[ad_1]

It’s always important to review where we are at and the strategy in place towards our goals.

When I first started with dividend investing in 2009, my primary goal was to get started with dividend investing and move away from mutual funds. I did not sit down and spend months trying to figure out the best and most effective strategy to the details and layout one plan action.

My annual dividend income tells a story and below you will find the story.

2009 Dividend Investing Strategy

I needed to get started and bought what many hold in their porfolios today. It’s basically the usual culprit from the TSX 60.

In a way, looking back, it’s like I was investing in the “Dogs of the TSX” but without applying any strategy to it.

The goal was to earn dividend income with a great yield. I had income trust (before the conversion) and the yield was driving my investing decision at this point.

Since I am a number person, I analyzed my portfolio and read more on dividend investing and then I learned about the 10-10 stock strategy by a small investment firm.

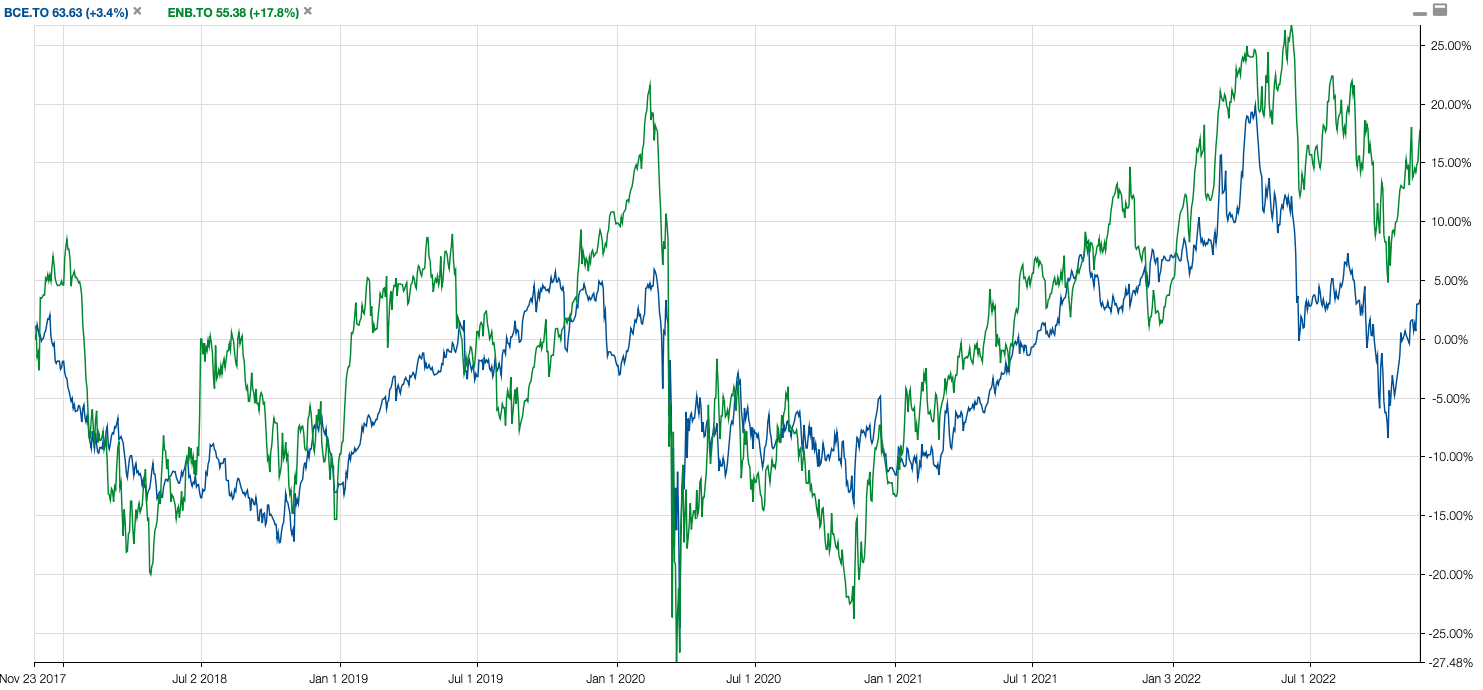

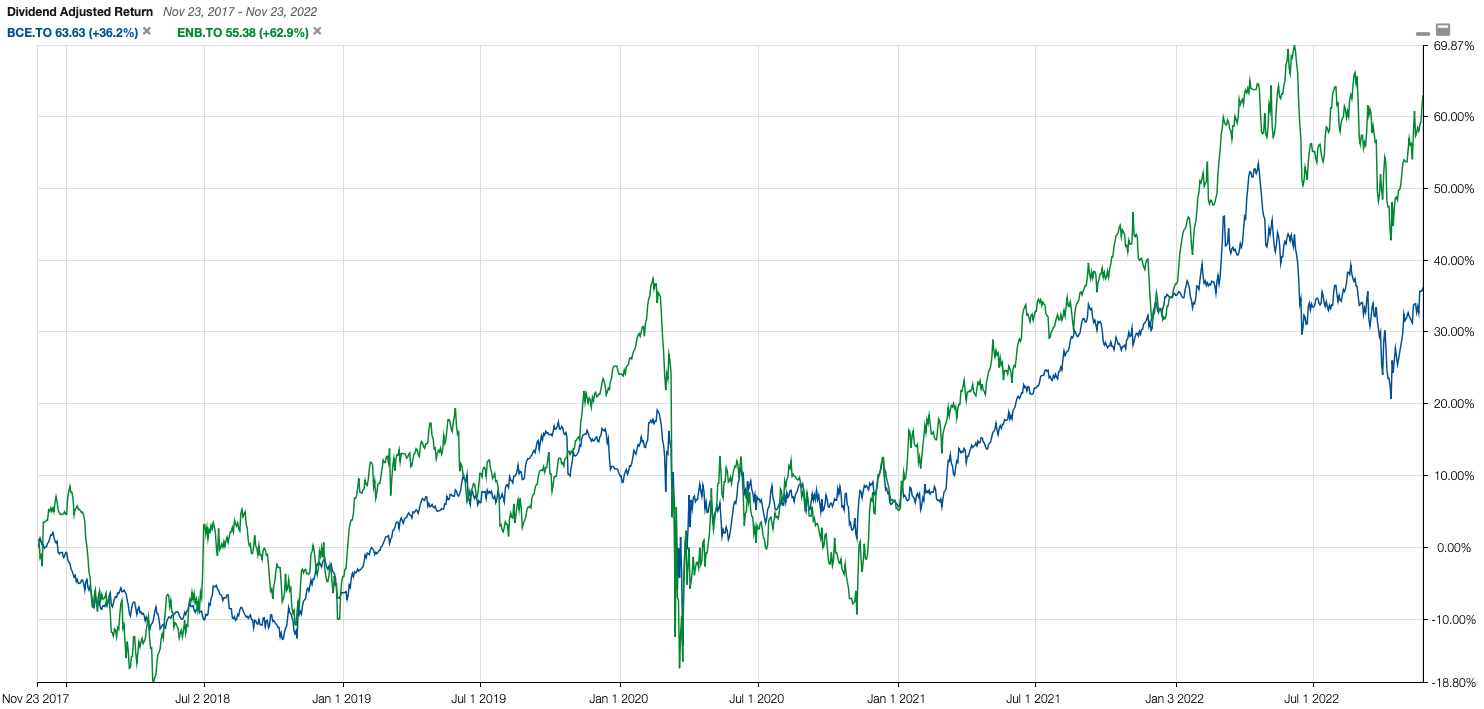

Stocks like BCE and Enbridge are the darling of many retirees but I find it disapointing to grow wealth. Essentially, the stock, from a valuation perspective, makes no money. See chart over 5 years.

The growth comes from dividend mostly when you adjust the graph for dividend reinvestment. While it can be better than the TSX as a whole, these investment only grow when you reinvest the dividend.

The above returns during the accumulation years are pretty pathetic …

2014 Dividend Growth Strategy

After 4 years of dividend investing and compounding the dividend by reinvesting, I felt like my portfolio was not growing as fast as it should. It was time for a change. I work hard for my money, and I want my money to work hard for me !!!

