[ad_1]

The Dividend Aristocrats Index is a list of S&P 500 companies that have managed to increase dividends for at least 25 years in a row. It is an elite group of quality companies which have managed to grow earnings, compound shareholder wealth and raise annual dividends for decades. It is a great list of companies for further research. Companies do not just raise dividends every year for over a quarter of a century by accident – this is a result of having strong competitive advantages in an industry, and the ability to grow the business, while also generating a ton of excess cashflows to shower shareholders with more cash each year.

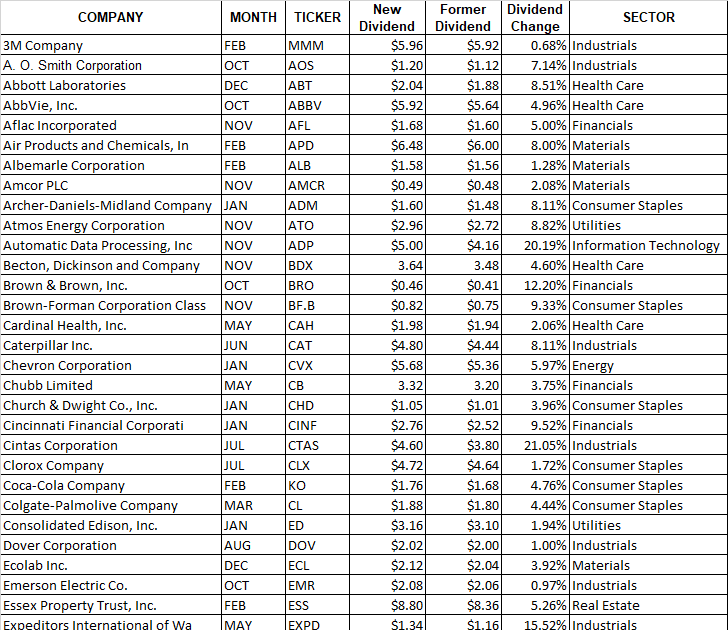

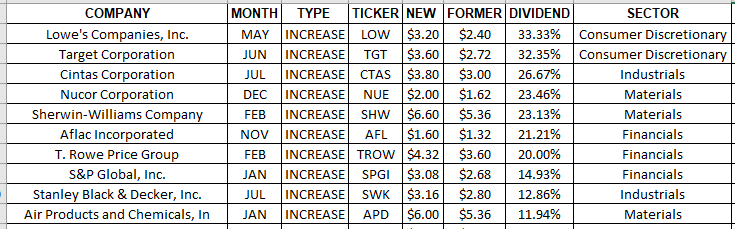

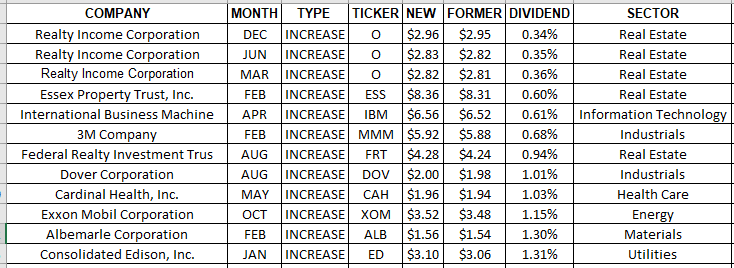

I went ahead and reviewed the raises behind all the 64 dividend aristocrats. I have compiled them in the table below. You can see the full list of 2022 dividend increases for the dividend aristocrats below:

You can download the list from here.

The average dividend raise was 6.50%. Note that the table above compares the annualized dividend amounts. It shows the sector, company name, symbol and month in which the dividend was increases.

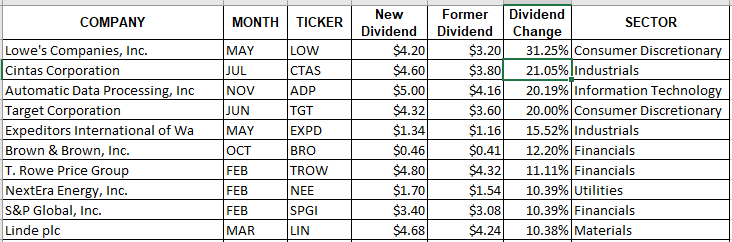

You can view the ten largest dividend increases for 2022 below:

