[ad_1]

Gold, XAU/USD, Crude Oil, WTI, Recession Woes, Fed – Commodities Briefing:

- Crude oil and gold prices fell sharply on Thursday as volatility struck

- Supportive US economic data bolstered the case for a hawkish Fed

- Traders eyeing University of Michigan sentiment before the weekend

Recommended by Daniel Dubrovsky

Building Confidence in Trading

Crude oil and gold prices wobbled on Thursday as market volatility struck once again. Better-than-expected US economic data was likely the key culprit. Weekly initial jobless claims (213K) and retail sales (0.3% m/m) beat forecasts at 227k and -0.1%, respectively. Front-end Treasury yields climbed to a new high for this year, signaling firming hawkish Federal Reserve expectations.

When volatility strikes, correlations tend to strengthen across markets. Anti-fiat gold prices are vulnerable to a stronger US Dollar and rising government bond yields. Since both the latter moved in the same direction, which was up, this proved to be too much for gold. XAU/USD slid 1.89%, touching a new low for this year as well as the cheapest price since April 2020.

As for sentiment-linked crude oil, rising fears of a global growth slowdown did not help the commodity. The Atlanta Fed GDPNow estimate for the third quarter slid to 0.5%, down from 1.3% a week ago. Looking at the closely watched 10-year 2-year Treasury yield curve, it slid deeper into negative territory. The latter is nearing August’s low of -0.5%, indicating rising concerns about growth.

The economic docket notably dies down heading into the weekend. Sentiment during the Asia-Pacific trading session remained pessimistic, leaving gold and crude oil prices at risk. Preliminary US University of Michigan sentiment will cross the wires at 14:00 GMT. An upward tick to 60 in September from 58.2 is seen. A better outcome risks further pressuring gold and crude oil.

Crude Oil Technical Analysis

WTI crude oil prices slid 4.33% on Thursday, the most in over a week. Prices turned right on the 20-day SMA as it reinstated the downside focus. Immediate support appears to be the October 2021 high at 85.387. Further losses would expose the September 8th low at 81.207.

Recommended by Daniel Dubrovsky

How to Trade Oil

WTI Daily Chart

Chart Created Using TradingView

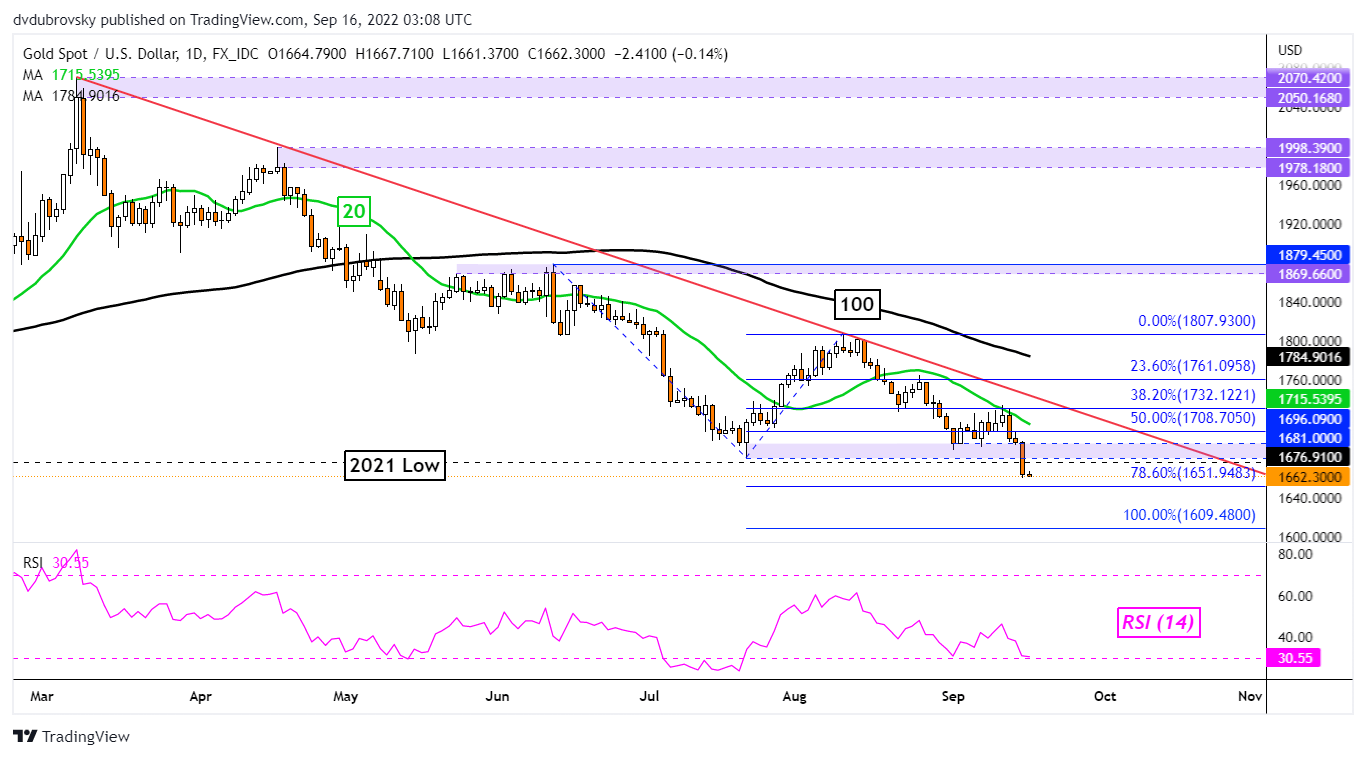

Gold Technical Analysis

Gold has broken under the 1681 – 1696 support zone, taking out the 2021 low as well. That has exposed the 78.6% Fibonacci extension at 1651 before the 100% level kicks in at 1609. In the event of a turn higher, keep a close eye on the 20-day Simple Moving Average. It could maintain the downside focus.

Recommended by Daniel Dubrovsky

How to Trade Gold

XAU/USD Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.