[ad_1]

Just when you thought the worst was behind, we still have chaos and opportunities in the markets.

- Chaos is when you look at the impact of your portfolio. However, you should always be prepared for a down market as it can happen out of nowhere. I don’t mean to move into cash … I mean to invest knowing it can drop and bounce back.

- Opportunities is when you see prices, P/E, and yield being attractive due to panic selling. The business world doesn’t change overnight, it’s all the expert analysts and crystal ball forecasters that create the noise … and therefore opportunities.

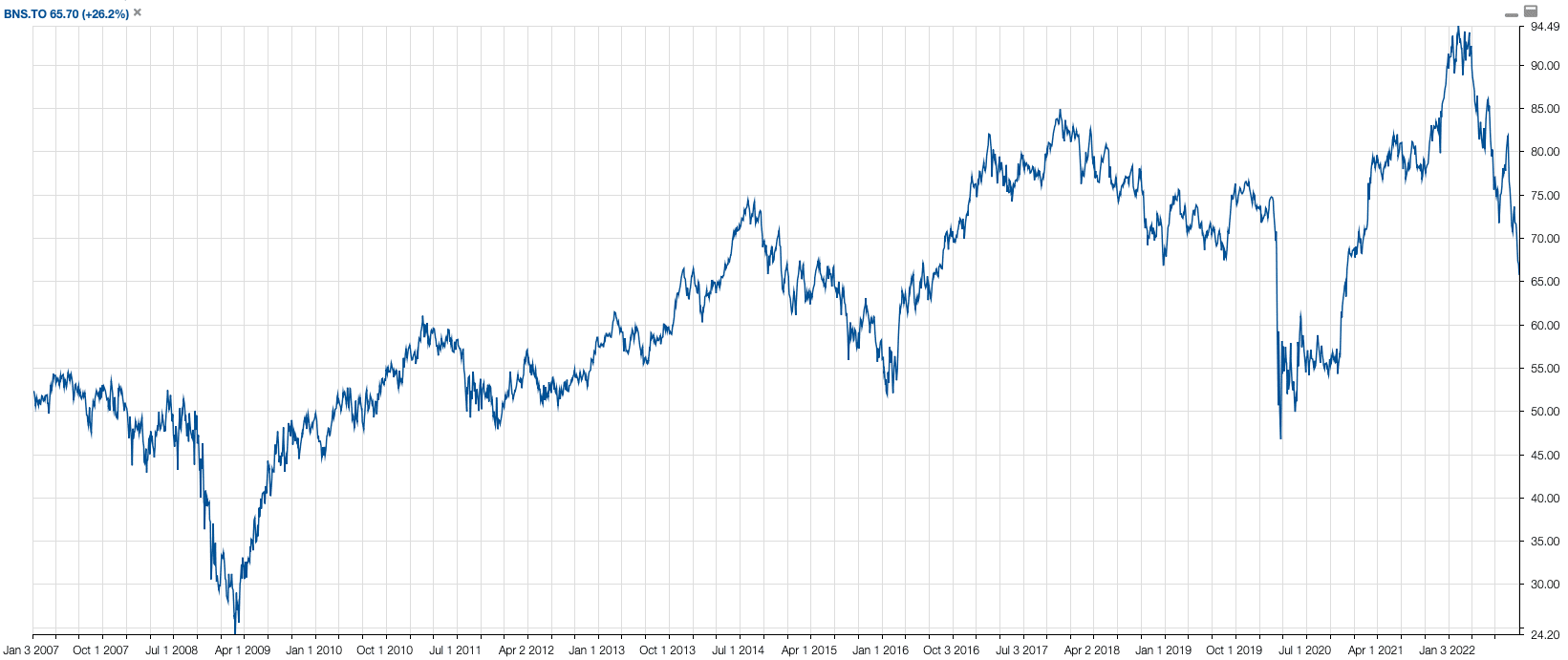

It’s important to put your portfolio drop into context. Take Scotia Bank as an example, the stock price has dropped to 2014 levels. Yes, it has done the bounce a few times but what is important is the first time it reached those levels.

