[ad_1]

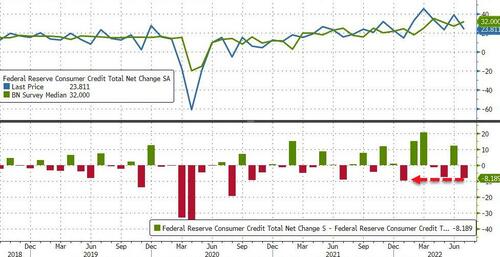

One month after the 2nd biggest monthly increase in consumer credit in US history, which in turn was just two months after the biggest surge in credit card and student/auto loans on record, in July the growth in consumer credit unexpectedly slowed to just $23.8 billion, down sharply from $39.1 billion in June, and the second lowest monthly increase of the year…

… not to mention the biggest miss to consensus expectations ($32 billion for July) since January.

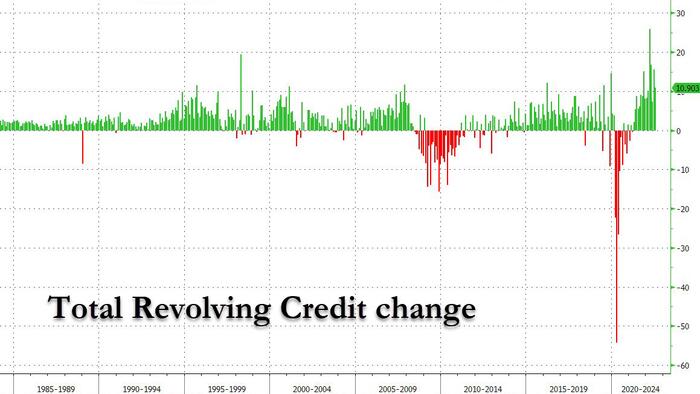

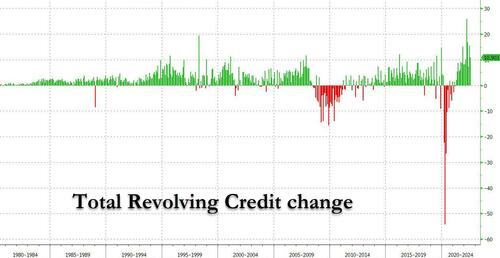

And while the slowdown was partially the result of some $10.9 billion in revolving credit in June, which actually is not that bad at all, and was one of the highest monthly increases on record, and the 4th highest of 2022…

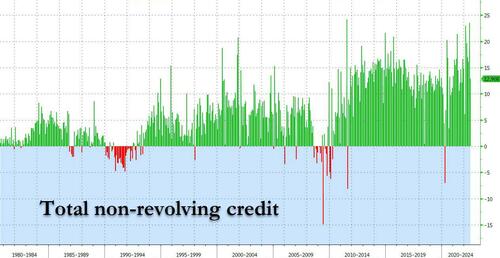

… the big surprise was the sudden slowdown in non-revolving credit growth, which was cut in half from $24 billion in June – one of the highest on record – to just $12.9 billion, the lowest since January.

And while we will have to wait until the next month to get the breakdown of student vs auto loans that make up the non-revolving total, it is almost certain that in July we saw the first direct impact of soaring interest rates on auto (and to a lesser extent college) loans, which are suddenly becoming prohibitively expensive. A few more months of this collapse in demand and the impact on the US auto sector could be dire, but at least new and used car prices will plunge allowing the Fed to start hinting at the coming pivot and making the rich richer all over again…

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.