[ad_1]

designer491

Thesis

The Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. (NYSE:DFP) is a closed-end fund (“CEF”) focused on preferred securities. As per the fund’s literature:

Under normal market conditions, the Fund invests at least 80% of its Managed Assets (defined below) in a portfolio of preferred and other income-producing securities issued by U.S. and non-U.S. companies. Preferred and other income-producing securities may include, among other things, traditional preferred stock, trust preferred securities, hybrid securities that have characteristics of both equity and debt securities, contingent capital securities (“CoCos”), subordinated debt and senior debt. “Managed Assets” are the Fund’s net assets, plus the principal amount of loans from financial institutions or debt securities issued by the Fund, the liquidation preference of preferred stock issued by the Fund, if any, and the proceeds of any reverse repurchase agreements entered into by the Fund.

The fund’s objective is to seek total return, and the vehicle currently sports an 8.34% yield. The fund runs a high leverage ratio of 38%, but due to the high collateral rating and lower overall standard deviation, it is down only -19% year to date on a total return basis. The fund focuses on highly rated bank and insurance companies preferred securities.

Surprisingly, the fund is not trading at a very wide discount, which is currently only -1%. The vehicle traded at discounts of over -10% in 2014/2015. From a total return perspective, the vehicle has historic results which are in the middle of the cohort versus some of its preferred securities peers. Expect an average 7% annualized return here with maximum -20% drawdown under normalized recessionary environments (i.e., non-financial driven). The highest risk for DFP is a repeat of the Great Financial Crisis when the market was pricing in actual defaults for many banks and insurance companies. Given the progress in capital ratios and requirements since the GFC that scenario has become more remote. We do not think the rates widening is completely over for the year, and the fund runs a medium 5.5-year duration. We also think we are in a bear market rally and are due for another sell-off, which should see the fund lower. We like the risk/return profile for this name, but we would wait for the market adjustment to be over before entering.

Analytics

AUM: $0.44 billion.

Sharpe Ratio: 0.22 (5Y).

St Deviation: 13.7 (5Y).

Yield: 8.34%.

Expense Ratio: 1.48%.

Premium/Discount to NAV: -1%.

Z-Stat: -1.42.

Leverage Ratio: 38%.

Duration: 5.5 years.

Holdings

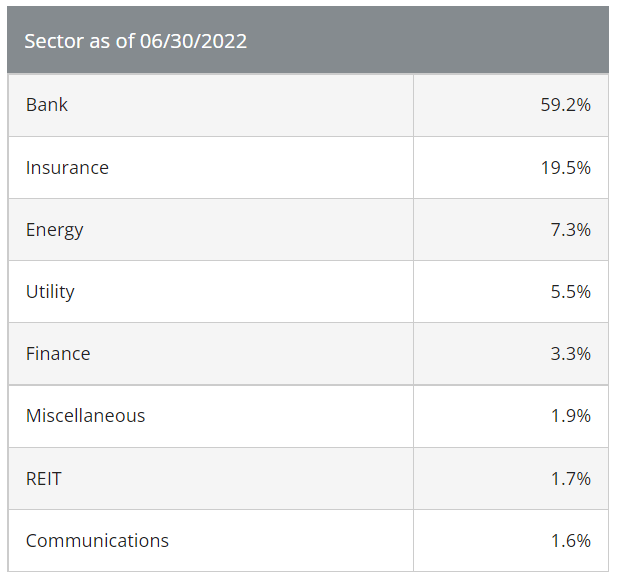

The fund is concentrated on bank and insurance companies’ preferred securities:

Sector Breakdown (Fund Fact Sheet)

We can see from the above table that Bank and Insurance sectors securities comprise over 78% of the fund’s portfolio.

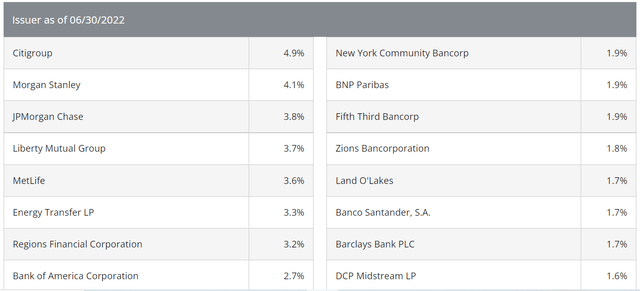

The top holdings in the vehicle are reflective of the sectoral concentrations:

Top Holdings (Fund Fact Sheet)

While no single issuer exceeds 5% of the portfolio, a financials-driven recession would take a heavy toll on this fund. Many of the large systemic U.S. financials would experience similar credit spread widening in the case of a financials-driven recession.