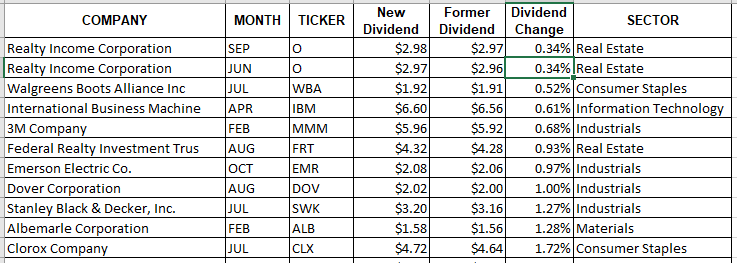

You can also view the ten smallest dividend increases for 2022 below:

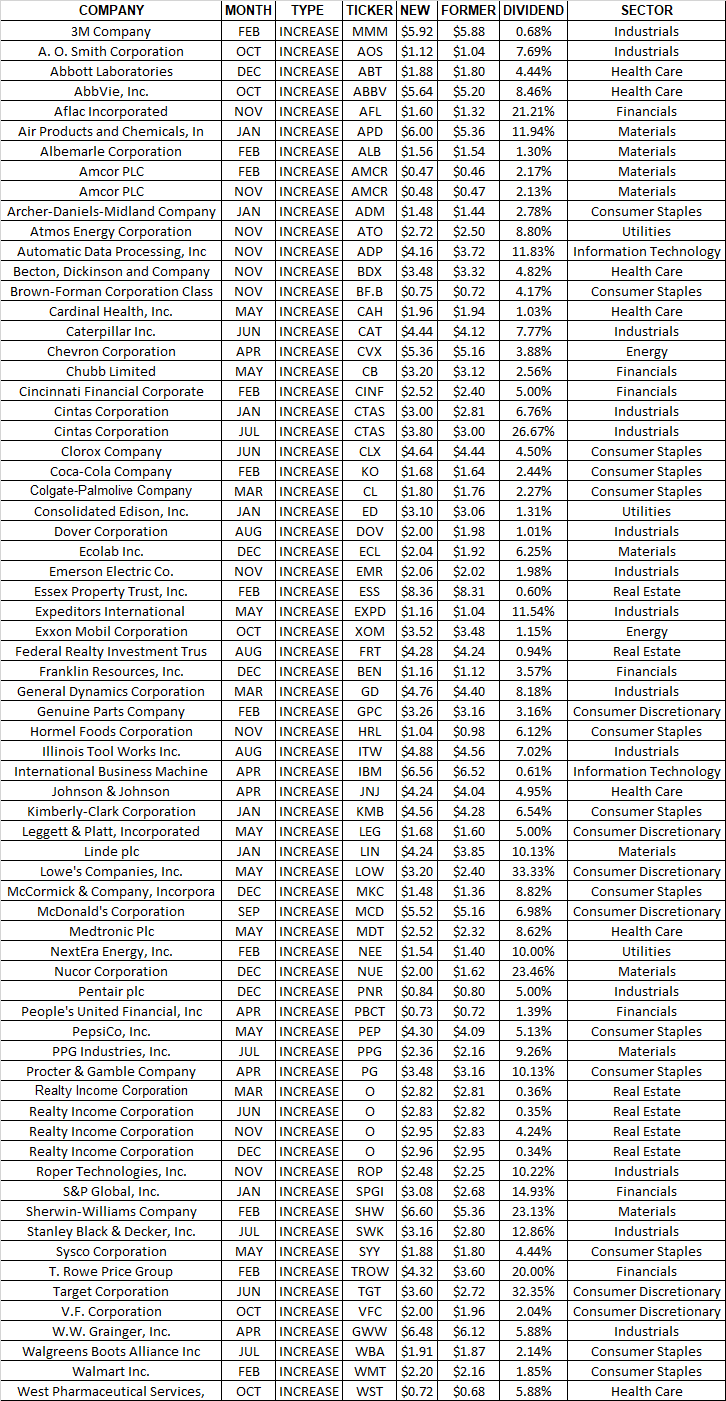

For comparison purposes, you can view the same data for 2021:

You can download 2021 list it from here.

These were the ten largest raises for the dividend aristocrats in 2021:

These were the ten smallest raises for the dividend aristocrats in 2021:

I had already posted the changes in dividend growth for the 2020 Dividend Aristocrats here.

Note that I am presenting this data for educational purposes. I believe that by observing this, I may be able to connect the dots and identify exploitable patterns going forward. I would be sharing those in future posts here or on my premium newsletter.

Relevant Articles:

[ad_2]

Image and article originally from www.dividendgrowthinvestor.com. Read the original article here.