[ad_1]

The security is fresh off a two-year low

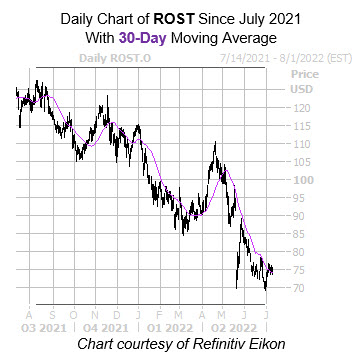

Ross Stores, Inc. (NASDAQ:ROST) has struggled on the charts of late, down 38.8% year-over-year. What’s more, the security just logged a July 1, two-year low of $69.24, after its June rally lost steam at the $78 area, and has struggled with pressure at its 30-day moving since May. At last check, the shares are up 0.2% to trade at $75.23, on the heels of a red-hot inflation report.

Options traders are bearish on ROST. This is per the stock’s 50-day put/call volume ratio of 3.18 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than 98% of readings from the past year. This suggests long puts have have been getting picked up at a much faster-than-usual clip.

The discount department store company offers a dividend yield of 1.66%, with a forward dividend of $1.24. Ross Stores stock continues to be a liability for investors’ portfolios in the short-term, due to its somewhat elevated valuation and the business’ negative 2023 expectations. ROST trades at a forward price-earnings ratio of 17.27, and a price-sales ratio of 1.42.

The company also holds a balance sheet with $4.07 billion in cash, and $5.62 billion in total debt. In addition, the discount department store is estimated to end 2023 with an 8.8% drop in earnings and a minimal decrease in revenues. Still, ROST is expected to generate 16.9% earnings growth and 7% revenue growth for 2024, making the stock best suited as a long-term recovery play.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.