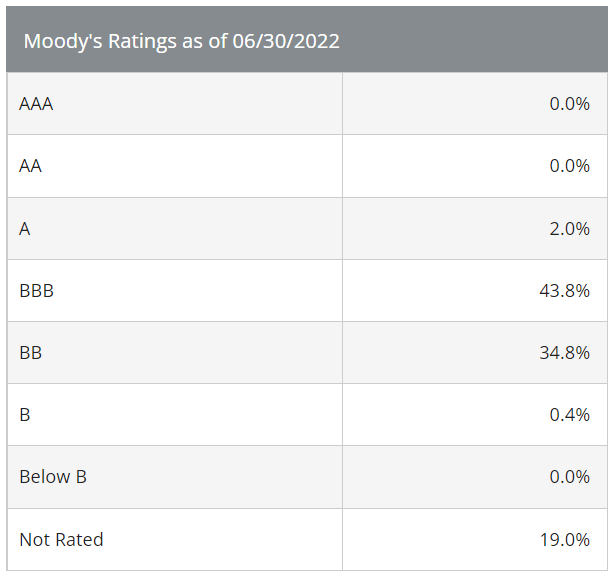

The collateral is evenly split between investment grade and junk securities:

Ratings (Fund Fact Sheet)

Overall, the collateral is fairly highly rated. While over 43% of the portfolio is investment grade, the junk portion is composed of “BB” names, which are the highest rated non-investment grade securities. There is also a substantial “Not Rated” bucket, which is not unusual for the asset class.

Performance

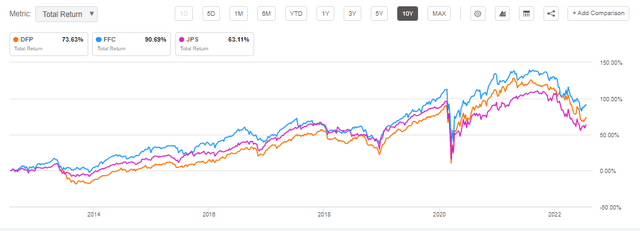

The fund is down approximately -19% year to date, in line with other preferred securities CEFs and with the S&P 500 on a total return basis:

YTD Performance (Seeking Alpha)

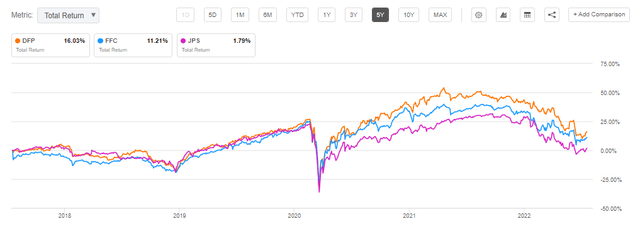

On a 5-year basis, the fund outperforms its preferred securities peers:

5-Year Total Return (Seeking Alpha)

The fund is up +16% versus just +11% for Flaherty & Crumrine Preferred Securities Income Fund (FFC) and +1.79% for Nuveen Preferred Securities Income Fund (JPS).

The 10-year return comes in at an annualized +7.3% rate and finds itself in the middle of the cohort in terms of performance:

Premium/Discount

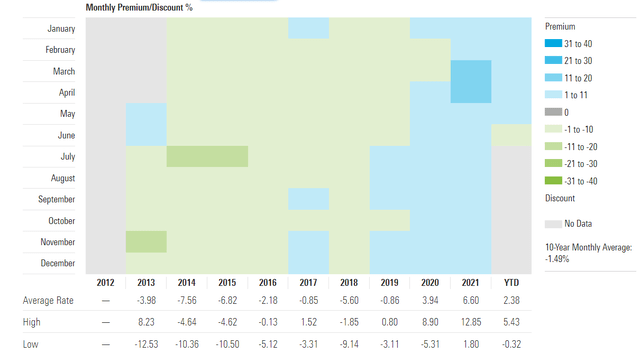

Up to 2017, the fund was usually trading at a discount to net asset value:

Premium/Discount to NAV (Morningstar)

We can see from the above table that up to 2017 the vehicle was trading at a discount, which switched to a consistent premium to NAV after 2017/2018. Today the vehicle is trading at a slight discount to NAV, which might widen further if we have another leg down in the market.

Conclusion

DFP is a CEF focused on preferred securities. Despite a high leverage ratio of 38%, the fund does not have extremely prohibitive drawdowns due to its investment grade collateral and low standard deviation for the underlying names. The fund has an average 10-year annualized total return around 7.3% and has traded at premiums in the past few years. The collateral pool is focused on Banks and Insurance companies and has a 5.5 years duration. We like this fund and its long-term analytics, but feel a more appropriate entry point is going to be later this year after the next leg down in this bear market.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.