[ad_1]

- DAX 40: Retreats as Energy Prices Continue to Soar, Sentiment Among Exporters Falls.

- FTSE 100: Lower as Banking and Commodity Sector Limit Losses.

DAX 40: Retreats as Energy Prices Continue to Soar, Sentiment Among Exporters Falls.

The Dax opened higher in early European trade before declining as the session wore on. Yesterday saw the index post its second consecutive day of gains thanks to a rally in the US session. Following on from its early week losses the index has shown some fight in the lead up to the highly anticipated Jackson Hole symposium which kicked off last night.

Earlier in the session, we had the Gfk German consumer climate index which painted a bleak picture. The forward-looking Gfk index fell to -36.5 for September, considerably below the -31.8 expected, and a hefty drop from the downwardly revised -30.9 seen the previous month. The release comes on the back of yesterday’s German Ifo business climate index which fell to its lowest level in over two years.

Customize and filter live economic data via our DailyFX economic calendar

In energy news, German Economy Minister Robert Habeck has said that he will re-evaluate the country’s levy on consumers to help fund aid for suppliers as gas prices surge, amid an outcry over corporate profits in the sector.

With the Jackson Hole symposium upon us, the focus will shift to US Federal Reserve Chair Jerome Powell’s speech on the way forward for US monetary policy which is expected to deliver volatility and direction. Fed Chair Powell is expected to speak at 14h00 GMT.

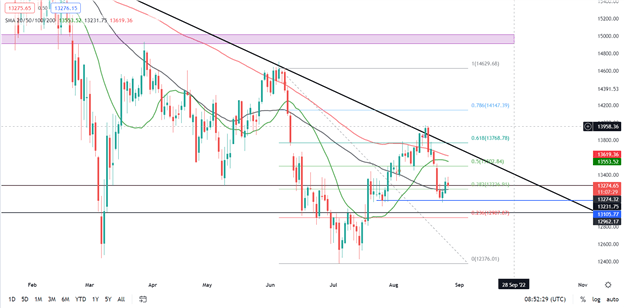

DAX 40 Daily Chart – August 26, 2022

Source: TradingView

Yesterday’s bullish candle close saw us break back above the 50-SMA as we trade between the 20 and 50-SMA. The last daily swing low rests around the 13100 level (the blue line on the chart). A daily candle close below here could see us push back below the key 13000 level and retest the YTD lows. Alternatively with the shifting sentiment and the Jackson Hole symposium later in the week we could remain rangebound between the key level and 13500 which also line up with the 20 and 100-SMA.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Psychological Levels and Round Numbers in Trading

FTSE 100:Lower as Banking and Commodity Sector Limit Losses.

The blue-chip indexfollowed the Dax as it posted marginal gains in early trade before being pegged back to trade in the red as the session wore on. The early session gains were attributable to the banking and commodity sectors which allowed the index to continue its resilient nature. Despite the resilience displayed by the index, it is still on course to post a weekly loss albeit smaller than many of its counterparts. Data continued to highlight the impact of surging prices on business activity and central bank policymakers stuck to an aggressive tone on interest rate hikes despite signs of economic slowdown.

In a massive blow to the UK economy, energy regulator Ofgem announced that British energy bills will rise 80% to an average of GBP3,549 (USD4,188) a year from October. Ofgem called it a disaster while calls continue to grow from various avenues for urgent and decisive government action. The regulator also warned that the market for gas in winter means that “prices could get significantly worse through 2023”.

In corporate news, GSK and former consumer healthcare division Haleon (HLN)were on the riser’s board. Fallers included London Stock Exchange (LSE), which dropped 98p to 8312p. Meanwhile, shares in former blue-chip stock Micro Focus International (MCRO) jumped 92% after its board recommended an offer from US-based information management business OpenText.

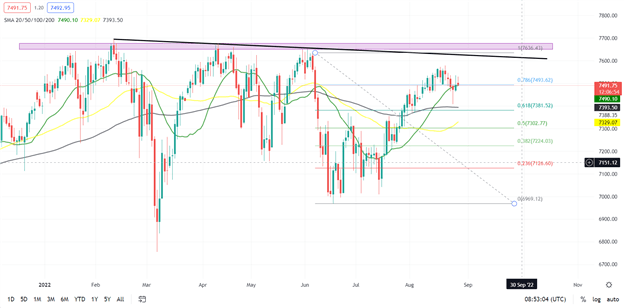

FTSE 100 Daily Chart – August 26, 2022

Source:TradingView

The FTSE continues to display resilience as Wednesday’s bounce off support continued yesterday. The index continues to buck the trend as losses have been capped in comparison to global indices. With the bullish trend still in play, there remain significant technical roadblocks that need to be cleared for a further move higher. We would need a catalyst that could come in the form of more nuanced messaging from the Fed at the Jackson Hole symposium.

Trading Ranges with Fibonacci Retracements

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.