[ad_1]

- The DAX Weekly Closed Below Major Support.

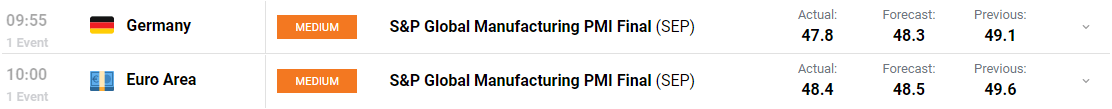

- German S&P PMI Final Actual 47.8 Vs Forecast 48.3.

- European Union Energy Ministers to Institute Windfall Tax on Energy Profits.

Recommended by Zain Vawda

Get Your Free Equities Forecast

The DAX continued its move higher in European trade retesting the key 12000 level. This comes on the back of a weekend in which markets digested renewed regional energy concerns following Friday’s meeting of European energy ministers.

Earlier we had Eurozone and German S&P global final PMI which confirmed worsening conditions across manufacturing as Europe’s most industrialized economy saw new orders decline. The German PMI came in at a 27-month low print of 47.8 as the surge in energy prices sees costs rise. The final Eurozone Manufacturing PMI print came in at 48.4 which marks the fourth successive month of declines. Eurozone business confidence meanwhile slipped back into negative territory with manufacturers now as pessimistic as they were in May 2020.

For all market-moving economic releases and events, see the DailyFX Calendar

Last Friday we heard from European Union energy ministers who stated their intention to introduce a windfall tax on the profits of energy firms. This was followed up by a draft statement earlier today in which the finance ministers are set to announce that governments cannot fully shield economies from energy price spikes. As consumers deal with a higher cost of living and alter their spending habits this will no doubt have an impact on earnings for both small and large businesses.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

European markets were keeping a close eye on the developments around Credit Suisse as the banking giant was down as much as 12% in European trade. As the credit default swap levels (cost of insuring against losses) reached all-time highs, Chief Executive Officer Ulrich Koerner’s attempts to calm the market failed. Fears remain around the creditworthiness of the bank, with there being a 22% chance the bank defaults on its bonds in the next 5 years, according to CDS pricing. The banking giant is currently finalizing its turnaround plans which include the potential of reviving the First Boston brand name.

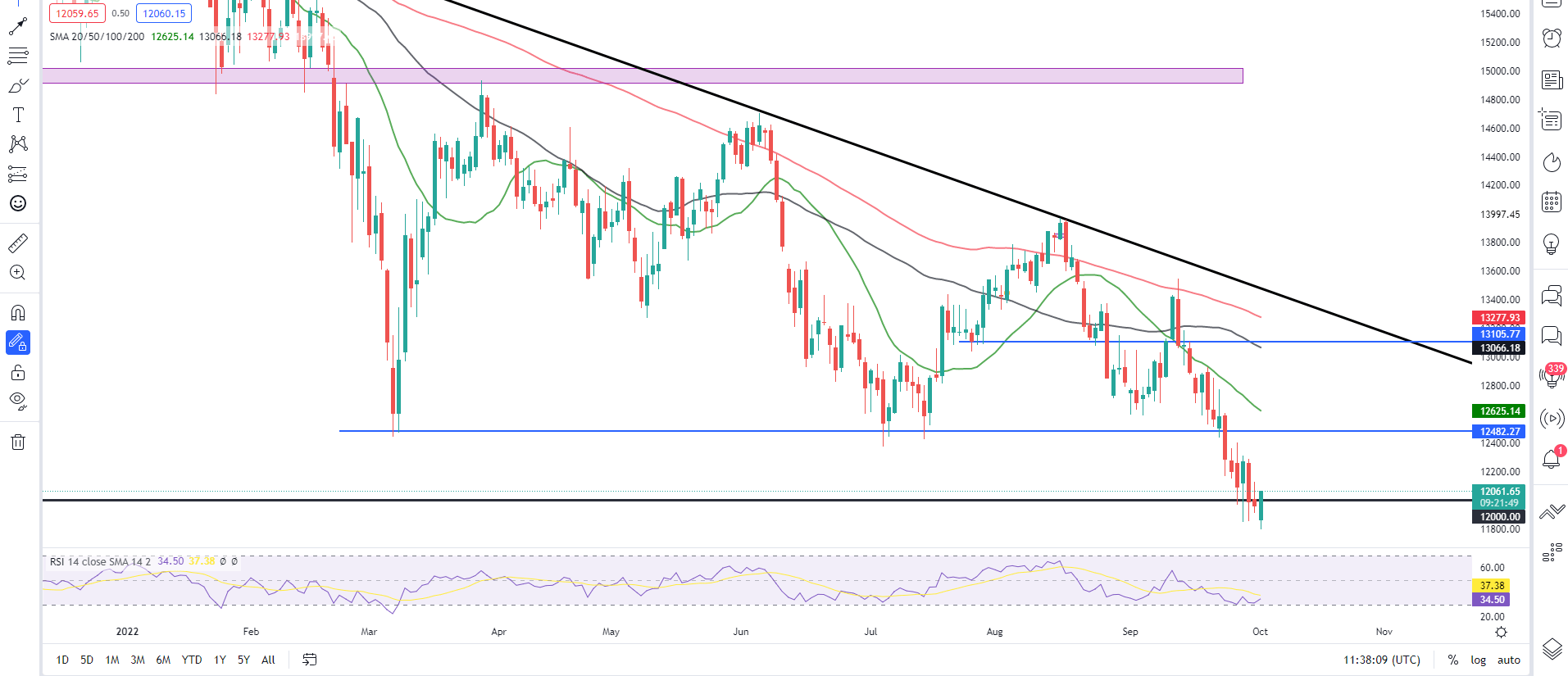

DAX 40 Daily Chart – October 3, 2022

Source: TradingView

From a technical perspective, the index finally closed below the 12000 key psychological level on the weekly timeframe. The index has rallied 220-odd points since the Asian session with downside risks resting just above current prices.

The current price is some way below the 20, 50 and 100-SMA while a pullback to retest the MA’s cannot be ruled out as the RSI confirms that the index has bounced off oversold territory. Should the index see a deeper pullback, the area around 12450 remains key and could offer would-be-shorts a good risk-to-reward spot. It’s important to keep in mind the geopolitical developments coupled with the overall sentiment that could influence any move from here.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•11780

•11615

•11450

Resistance Areas

•12115

•12310

•12450

| Change in | Longs | Shorts | OI |

| Daily | 14% | 37% | 21% |

| Weekly | -2% | 0% | -1% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.