[ad_1]

- DAX 40: Key 13000 level in Play as Growth Outlook and Recession Fears Weigh.

- FTSE 100: Energy and Mining Stocks Keep Losses in Check.

DAX 40: Key 13000 level in Play as Growth Outlook and Recession Fears Weigh.

The Dax rallied off support in early European trade as markets came to terms with a global slump in business activity, darkening economic prospects. We also heard comments from US Federal Reserve member Neel Kashkari reiterating the hawkish noises from the US central bank as the Jackson Hole symposium nears.

Following yesterday’s Euro and German PMI showing signs of slowing activity across the economy, we saw the index decline toward the key 13000 level. German businesses warned they are still facing “strong costs pressures.” In addition, consumer inflation in the Euro Zone is already close to 9%, keeping a lid on demand, which will also weigh on sales and profits.

In a rare positive, Germany and Canada have inked a historic hydrogen deal. Canada intends to start shipping green hydrogen produced by wind farms to Germany by 2025, the first step in a partnership to help Europe’s biggest economy reduce its reliance on fossil fuels. The timeline might be a way off, but the move is nonetheless a positive one.

Customize and filter live economic data via our DailyFX economic calendar

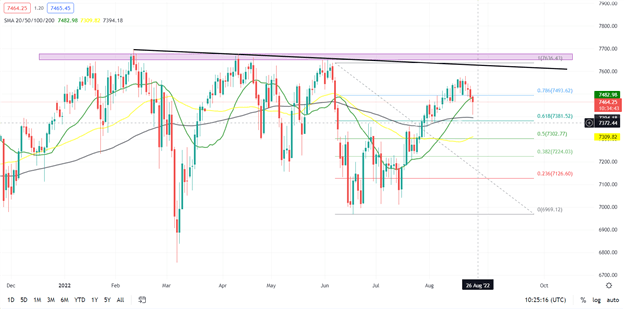

DAX 40 Daily Chart – August 24, 2022

Source: TradingView

From a technical perspective, we had abearishengulfing candlestick close on the weekly chart which indicates the potential for more downside in the week ahead. We have now had 3 consecutive days of bearish price action as we approach the key psychological 13000 level. We are currently trading below the 20, 50 and 100-SMA.

We are trading in a support area now as the last daily swing low rests around the 13100 level. A daily candle close below here could see us push back below the key 13000 level and retest the YTD lows. Alternatively with the shifting sentiment and the Jackson Hole symposium later in the week we could remain rangebound between the key level and 13500.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Psychological Levels and Round Numbers in Trading

FTSE 100: Energy and Mining Stocks Keep Losses in Check

The blue-chip index was led lower in European trade following a fall in the US on Tuesday and Asia overnight with little corporate or economic news to provide direction.Tuesday’s UK PMI data was mixed with services gaining while manufacturing slumped. With signs of a global slowdown, the UK is not immune, while growing strikes and energy worries weigh on sentiment. Energy costs in the UK threaten to push thousands of UK companies to the brink of collapse, Britain’s biggest business group has warned.The Confederation of British Industry (CBI) urged the Government to freeze business rates for another year and take quick and targeted action to prevent otherwise viable businesses from going bust.Two-thirds of businesses are facing a jump in their bills over the next three months, with a third of those firms facing increases of more than 30pc, the CBI said.

On the corporate front shares in Allied Minds (ALML) almost halved this morning after the company said it wants to delist from the London Stock Exchange.The company, which invests in the tech and life sciences sectors, said the costs of maintaining a premium listing on the LSE were now “prohibitively high” relative to its size.Defensive stocks including BAE Systems (BAES) and British American Tobacco (BATS) provided some shelter after rising 10p to 807p and 18.5p to 3442p respectively.

Caution remains the smart play with expectations that aggressive policies to tame soaring inflation will continue despite fresh signs that the US economy is slowing.Attention now turns to tomorrow’s start of the Jackson Hole economic symposium in Wyoming, with Federal Reserve chairman Jerome Powell due to make comments on US monetary policy on Friday.

FTSE 100 Daily Chart – August 24, 2022

Source:TradingView

The FTSE closed Friday as a doji candlestick on the daily chart signaling indecision may be ahead, which is in line with current market conditions. The index continues to buck the trend as losses have been capped in comparison to global indices.

We currently trade above the 50 and 100-SMA which served as support in early European trade seeing the index bounce from session lows to gain 60 odd points before the US open. The bullish trend may still be in play, but significant technical roadblocks need to be cleared for that to occur. We would need a catalyst that could come in the form of more nuanced messaging from the Fed at the Jackson Hole symposium.

Trading Ranges with Fibonacci Retracements

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.