[ad_1]

- Robust Earnings Season and M&A DealsHaveBolstered Market Sentiment.

- Investors Fret About Risk of aMore Prolonged Inflation Fight and Fed Rate Hikes.

Bond Yields and Their Relationship to FX

DAX 40: Moves Higher as Investors Assess Robust Earnings and Fed Hikes

The DAXbegan the week in the green as markets digested more corporate earnings, while we have the US CPI later in the week. The importance of this release has been exacerbated by the blowout NFP jobs data released on Friday.

Given the largely positive reception of earnings thus far, Siemens Energy (ENR1n) bucked the trend Monday, its stock falling 3.9% after the supplier of equipment to the power industry warned of a deeper than previously expected net loss in 2022, announcing a charge of around 200 million euros ($204 million) due to the restructuring of its business in Russia. The positives are a couple of M&A deals that seem to have helped the overall market tone.

Europe’s bond investors, caught between a central bank raising rates for the first time since 2011 and the prospect of a recession are braving some of the wildest swings on record by some metrics. The yield on Germany’s benchmark bond has oscillated 10 basis points on almost 80 days this year something that happened only once in 2021. Hedging costs across euro rates markets have soared.“Rates volatility has seen an explosion in activity,” said Phillip Pearce, an associate at Validus Risk Management. “Without any firm guidance, the market is free to price in whatever the data warrants.”The fallout is palpable. Investors say it’s becoming more difficult to execute orders in some corners of the market. European companies are reluctant to issue debt or buy prohibitively expensive protection against price swings. While volatile conditions are what traders usually dream of, some market players are hesitating to take on larger positions, creating a self-amplifying cycle of deeper swings as liquidity dries up. Since April, the German two-year yield has ended the day 20 basis points lower three times and 20 basis points higher once. Moves of that size haven’t been seen since the depths of the eurozone crisis in 2011.

Focus for the week will be on the US CPI figure due out on Wednesday whileinvestors will also get to hear from several Fed speakers, with policymakers under renewed pressure to deliver a third 75 basis point rate hike at their upcoming meeting in September. We also have the final inflation numbers from Germany being released on Wednesday which could give more direction for investors moving forward.

For all market-moving economic releases and events, see the DailyFX Calendar

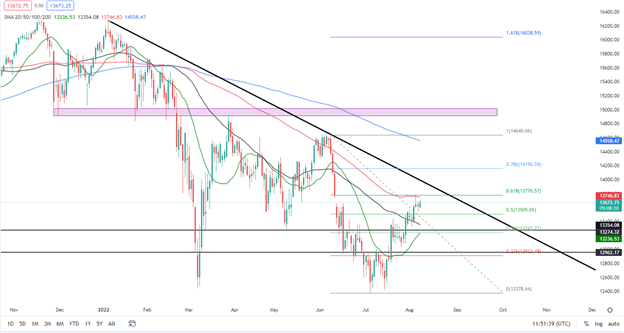

DAX 40 Daily Chart – August 8, 2022

Source: TradingView

From a technical perspective, last week Friday saw an indecisive weekly candle close while the daily closed as a hanging man candlestick hinting at further downside. We have had bullish price action during European trade as we trade between the 50 and 100-SMA and just below the 61.8% fib level. We need a daily candle close above or below the SMA to confirm a longer-term bias.

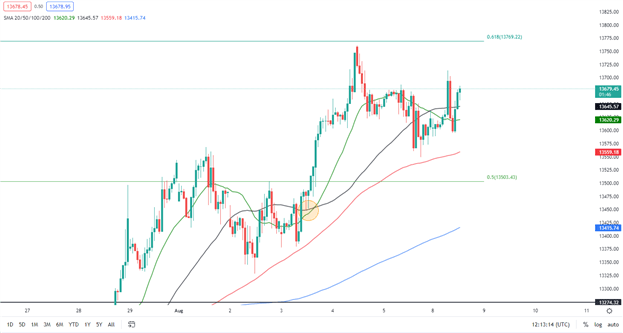

DAX 40 1H Chart – August 8, 2022

Source: TradingView

The 1H chart has seen a price drop since reaching last week’s high of 13787 on Wednesday and tapping into the 100-SMA on the daily chart. We have seen a change of structure on the 1H as we are now creating higher highs and higher lows. Should we have no surprises in the US session or changes in sentiment we could very well move higher and look to break above the 61.8% fib level targeting the trendline or higher into the 78.6% fib level.

Key intraday levels that are worth watching:

Support Areas

•13505

•13274

•13000

Resistance Areas

•13787

•14000

•14156

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter:@zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.