[ad_1]

The Zacks Retail and Wholesale sector has struggled in 2022, underperforming the general market by a fair margin.

A popular company residing in the realm, Dollar General DG, is on deck to unveil quarterly results on December 1st, before the market open.

Dollar General offers a wider selection of merchandise, including consumable items, seasonal items, home products, and apparel.

Currently, the company sports a favorable Zacks Rank #2 (Buy) with an overall VGM Score of a C.

How does everything else stack up? Let’s take a closer look.

Share Performance & Valuation

DG shares have been a brighter spot in an otherwise dim market in 2022, up 10% and outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last month, however, shares have modestly lagged behind the S&P 500’s 5% gain.

Image Source: Zacks Investment Research

DG shares currently trade at a 22.2X forward earnings multiple, above the 20.9X five-year median but below its Zacks sector average.

The company carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bullish in their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $2.55 indicating a 22.6% Y/Y uptick in earnings.

Image Source: Zacks Investment Research

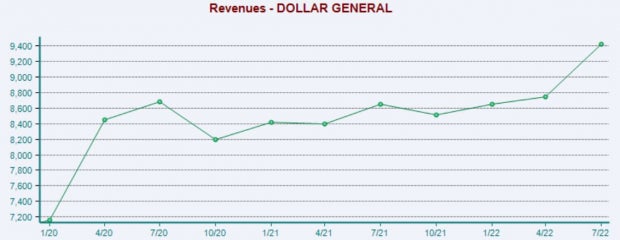

DG’s top-line is also in solid health; the Zacks Consensus Sales Estimate of $9.4 billion suggests an improvement of more than 10% Y/Y.

Quarterly Performance

DG has posted solid quarterly results as of late, exceeding earnings and revenue estimates in back-to-back quarters.

In its latest print, the company registered a 1.7% bottom-line beat paired with a marginal 0.3% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

DG shares are well in the green year-to-date but have modestly lagged behind the S&P 500 over the last month.

Shares trade above the five-year median forward earnings multiple and slightly below the Zacks Retail and Wholesale sector average.

Analysts have taken a bullish stance regarding the quarter to be reported, with estimates indicating Y/Y upticks in both revenue and earnings.

Further, the company has posted strong quarterly results as of late, exceeding earnings and revenue estimates in back-to-back quarters.

Heading into the release, Dollar General DG carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of 1.6%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Dollar General Corporation (DG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.