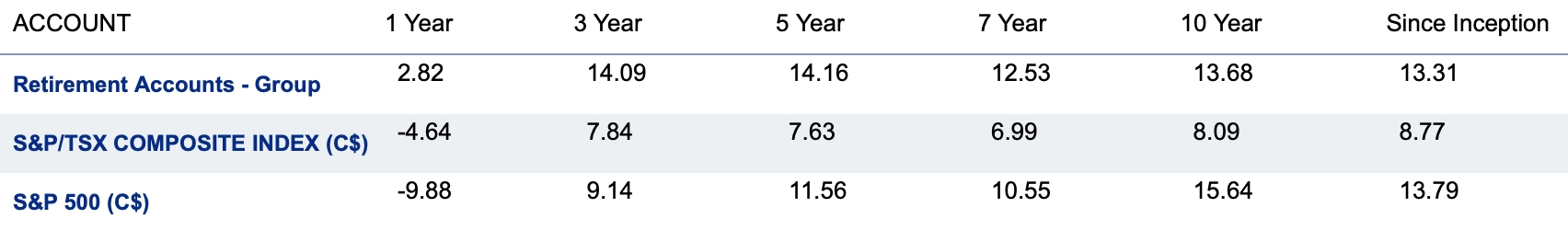

First of all, I needed to build a Portfolio & Dividend Tracker to get a clear picture because Quicken and the discount brokers could not give me the real numbers I needed. The real number, the one that matters during the accumulation years is the “Annual Rate of Return“.

See below of my ROR. 1 year is just noise. What really matters is to see your 5, 7, and 10 year ROR.

Now the brokers have to give it to you. It’s the money-weighted formula to tell you how much your portfolio performs on an annual basis since a certain time.

This number is critical as I use it to understand how fast I can double my money with the rule of 72.

2014 is when I started with dividend growth investing and also when I started shifting my RRSP account to be 100% USD investments.

Now, US stocks do not pay high yield like Canadian stocks in general when you compare the leaders. The options are quite different too as you get exposure to sectors we barely have coverage on in Canada.

I also figured out the best banks and just stuck to the three banks I have a large position in today.

2020 Account Strategy

Up until 2020, I had overlapping stocks across multiple accounts. There is nothing wrong with that really but I had a mix of dividend income and dividend growth across all accounts.

While my holding were spread accross accounts, it was not strategic from a tax perspective. While I want to retire from my dividend income, I cannot be blind to taxes down the line.

The reality is that it doesn’t matter how the money grows in a RRSP as you withdaw income anyways … Whether I have a 4% yield, or a 1% yield, I need the largest amount and then I have to withdraw and pay taxes. Depleting the RRSP in favor of other accounts is what I plan to do if that makes sense. It doesn’t mean spending the money but withdrawing at the best tax rate and investing it possibly.

The TFSA is my favorite account by far. If you can grow the accounts (both) to be over $500,000 over time, you can generate a lot of income tax-free. Why should I invest in a stock like BCE in a TFSA.

I want this account to reach the $1M threshold and it’s not BCE that will bring it there. So I need dividend growth stocks and the minimum threshold to beat are my favorite bank stocks.

While I do want $1M in my TFSA, I probably will retire before that happens and I will convert it to split growth and income with the covered call ETFs I am currently evaluating with the corp investment account.

The strategy by accounts.

- Taxable Account: All dividend stocks for the best tax efficient income.

- TFSA: Dividend growth stocks for now with a plan to have covered call ETFs down the line.

- RRSP: Dividend growth stocks for now with a plan to withdraw efficiently. To be clear, at a certain age, the RRSP account will become a RRIF account with withdrawal requirements. Afterall, the taxman wants its due.

The RRSP strategy is not final yet. I am still working on it but basically, at some point, can I withdraw money to fund the TFSA.

I can’t avoid taxes, and what I want is to maximize the annual income I can get down the line that is the most tax efficient.

2022 Investment Strategy

As we entered into 2022, I had some cash to invest and with the interest rate increase, inflation, and impending recession, I focused on opportunities.

The investments I made in my taxable account were mostly about taking advantage of opportunities. I do not expect to hold Great West Life, Scotia Bank, or Algonquin Power & Utilities Corp for long.

I get paid a really good yield to wait for the bounce back. We shall see what Algonquin Power & Utilities Corp has in store in January though …

[ad_2]

Image and article originally from dividendearner.com. Read the original article here.