[ad_1]

Crude Oil (WTI) News and Analysis

- Chinese lockdowns, OPEC supply cuts and US inventory builds align to send prices lower

- WTI crude oil – key technical levels analyzed

- EIA oil stock data at 16:00 BST – inventory build remains a possibility. Favors the current trend

Chinese Lockdowns, OPEC Supply Cuts and US Inventory Builds

The oil market continues to be determined by the dominant theme of demand destruction – a direct result of aggressive monetary tightening which is gaining traction globally. At 13:15 (BST) today, even one of the major dovish central banks, the ECB, is expected to announce a record rate hike of 75 basis points in an attempt to lower inflation. This week we have already seen a 50 bps hike from the Reserve Bank of Australia and a 75 bps hike from the Bank of Canada.

An opposing force to the steady oil decline is OPEC +, which agreed to cut supply for October in an attempt to stabilize oil prices. Up until this point, the organization had attempted to increase the supply of oil to calm surging oil prices but now the biggest threat to the group is declining oil prices along with declining profitability.

Yesterday US API crude stocks surprised the market with a massive inventory build of 3.645M when the expectation was a drawdown of 733k which helped keep prices suppressed after declining earlier in the day.

China’s extended lockdown of Chengdu for the majority of its 21 million inhabitants weighed on oil prices and as this is likely to have further ramifications of China’s economic growth this year. China is the world’s largest exporter and a slowdown in domestic growth is likely to affect major trading partners.

Recommended by Richard Snow

How to Trade Oil

WTI Crude Oil – Key Technical Levels

Taking a look at recent developments, it appears that the effect of the OPEC supply cuts has waned, in fact, oil prices continued lower after the announcement of the cuts. A large bearish reversal – revealed via the bearish engulfing candle at the 50% retracement od the 2021-2022 major move – put an end to oil’s impressive move higher.

After OPEC’s announcement to cut supply, there has been a concerted move lower, in line with the bearish trend, breaking below the prior low of $85.75. The next big test for bears appears at the 78.6% retracement at $77. Resistance naturally lies at prior support of $85.75, followed by $88.40 and finally the pre-invasion level of $93.

Crude Oil Futures (CL1!) Daily Chart

Source: TradingView, prepared by Richard Snow

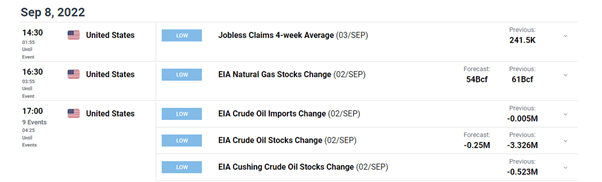

Later today (16:00 BST) we have the weekly data from the Energy Information Agency (EIA) where forecasts suggest there is likely to be further drawdowns of oil stocks, although the estimate is relatively small compared to prior prints. Oil prices could continue to sell off in the event we actually see an increase on oil stocks.

Customize and filter live economic data via our DaliyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.