[ad_1]

- DAX 40:Rises as Gas Cuts Threaten to Shutter German Economy.

- FTSE 100:Higher as Mining Stocks Lead the Way.

- DOW JONES:Continues Rally as Sentiment Improves, Earnings Pick up Pace.

DAX 40: Rises as Gas Cuts Threaten to Shutter German Economy

The Daxrose for a second day as investors scaled backfears of a looming recession. Investors are expecting the European Central Bank to increase rates by a quarter point when it meets on Thursday, marking its firstrate hike in more than a decade. All eyes are on Nord Stream 1 (NS1), the pipeline linking Russia directly to Europe via the Baltic Sea. Gazprom, Russia’s state-controlled gas giant, reduced NS1’s capacity by 60 percent in June, and last Monday shut it down completely for routine maintenance. In normal circumstances, this lasts just 10 days. But the fear in Berlin is that NS1 will not come back into operation as scheduled this Thursday.The potential shortage means “companies will either have to reduce their gas consumption or curb production”. Should flows cease completely, most economists expect the eurozone’s economic powerhouse to experience a severe fall in output. No gas this winter would, according to analysts at Swiss bank UBS, trigger a “deep recession” with almost 6 percent wiped off GDP by the end of next year.

DAX 40 Daily Chart – July 18, 2022

Source: IG

From a technical perspective, Friday saw a bullish engulfing daily candle that engulfed the previous two days of price. We did however close below the key psychological 13000 level and after a brief spike above it in European trade we are back below said level. We do need a daily candle close above the psychological level if we are to see higher prices, while fundamentals weigh heavy on the Eurozone with gas worries multiplying.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

FTSE 100: Higher as Mining Stocks Lead the Way

The FTSEbegan on the front foot today as oil and mining stocks led the blue-chip index 1.1% higher. A big week ahead for the index as we have UK unemployment, wage and inflation readings without forgetting the European Central Bank (ECB) rate rise. Glencore and Rio Tinto shares jumped 4% as global recession fears eased a little after Friday’s better-than-expected retail sales figures in the United States, while Oil majors BP and Shell rose more than 3% as the price of Brent crude lifted 2% to $103.58 a barrel. Deliveroo pointed to increased consumer headwinds today as it made a significant cut to forecasts for its gross transaction value in 2022.Consumer healthcare business Haleon makes its debut on the London stock market today after completing its demerger from GSK.

Bank of England (BoE) policymaker Michael Saunders has warned that interest rates could reach 2% or higher during the next year in order to curb inflation.Saunders will be stepping down as BoE policymaker on 8 August.

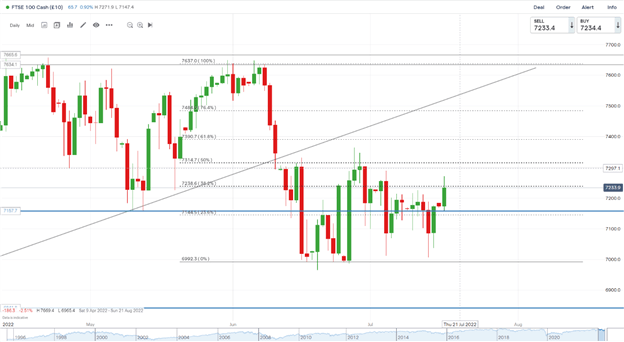

FTSE 100 Daily Charts – July 18, 2022

Source:IG

The FTSE weekly candle closed as a hammer just above resistance now turned support at the 7150 area. Friday saw a bullish inside bar daily candle which in theory should see further upside. Given the most recent ranging nature of indices, we remain rangebound between the 50% and 0% fib level, until we have a daily candle close outside these levels rangebound opportunities remain.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

DOW JONES:Continues Rally as Sentiment Improves, Earnings Pick up Pace

The Dowrallied higher in premarket trade as sentiment around tightening policy improves. Policy makers pushed back against even bigger hikes in interest rates and fresh data showed a greater decline in US consumers’ long-term inflation expectations.That boosted odds for a 75 basis point July Fed rate hike, squashing talk of a 100 basis-point move.

We had a mixed bag on the earnings front today, as Goldman Sachs and Bank of America Provide Mixed Earnings.Goldman was the last of the six biggest US banks to post results, with investors scouring the reports for clues on the health of the economy. Still, the outlook remains troubling for many investors. Gains in stock markets may prove to be short-lived as inflation pressures remain high and a recession seems increasingly likely, according to strategists at Morgan Stanley.

Customize and filter live economic data via our DailyFX economic calendar

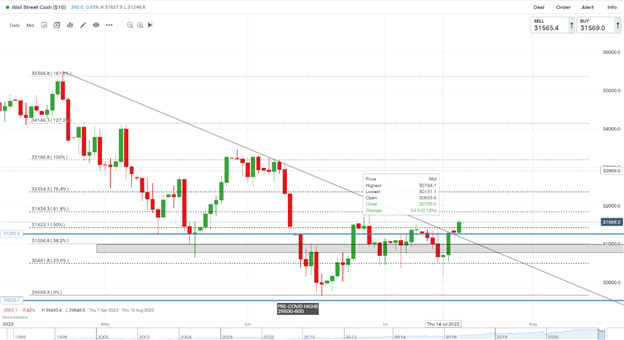

DOW JONES Daily Chart – June 18, 2022

Source: IG

From a technical perspective, last Friday saw us close as a bullish engulfing candlestick while forming a three-pin candle formation as well, both of which signal reversal and a potential for higher prices. Today we’re breaking through the three-month downtrend line, and we’ve also taken out the previous high from earlier in July at 31509. We would need a daily candle close above the trendline today to confirm the break, with any retest of the trendline providing an opportunity for would-be-buyers.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.