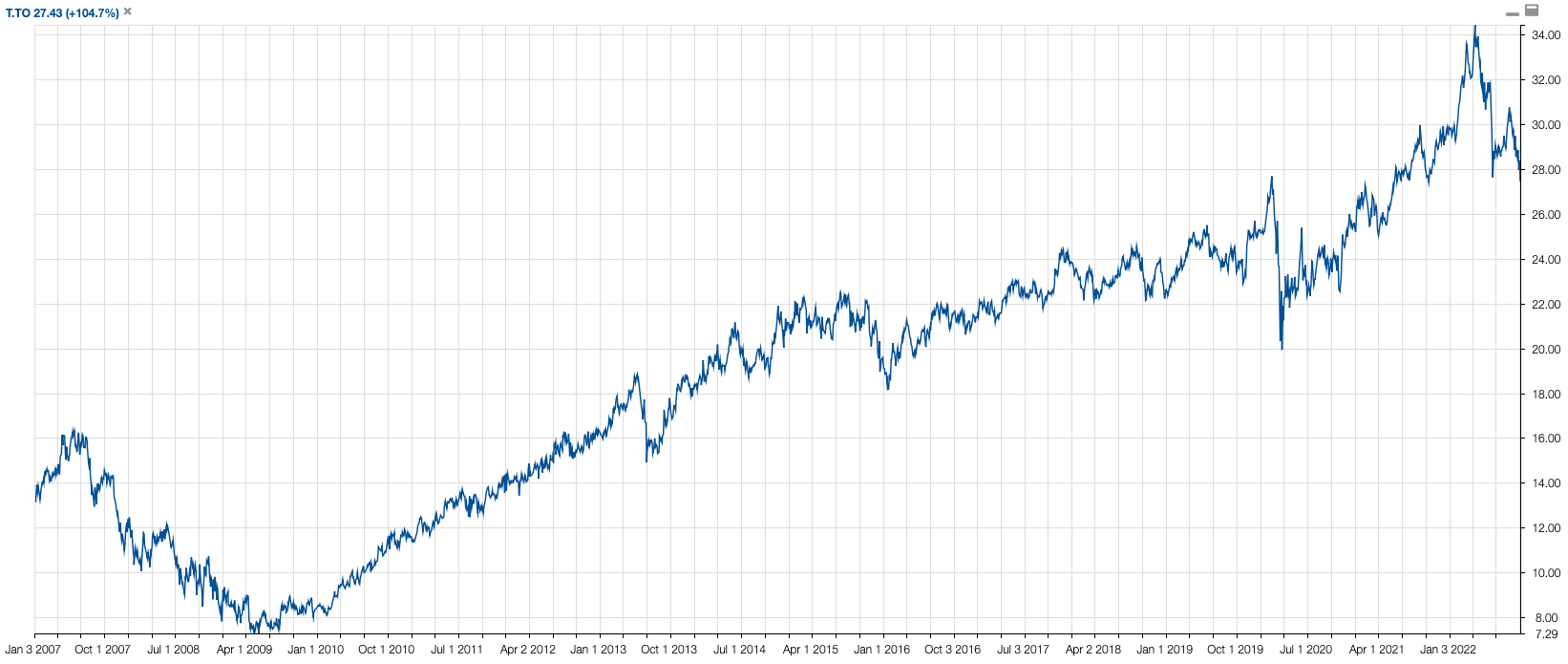

Scotia Bank on the other hand has only dropped back to the 2021 levels.

Has your portfolio dropped to 2014 levels like Scotia Bank? I hope not. Mine is still bouncing around the 2021 levels.

Here are my rate of returns.

The TSX above is the simulated index investing strategy based on XIC ETF.

Stock Trades

One investing strategy I want to make clear is that I am not in cash. I do not hold cash waiting on the sideline. I also do not simply rush in as soon as I have cash.

I have my portfolio as a watchlist, but I also have a candidate watch list. A candidate watch list is a fully vetted list of potential addition. When I have cash, I go through both list, and start assessing which one is a better buy today.

I announced I had $50,000 to invest and so far I have invested $30,000 of it in two existing holdings.

- Scotia Bank saw more funds added to it. It’s not the best bank by any means. This is mostly a strategic play on getting paid a high yield while waiting for it to bounce back. Could take a year, or it could take a five years …

- Telus also saw more funds added as a great opportunity due to the drop.

Both have their dividend yield above their 5-year average yield, and have bounced back from mighty highs.

Portfolio Management

While I do track my sector allocation, the industry exposure is what I look at. For more on sector diversification, read my thinking on it here.

It should be telling what my exposure to the Canadian market really is, and it’s invested in 10 stocks. Yes, 10 Canadian dividend stocks make up my portfolio, and a lot of it in the financial sector.

Dividend Income

My September 2022 dividend income is $1,924.

Don’t spend time balancing your monthly income. It should not matter as you should have a year or two in cash as a safety net.

If you live from your actual monthly income, you either have a large portfolio that generates more than you need, or you have a solid system as RRSP withdrawals need to be planned.

There was a small window of time when I had a retirement portfolio when I started where I thought I should balanced my monthly income but I learned differently. It’s not about having a balanced monthly income as you should not live from this month’s dividend but have a cash wedge with a buffer.

[ad_2]

Image and article originally from dividendearner.com. Read the original article here.