[ad_1]

bopav

Thesis

We are continuing our series of revisiting equity “buy-write” closed-end funds (“CEFs”) given today’s market dynamic of high volatility. There is tremendous investor interest in monetizing today’s high VIX levels, and one of the “go-to” strategies has been buying equity buy-write CEFs. The Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE:DIAX) falls in this category and it is a buy-write fund geared towards the Dow Jones index. As per the fund’s literature:

The Fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Dow Jones Industrial Average (DJIA or “Dow30”) by investing in an equity portfolio that seeks to substantially replicate the price movements of the DJIA, as well as selling call options on 35%-75% of the notional value of the Fund’s equity portfolio (with a 55% long-term target) in an effort to enhance the Fund’s risk-adjusted returns

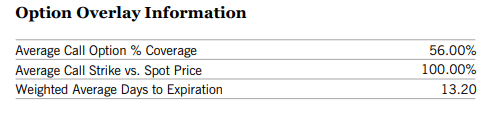

Currently, the CEF writes at-the-money options on 56% of its portfolio, as per the latest available Fact Sheet:

Option Overlay (Fund Fact Sheet)

We can see from the above table that this CEF writes at-the-money options, meaning that the strike of the written calls is equal to the spot price. This is a conservative strategy to undertake in a down market, since the realized premium is higher than out-of-the-money options.

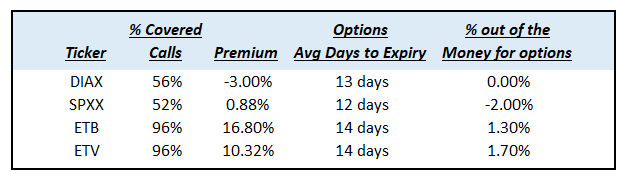

Let us quickly benchmark the “buy-write” funds we have looked at so far to better understand the premia disparities:

Funds Comparison (Author)

Currently, DIAX is trading at a discount to net asset value versus the other funds we have reviewed. DIAX falls in the same bucket as Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) in terms of having roughly only 50% of the portfolio overwritten with calls. All of the funds seem to prefer a two-week maturity for their options, but they differ in terms of “in-the-moneyness.” Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) and Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), which have covered calls written against most of their portfolios, like to write their options slightly out of the money, while DIAX and SPXX take a more aggressive delta stance via at the money or in the money calls.

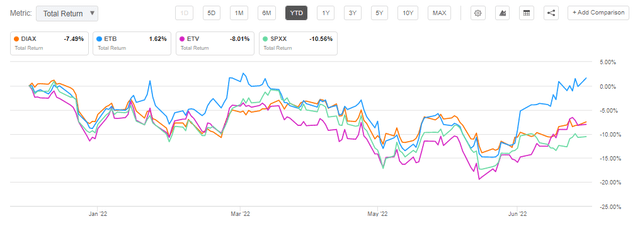

It is ultimately about performance, and DIAX has delivered a good return when benchmarked against the other funds this year:

YTD Performance (Seeking Alpha)

Please keep in mind that ETB, the outlier in the graph, is trading at an absolute massive premium to NAV.

DIAX has a dividend yield of 7.25% and has managed to navigate fairly robustly a very difficult 2022. The fund takes advantage of the Dow Jones volatility, rather than the S&P 500, but the basis is not that large. We are currently seeing DIAX trading at a discount to NAV, which is unusual when compared to the other “buy-write” funds in the cohort. The fund is a robust vehicle to take advantage of the high volume levels in the market currently, but will negatively be affected by another leg down in this bear market.

Holdings

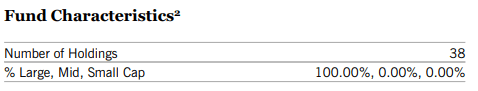

The fund aims to replicate the Dow Jones (DIA) holdings:

Fund Characteristics (Fund Fact Sheet)

On top of the regular equity holdings, the CEF overlays call options as outlined above.

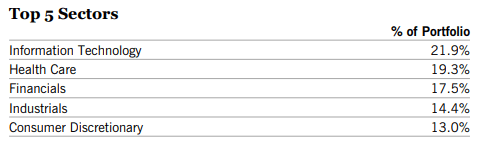

The sectoral composition tries to replicate the index:

Top Sectors (Fund Fact Sheet)

The top industries also are consistent with the figures we are seeing for the Dow Jones:

Top Industries (Fund Fact Sheet)

The fund does not hold like-for-like percentages as the Dow Jones but aims to replicate to a large extent the index moves and tries to outperform via alpha generation via its exact weightings.

Performance

The fund has outperformed the index on a year-to-date basis:

YTD Performance (Seeking Alpha)

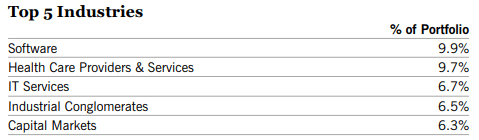

However, on a longer look-back period, the CEF significantly underperforms the benchmark index:

5-Year Total Return (Seeking Alpha)

The same underperformance is exhibited by a 10-year lookback:

10-Year Total Return (Seeking Alpha)

On a decade-long basis, the index is up more than 200% while the fund is up “only” 112%. Please keep in mind that in an up market, DIAX is going to underperform because the options it writes are always going to be triggered. We talked about the fund writing at-the-money options – this means that even small market gains of 1% would trigger said options, hence forcing the fund to realize gains which are capped at the option premium. We can see the fund’s performance diverging significantly from the index after the Covid-19 downturn, when the market experienced a very sharp rally. Due to its set-up, DIAX will always underperform significantly when the market experiences very sharp up-swings.

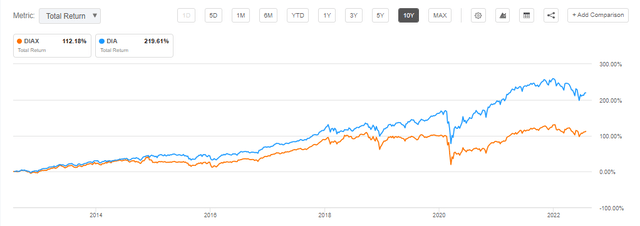

Premium/Discount to NAV

The fund usually trades at a discount to NAV:

Premium/Discount to NAV (Morningstar)

We can see that historically, this CEF trades at a discount to net asset value. We are inclined to think that due to the lower volume for the Dow Jones and the lower overall dividend yield for the fund, investors find DIAX less attractive than other “buy-write” funds in the market, despite its very solid track record.

Conclusion

DIAX falls in the equity “buy-write” product suite and tries to replicate the Dow Jones index with a covered call option overlay. Unlike its other peers, the fund writes at-the-money calls and is currently trading at a discount to NAV, an outlier in the sector. The fund has performed robustly year-to-date, being down only roughly -7%. If the fund were to trade flat to NAV, the performance would be even more impressive. With a 7.25% dividend yield, the vehicle delivers on a high distribution level, corroborated with robust long-term annualized returns. DIAX displays good risk/reward analytics and, unlike its peers in the space, is correctly priced.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.