 Zacks Industries. Long-term investors could still be rewarded for holding the stock as it trades at an even steeper discount relative to its past and the benchmark. And the Zacks Average Price Target suggests 135% upside from current levels.

Also, despite the decision to continue expanding the Metaverse, Facebook’s daily active users (DAUs) and monthly active users (MAUs) did increase by 3% and 2% during September. DAUs were close to 2 billion and marketers will certainly continue to see value in the platform.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meta Platforms, Inc. (META): Free Stock Analysis Report

Alphabet Inc. (GOOG): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.