[ad_1]

The U.S. Department of Commerce released plans for a $50 billion investment program

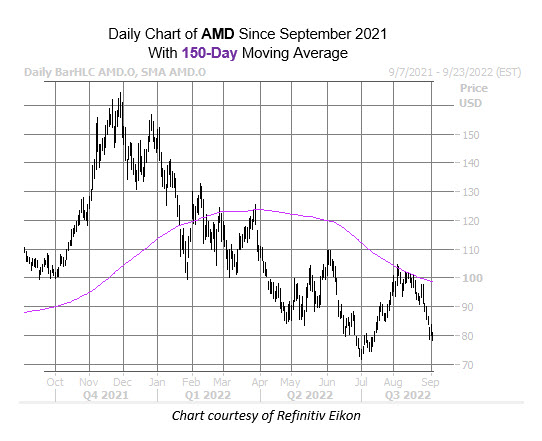

It’s been a rough road for the equity, which has lost 45.3% this year, and over 28% in the last 12 months. AMD staged a notable rally in July, though this positive price action lost steam at the 150-day moving average, which also put pressure on the stock back in March of this year.

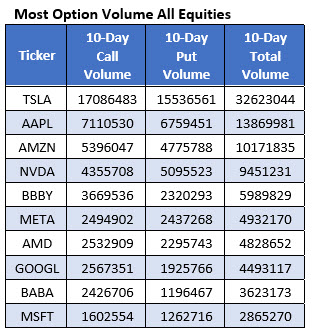

Amid all these big updates for the semiconductor sector, Advanced Micro Devices stock has once again landed on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of names that have attracted the highest weekly options volume within the past two weeks. Per White’s table, 2,532,909 calls and 2,295,743 puts have been exchanged during this time period, with the weekly 8/26 98-strike call and 90-strike put being the most popular.

While calls are still just outpacing puts, the latter haven’t been more popular during the past year. This is per AMD’s 10-day put/call volume ratio of 0.94, which sits higher than all other annual readings at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

Analysts remain optimistic. Of the 25 in coverage, 18 call the stock a “buy” or better, compared to seven “hold” ratings, and not a single “sell.” What’s more, the 12-month consensus price target of $123.89 is a 56.3% premium to current levels.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.